The Euro has spent the better part of the month of April going sideways in a relatively tight range. This is an overly surprising considering that the pair does tend to be very choppy, but what is worth paying attention to is that the Federal Reserve has suggested that it was more than willing to flood the market with liquidity if it is necessary, so that could help the Euro, except the fact that the ECB is more than likely going to be doing the same thing as well. With that in mind, we probably will not have much in the way of a resolution to the situation that we find ourselves in, and I anticipate that May will probably be just as frustrating as April is for those looking to trade some type of trend.

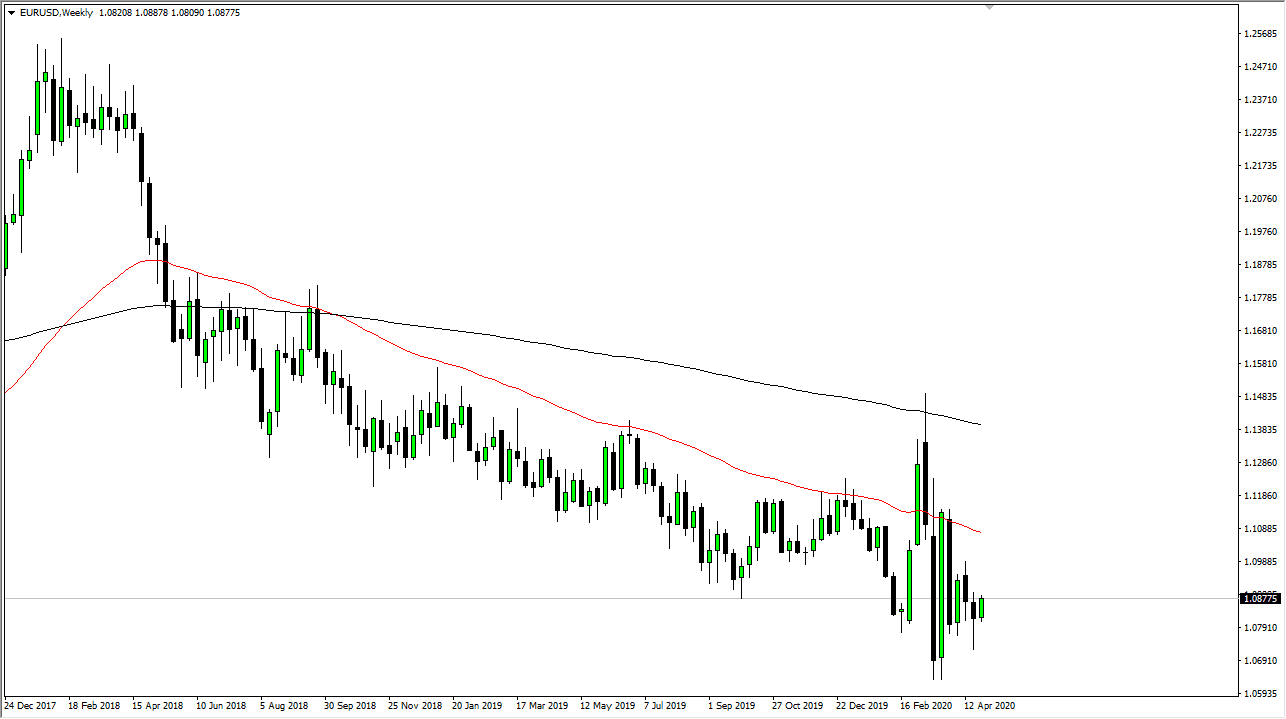

When you look at the Euro over the course of the last several years, we have most decidedly been negative, but it is worth paying attention to is that the pair has been negative, but in a very choppy manner and therefore it has not necessarily been as simple as shorting this market and hanging on. You need to pick your battles and fade at the right levels.

Going into the month of May, the 1.10 level should be significant resistance, just as the 1.11 level will be. To the downside, the 1.08 level is support, while the 1.0650 level will also be supported. I believe that this market probably goes back and forth and chops around without any real clear direction as both central banks are likely to compete in a “race to the bottom” when it comes to currency value. Because of this, I believe that we will see no relief to the grinding action that has been such a staple of this pair for so long. Typically, the Federal Reserve get what it wants, so one would have to think that there is probably going to be a significant amount of upward pressure given enough time. I am not necessarily expecting an explosive move to the upside, but we may be in the process of trying to turn things around. Having said that, the European Union is an absolute mess and it is not getting better. It is because of this that you may be better off buying the US dollar against other currencies, especially when it comes to emerging markets.