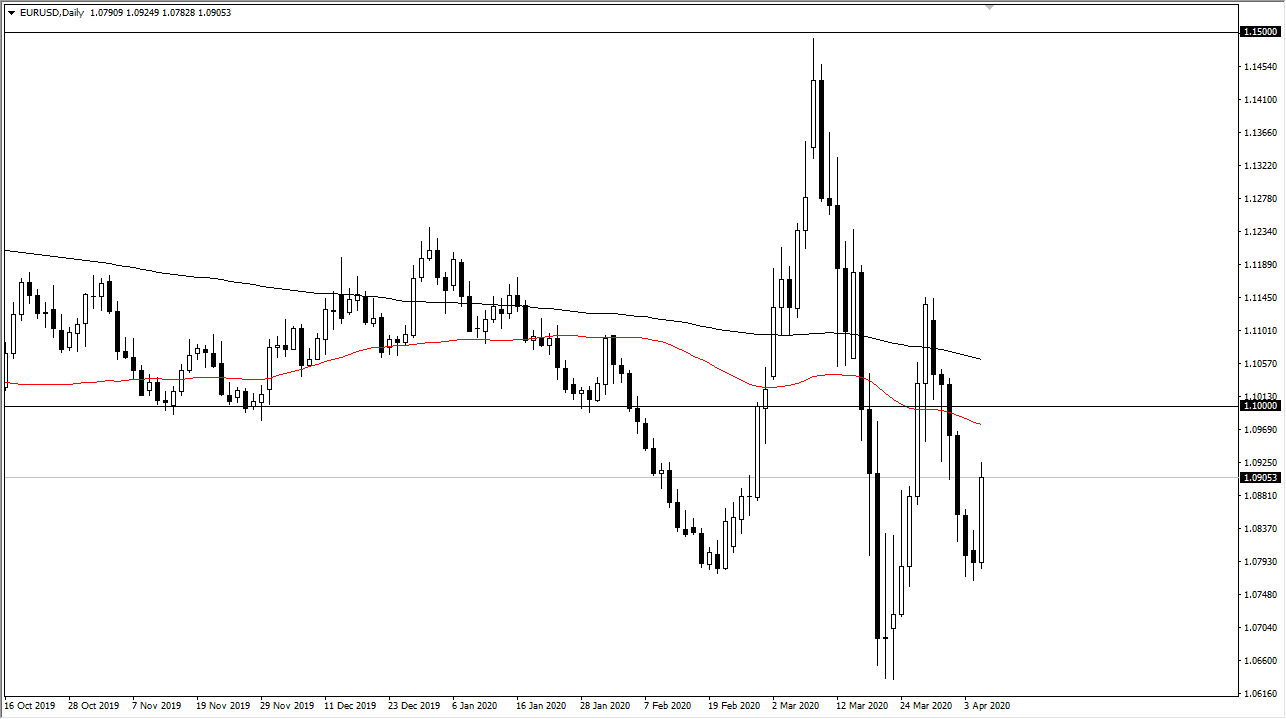

The Euro rallied during the trading session on Tuesday, reaching above the 1.09 level. Having said that, the market still has plenty of resistance above at the 1.10 level so it’s very unlikely that we can simply break out to the upside and keeps going. The market looks as if it is making a “higher low”, but the recent high was lower than the ones before it. In other words, there are a couple of different things that we may be looking at right now.

The first scenario would be that the market is compressing, and therefore trying to build up enough momentum to go much higher. As the market impresses, eventually inertia comes into the market, and we break out to make a much bigger move. This would imply that the market was ready to make it extended run. Quite often, a compression like this could lead to a trend change, but I think that’s asking a lot out of the Euro as the European Union is struggling so much economically. Furthermore, the European Central Bank is willing to buy just about anything it can get its hands on.

The other scenario would be that the market is simply returning to a bit more stability in choppiness which is much more common for the Euro. This is a market that typically doesn’t move very much, and as a result more choppy and sideways conditions with a slightly downward trend probably would be expected if volatility finally slows down. After all, all you have to do is take a look at the last several years, this pair has spent a lot of time going basically nowhere in a slow drift lower.

On the other hand, if the market were to turn around a break down, that could be a continuation of the massive bearish pressure that we have seen. In the short term, I suspect that we could very well easily go towards the 1.10 level and then pull back. At this point, the market is very likely to see more confusion and more nasty volatility, but the 1.10 level of course is a very significant round figure that will cause a reaction under most circumstances. This is essentially what I am banking on if we do in fact find yourself drifting in that general vicinity. One thing is for sure, markets are jittery and certainly seem to be very reactive to each and every headline.