For the second day in a row, the EUR/USD pair fails to return to the path of its recent gains, which reached the 1.0925 resistance, and dropped to the 1.0830 support during yesterday's trading, and settled around 1.0860 amid limited movement during Thursday’s trading, awaiting more stimulus for a upward correction possibility, which is still a weak trend. European stimulus still faces constraints, in contrast to ongoing US stimulus and with record plans in trillions of dollars. The 14-hour Eurozone finance ministers meeting on Tuesday failed to reach an agreement that supports a joint financial response to counter the coronavirus crisis, which is increasingly being controlled in some countries, but will continue to impose heavy costs on European economies for some time to come.

Adding pressure on the euro, European governments are still at odds over measures to help the economy overcome the coronavirus outbreak, which led to cutting off a meeting of finance officials who have disagreed over aid terms and a proposal to borrow together to pay for the health crisis.

European governments are striving to raise hundreds of billions of Euros to save lives as well as companies and families from bankruptcy, as there are many countries more affected by the virus are also the ones that can afford it, such as Italy and Spain, but the virus affected everyone. Where the French central bank said that the country entered a recession with a decline of - 6% in the first quarter, and German economists expect the German economy to shrink - 4.2% this year.

Countries are divided on the best way to meet the challenge. Italy and Spain, with the support of France, want to shed all economic power of the European Union in fighting the virus and the damage caused by the turmoil it caused as soon as possible, while Germany and the Netherlands are resisting more comprehensive measures. The impasse is reminiscent of the divisions that have occurred in the Eurozone debt crisis 2010-2015.

On the table are a set of three parts, worth about half a trillion Euros (550 billion dollars). It consists of up to 240 billion Euros in emergency loans from the permanent rescue fund in the Eurozone, credit guarantees from the European Investment Bank to keep companies alive, and support for short action plans that help companies avoid temporary layoffs during the work period that hopefully will be a temporary business disruption.

On the American side. Fed officials pledged at two emergency meetings last month to use their full arsenal to support the US economy, which is suffering greatly from coronavirus outbreaks. The content of the minutes from the two meetings, released yesterday, showed that Fed officials were already annoyed at the effect of the virus on US economic activity. They also indicated that more harm could happen to companies and families as a result of strict guidelines being deployed across the country to try to limit the spread of the virus.

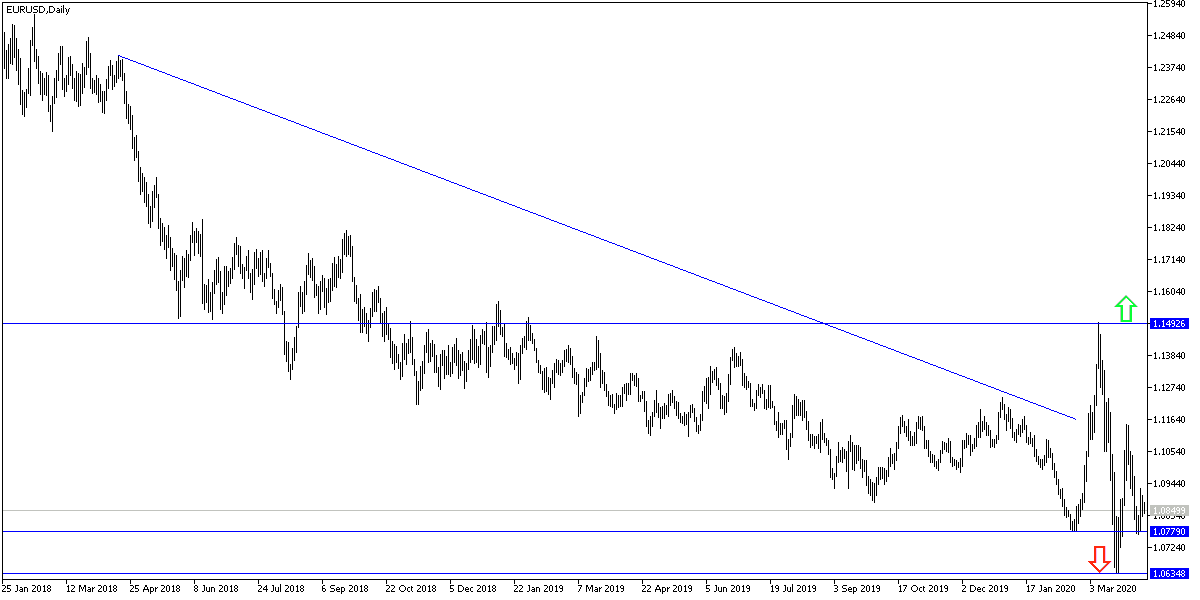

According to the technical analysis: No change to my technical view for the EUR/USD pair, as the general trend is still bearish and the move around and below the 1.0800 psychological support will increase the selling operations, and will give stronger control of the bears. The pair maight be ready to move towards the support levels at 1.0820, 1.0765 and 1.0645 respectively. As I mentioned before, the 110.00 psychological resistance will remain a first opportunity to reverse the trend. So far, it is best to sell the pair from every higher level.

As for the economic calendar data today: The German Trade Balance will be announced, then the European Central Bank's bulletin on monetary policy. From the United States, unemployed claims, producer price index and Michigan consumer confidence data will be released.