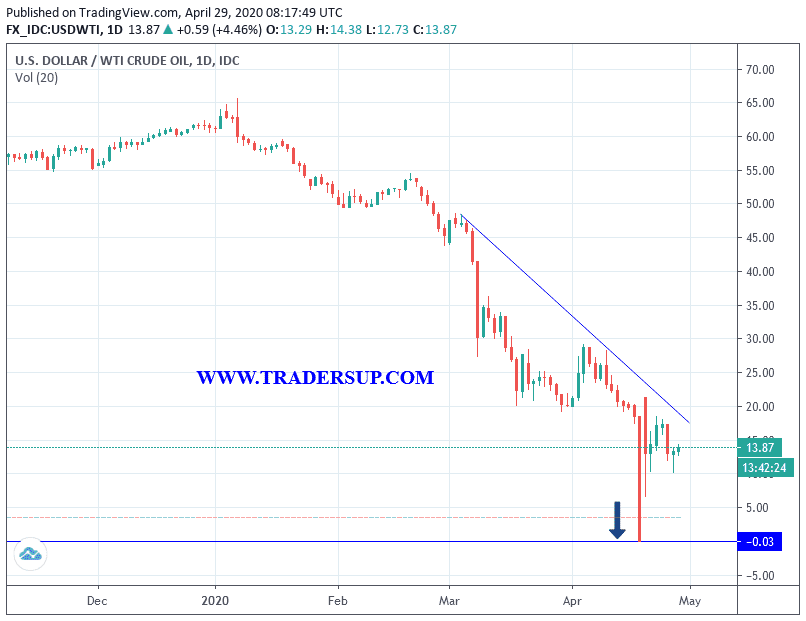

During yesterday's trading, crude oil prices fell sharply, then rebounded back and then stabilized after that, but the pressures remain. Worries about the outlook for global energy demand, the increase in supply in global markets, and the lack of storage, continued to affect the commodity. Prices have received some support from news of a bomb explosion on an oil tanker in Syria. West Texas crude futures fell to $10.27 a barrel before recovering around $14.20 a barrel at the time of writing. Brent crude futures fell to $20 a barrel. During last week's trading, prices tumbled 32.3%, the largest drop ever as May futures traded in the negative region on April 20 for the first time in the history of energy prices.

As the Covid 19 virus pandemic continues to destroy global economies, oil demand is unlikely to see any significant increase in the short and medium term. On Monday, the US Oil Fund LP - the world's largest oil trading fund - said it would exit from its positions in June crude oil futures and may need to maintain more liquidity to meet potential margin requirements.

Goldman Sachs warned last week that the market will test global storage capacity within the next 3-4 weeks. Oil investors monitor the weekly US oil inventory reports from the American Petroleum Institute (API) and the US Energy Information Administration (EIA). Reuters, quoting initial reports of the Turkish Anatolia News Agency, reported on Tuesday that the explosion on the tanker in the city of Afrin in northern Syria killed at least ten people.

Analysts believe that traders fear a re-collapse of prices, as happened with May contracts, causing some investors to exit from June contracts earlier than expected. Interest in the June contracts fell by 44% over the past week. Currently, storage capacity is dwindling around the world as the economic shutdown due to the global epidemic affected oil demand.

From a technical perspective: West Texas crude could form a range as the price rebounded from support around $10.50 a barrel and may set eyes on resistance at $18.20 a barrel. The 100 SMA is below the 200 SMA, confirming that the general trend is still downward, that the support is more likely to break rather than hold. The price rose after the 100 SMA as an early indication of the bullish pressure, but the 200 SMA dynamic diverts have not yet been tested. Stochastic has already reached the overbought zone to reflect fatigue among buyers, and a downturn could increase selling pressure. ADX above 25 to indicate possible trend, but size remains weak so cohesion can continue.

Crude oil is still struggling to regain strength after the sharp drop to negative levels last week. June futures look positive so far, along with contracts that have expiration dates much later, but doubts that global economies may soon recover affect risk appetite and energy demand.