Japan’s ¥108 trillion or 20% of GDP economic stimulus in response to the global Covid-19 pandemic represents the most massive one announced globally. While it is expected to provide a safety net to the already struggling economy, divisions regarding the distribution of it emerged. A lack of fairness and speed were noted, which may reduce the short-term positive impact of the debt binge. Canada’s government, arguably in worse shape than Japan, passed a C$107 billion stimulus. The CAD/JPY advanced into its short-term resistance zone from where a profit-taking sell-off is pending.

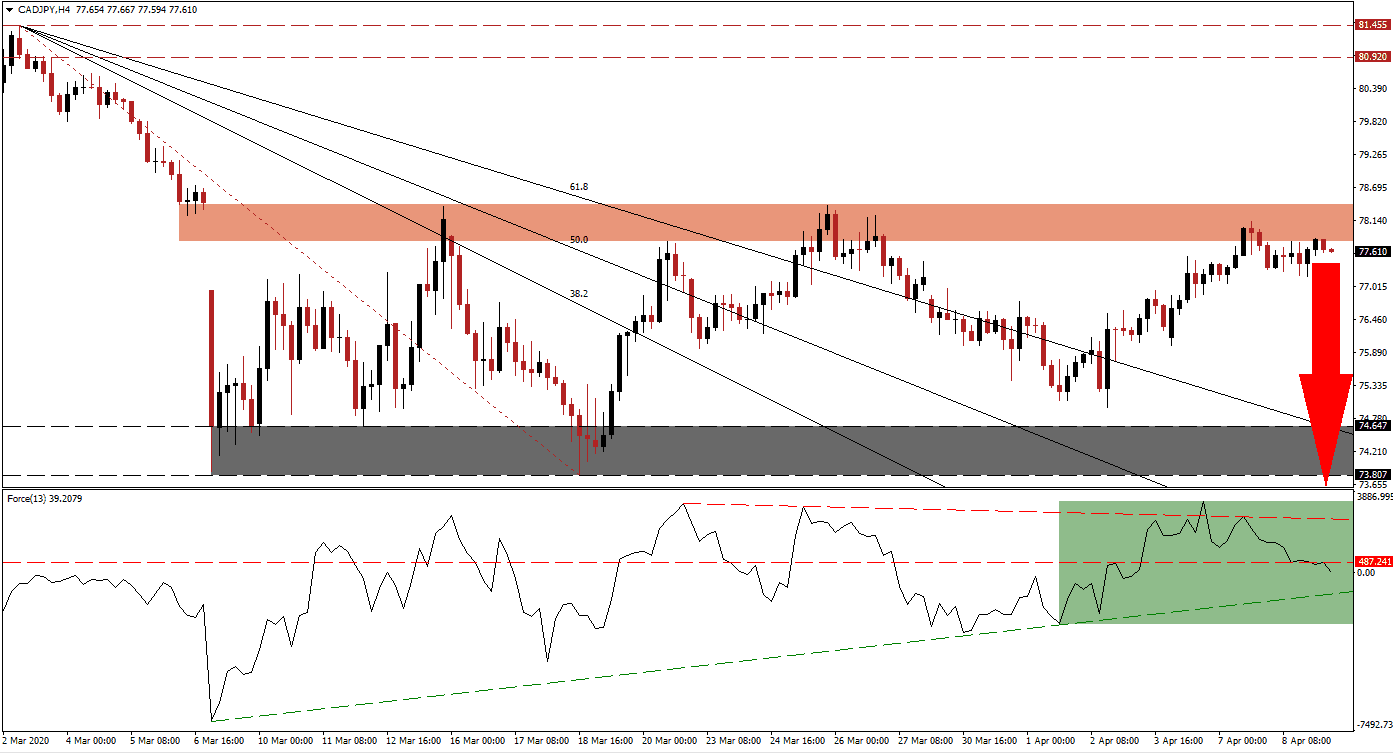

The Force Index, a next-generation technical indicator, shows the collapse in bullish momentum after retreating from a new 2020 peak. A shallow descending resistance level emerged, and the horizontal support level was converted into resistance, as marked by the green rectangle. This technical indicator is now expected to contract below its ascending support level, and into negative territory. It will cede control of the CAD/JPY to bears. You can learn more about the Force Index here.

Price action was rejected on five previous occasions by its short-term resistance zone, making the current one the sixth one. This zone is located between 77.783 and 78.408, as marked by the red rectangle, which includes a price gap to the downside. Today’s employment report out of Canada is forecast to show as many as 500,000 job losses for March, any data exceeding the top range is anticipated to provide a bearish catalyst for an accelerated sell-off in the CAD/JPY.

Forex traders are recommended to monitor the intra-day high of 76.948, the top of a previous price gap to the downside. A breakdown below this level is favored to result in the addition of net short orders, providing the required volume to pressure the CAD/JPY into its descending 61.8 Fibonacci Retracement Fan Support Level. It entered the support zone located between 73.807 and 74.647, as identified by the grey rectangle. More downside cannot be excluded. You can learn more about a breakdown here.

CAD/JPY Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 77.600

- Take Profit @ 73.800

- Stop Loss @ 78.700

- Downside Potential: 380 pips

- Upside Risk: 110 pips

- Risk/Reward Ratio: 3.46

A breakout in the Force Index above its descending resistance level will pressure the CAD/JPY to the upside. The long-term resistance zone is located between 80.920 and 81.455. Underlying fundamental conditions suggest more downside in this currency pair, with bearish pressures on the rise. Any price spike from current levels will present Forex traders with an excellent selling opportunity.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 79.200

- Take Profit @ 81.300

- Stop Loss @ 78.700

- Upside Potential: 110 pips

- Downside Risk: 50 pips

- Risk/Reward Ratio: 2.20