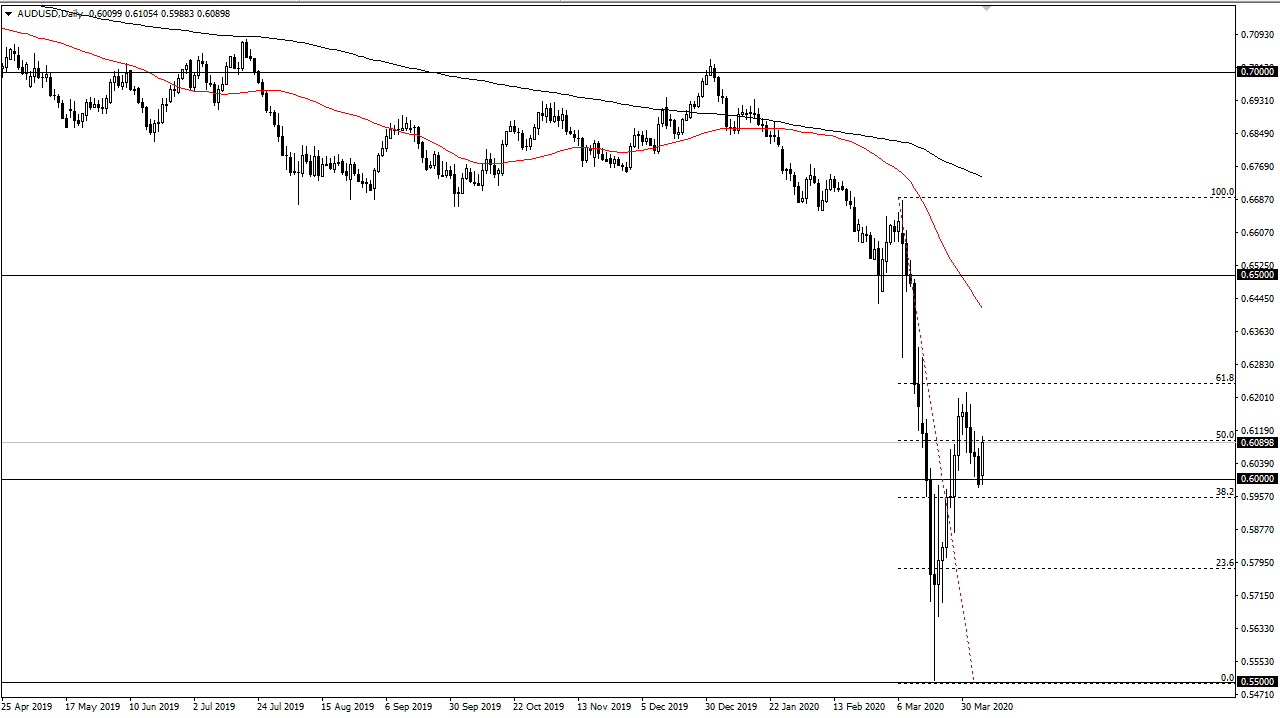

The Australian dollar has rallied significantly during the trading session on Monday, showing signs of support at the 0.60 level. The size of the candle is something to pay attention to, as the gains are being held onto, but we still have a lot of overhead resistance. This is especially true near the 0.62 handle, which was the most recent high and should be noted as the 61.8% Fibonacci retracement level. At this point, I would anticipate that level would be resistance yet again.

The Australian dollar is highly sensitive to the Chinese economic situation and of course demand for Chinese goods. This is because Australia provides China with most of its commodities and therefore it is inexorably tied to the global supply chain. If there’s going to be a serious lack of demand, it makes an argument that there will probably be a serious lack of Australian commodities. Furthermore, the Reserve Bank of Australia is likely to cut rates this week, and that of course won’t do much for the strength of the Aussie dollar. At this point, it’s very unlikely that the Australian dollar can rally significantly for a longer-term move.

The market has recently seen a massive selloff and with good reason. That being said, price is truth and if we can break above the 0.62 level, it’s likely that the market then goes looking towards the 50 day EMA, perhaps even the 0.65 level after that. All things being equal, it’s very likely that we will continue to see selling into rallies, but the choppy conditions should continue to be an issue for traders in this pair. Remember, risk sentiment seem to be moving on the latest coronavirus headlines, which of course are all over the place. During the session on Monday, the number seem to be shrinking in Italy in New York and therefore it has given the markets hope about a resumption to normalcy. That being said, the market still has a lot of headlines that it will have to work through in the short term, so at the very least you are going to see a lot of noisy back and forth action. If that’s going to be the case, you need to keep your position size rather small over here as well. At this point I still favor the downtrend, but recognize I have to trade the market that’s in front of me.