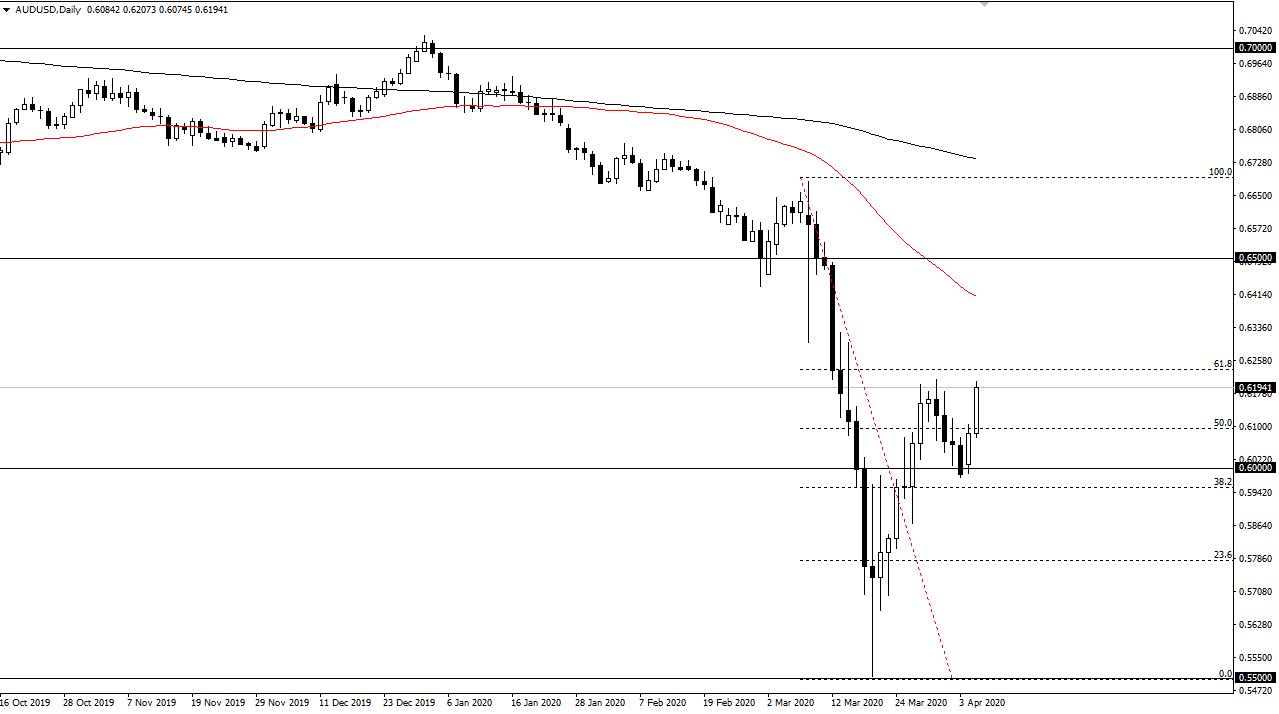

The Australian dollar has exploded to the upside during the trading session on Tuesday, as we continue to see a lot of US dollar weakness in the short term, but longer-term the greenback is obviously a very bullish currency. Looking at this chart, it is very likely that the market will continue to see a lot of interest near the 0.62 region, extending up to the 0.6250 level. In that area, we could see a little bit of a pushback against the Aussie. However, if the market breaks above there it’s likely to continue going much higher, as it will be a “higher high” and could send this market towards the 0.65 level over the longer term.

Keep in mind that the Australian dollar is highly sensitive to commodities and risk appetite in general. The Australian economy is highly sensitive to what’s going on in China, and by extension the global growth. Ultimately, the market is likely to focus on whether or not there is going to be global economic activity, which quite frankly is hard to believe. Even if this pair does rally, I find it very difficult to imagine that the Australian dollar isn’t going to have some type of big selloff.

Looking at this chart, it is likely that noise will be a continuing factor in this pair, but if we get some type of negativity, I could see this pair dropping all the way down to the 0.60 handle underneath. If the market breaks down below there, then it opens up a bigger move to the downside, something that I would anticipate that the market will eventually try to do. After all, the market does like to retest the bottom occasion, so having said that it’s likely that we will continue to see a lot of noise in this market, because the Australian dollar is so highly sensitive to global growth and geopolitical issues as commodity such as copper, iron, and gold are all attached. At this point, the next headline will probably determine where we go further. The next headline to move the market will almost certainly have something to do with the coronavirus, and therefore it’s unfortunate that we need to continue to follow those numbers more than anything else. China is losing its customer base, at least for the time being and therefore it will continue to be a weight around the neck of Australia by extension.