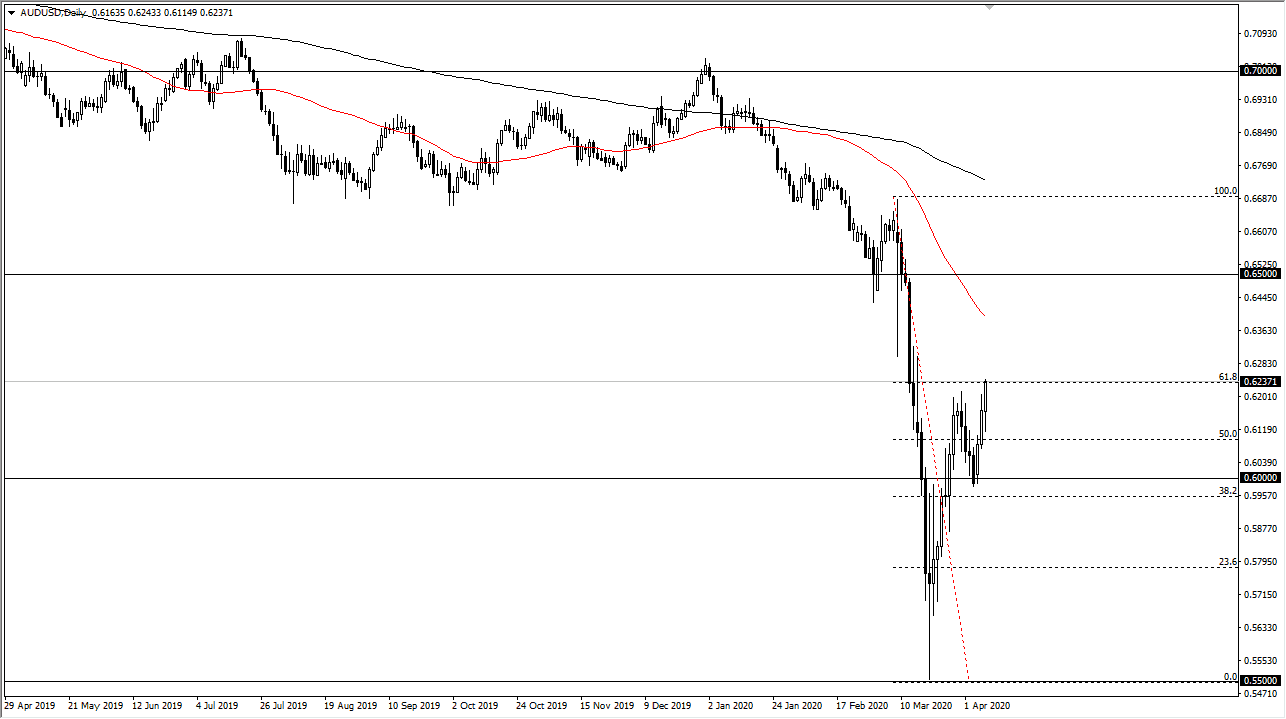

The Australian dollar has initially pulled back a bit during the trading session on Tuesday but then shot straight up in the air for the third day in a row, showing signs of life again. The Australian dollar is of course a commodity currency and therefore it follows risk appetite. With that being the case, the market should continue to see a lot of volatility, and it should be noted that the 61.8% Fibonacci retracement level has shown signs of resistance. Ultimately, I think this is going to be a very difficult move to the upside, but it certainly has made pretty decent strides during the day on Wednesday.

Pullbacks at this point could be thought of as buying opportunities, but we obviously need strength in stock markets around the world as they can show whether or not there is more risk appetite or not. If there is, then the Australian dollar should continue to march higher. However, if there is some type of selling of risk appetite, then it makes sense that the Aussie drops from here. The Australian dollar is highly levered to China, so you need to pay attention to the Chinese situation itself. If the global supply chain is going to break down, the Australian dollar is one of the first places traders will punish currencies. That being said though, the question isn’t so much whether or not the Aussie could rollover from here, but whether or not it had gotten too far ahead of itself.

The 0.60 level underneath is massive support, and therefore the market breaking below there would of course be an extraordinarily negative sign. At this point in time, I think that one would think this simply goes back and forth, based upon the latest whim of the market, so keep in mind that you should be cautious about your position size, because even if we do take off to the upside it is still against the overall trend. The Australian dollar has seen a nice run higher, but we still have a major downtrend so it’s something to pay attention to. Ultimately, expect volatility going forward as the headlines continue to come at you rather rapidly. There have been big moves in the stock markets showing signs of strength, but there is still a huge argument to be made for the possibility of a bear market rally, something that will sell off rather drastically, leaving to US dollar buying.