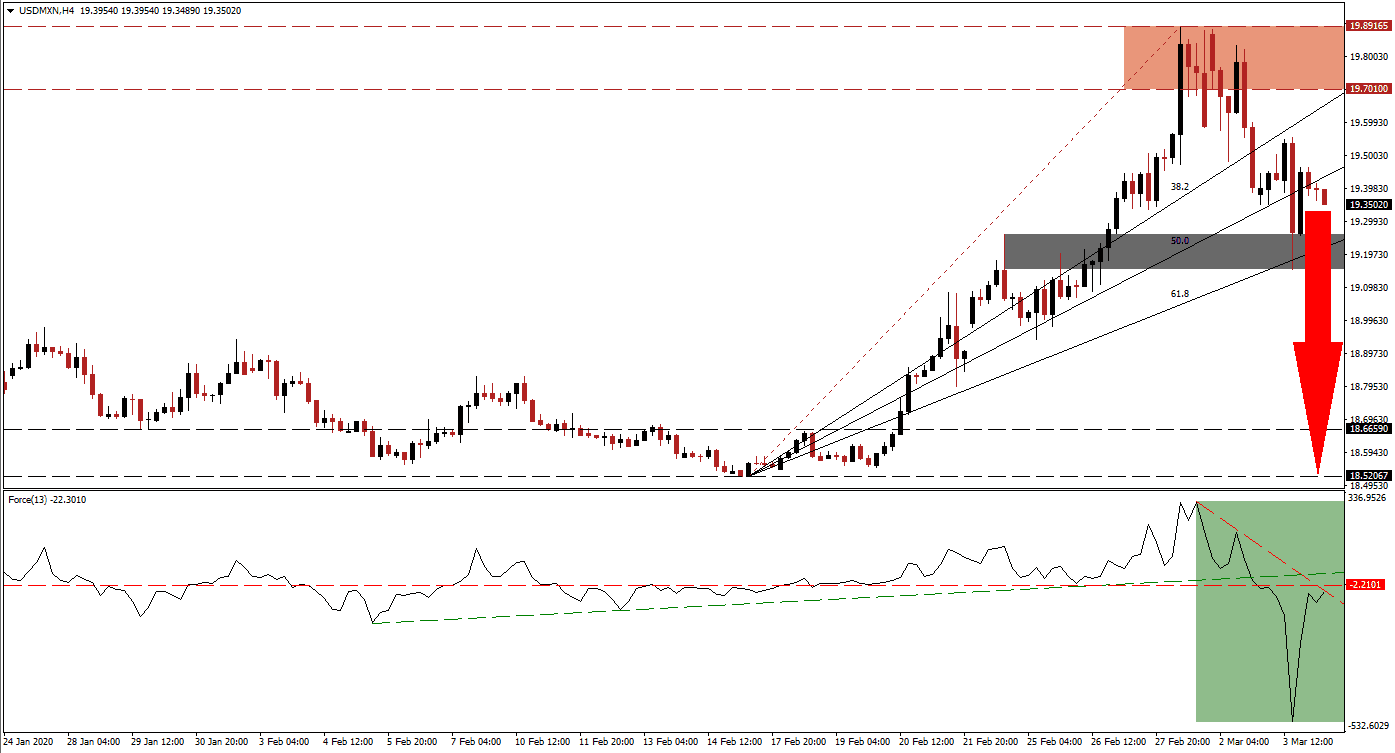

After the US Federal Reserve slashed its benchmark interest rate by 50 basis points to 1.00% yesterday, downside pressure on the US Dollar increased. It was the first monetary adjustment in-between official FOMC meetings since the global financial crisis and indicated panic by the central bank. The USD/MXN accelerated to the downside and briefly touched the bottom range of its short-term support zone before bouncing to the upside. Following the move below its ascending 50.0 Fibonacci Retracement Fan Resistance Level, breakdown pressures have spiked, suggesting a potential extension of the corrective phase.

The Force Index, a next-generation technical indicator, plunged to a fresh 2020 low from where it launched an aggressive recovery. It remains below its horizontal resistance level, as marked by the green rectangle, with the descending resistance level applying downside pressure on the Force Index. This technical indicator maintains its position in negative territory, granting bears control of the USD/MXN. The breakdown below its ascending support level added to bearish developments.

Price action was exposed t a profit-taking sell-off once it pushed below its resistance zone located between 19.70100 and 19.89165, as marked by the red rectangle. A double breakdown below its 38.2 and 50.0 Fibonacci Retracement Fan Support Levels converted both into resistance. While the Mexican economy faces economic challenges of its own, the US central bank shifted the dynamics in the USD/MXN to the downside. The Mexican finance minister noted there is less space for an interest rate cut, providing a fundamental boost to this currency pair.

One critical level to monitor is the 61.8 Fibonacci Retracement Fan Support Level, which currently passes through its short-term support zone. A breakdown below it is expected to initiate the next wave of net sell orders in the USD/MXN. The short-term support zone is located between 19.15090 and 19.25930, as marked by the grey rectangle. Should price action push through it, an accelerated contraction into its long-term support zone between 18.52067 and 18.66590 is anticipated. You can learn more about a breakdown here.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 19.35000

Take Profit @ 18.55000

Stop Loss @ 19.60000

Downside Potential: 8,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.20

Should the Force Index recover above its ascending support level, the USD/MXN could spike higher. The upside potential remains limited to its resistance zone, close to the key psychological resistance level of 20.00000. With more interest rate cuts expected out of the US central bank, any retracement of the breakdown will grant Forex traders a second short-selling opportunity.

USD/MXN Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 19.65000

Take Profit @ 19.89150

Stop Loss @ 19.55000

Upside Potential: 2,415 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.42