The surprising decision of the Federal Reserve to cut the US interest rate by half a point, backfired on the dollar and US stock indices. As the dollar tumbled and US stocks deepened their losses again after Monday's recovery session. The share of the USD/JPY pair was to drop to the 106.92 support, the lowest level of in more than four months, before stabilizing around the 107.20 level at the time of writing. What contributed to pressure on the dollar was fears that the outbreak of the Corona epidemic in the United States of America will increase the pressure on the global economy as a whole. Jerome Powell and his team tried to accelerate assistance to maintain the US economic growth, which remains the strongest among other global economies. The latest Chinese economic figures foreshadow a sharp slowdown of any economy hit by the Covid-19. The bank's official meeting to determine its monetary policy is two weeks from now.

"We saw a danger to the economy, and we chose to act quickly," Powell said at his press conference an hour after the bank announcement. Powell added that the virus "will definitely burden economic activity here and abroad for some time". Meanwhile, Powell sought to balance fears by indicating that the US economy was still strong, with lower unemployment and stronger consumer spending. "The economy continues to do well," he said.

In the same path as the bank, members of Congress are finalizing the $ 7.5 billion emergency bill to fund the government to counter the Coronavirus outbreak in a rare act of cooperation between political parties. The legislation will accelerate the development of the Coronavirus vaccine, reimburse the costs of preparedness by states and localities, assist other countries in combating the outbreak and seek to ensure that the vaccine is available to all when it is ready, although this may take a year.

Economists have warned that lowering interest rates by the Federal Reserve cannot directly solve the problems caused by the virus, from closed factories to canceling business trips to idle supply chains.

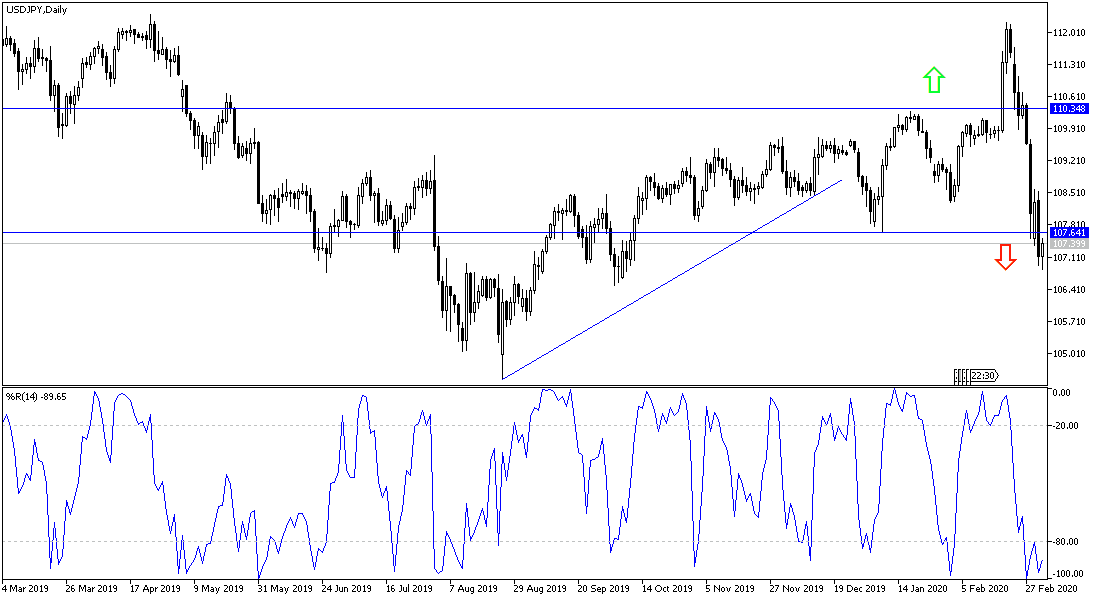

According to the technical analysis of the pair: As is evident by the USD/JPY performance on the daily chart below, there is a strong reversal of the trend into a strong bearish trend, since it broke the 110.00 psychological resistance, and is still subject to more downward pressure as long as the Coronavirus persists. Investors are indifferent to the pair's arrival to strong oversold areas. Closest support levels for the pair are currently at 106.85, 106.00 and 105.45, respectively. Rebound attempts will remain new selling targets. The Japanese yen is one of the most important safe havens for investors in times of uncertainty, as is the current global situation.

As for the economic calendar data: The focus will be on the US economic data; the ADP survey for the change in the US non-agricultural jobs and the ISM services PMI.