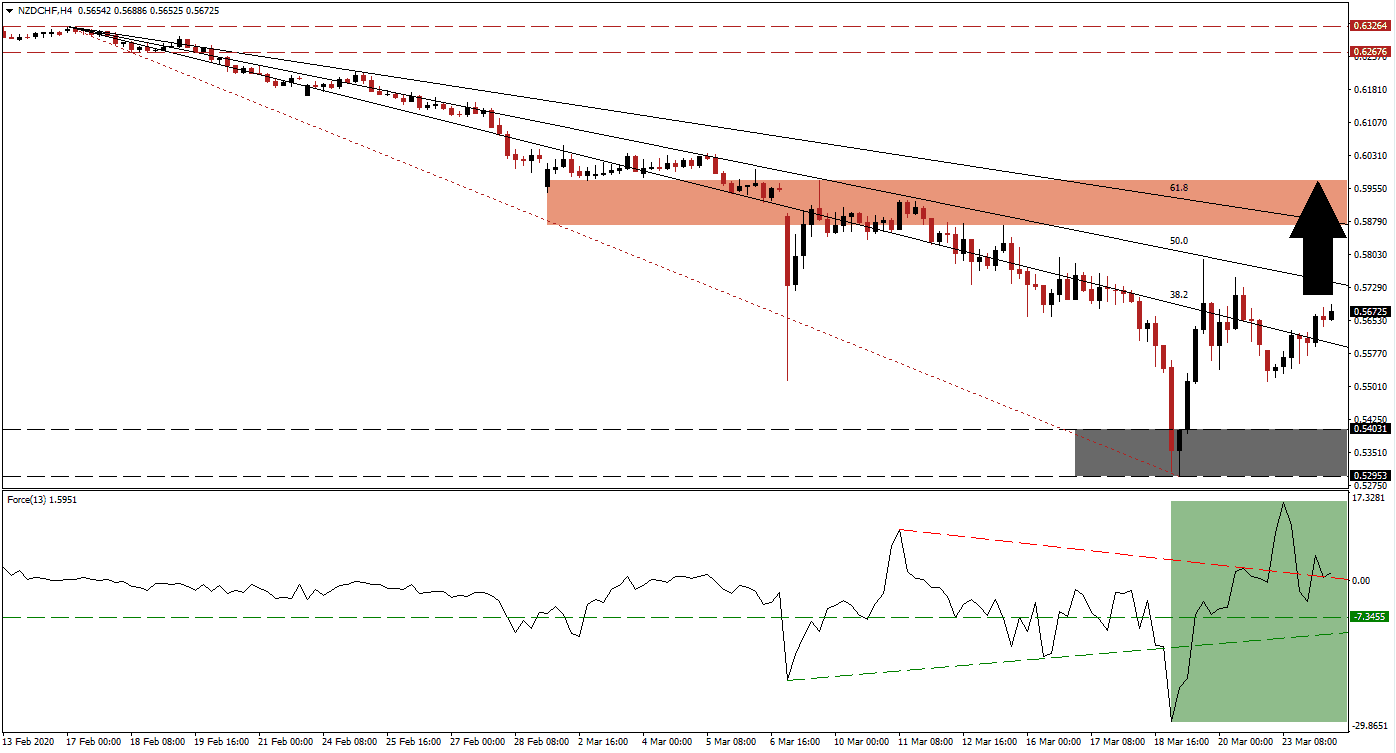

New Zealand prepares for a nationwide lockdown to combat Covid-19. It is one of the least infected countries with just over 100 confirmed cases, only two local transmissions, and no reported deaths. The government was one of the first ones to ban indoor/outdoor gatherings and to force arrivals into self-isolation. New Zealanders now prepares for a thirty-day full lockdown after announcing an NZ$12.1 billion economic stimulus or roughly 4% of GDP. The NZD/CHF completed a breakout above its support zone and reclaimed the descending 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support.

The Force Index, a next-generation technical indicator, points towards a significant built-up in bullish momentum after collapsing to a new 2020 low. It reversed the dip below the ascending support level and converted its horizontal resistance level into support. The magnitude of the recovery pressured the Force Index above its descending resistance level, as marked by the green rectangle, which now acts as support. This technical indicator is currently challenging it, a necessary step in the confirmation process, while bulls are taking control of the NZD/CHF.

Price action embarked on a quick reversal after reaching extreme oversold conditions inside of its support zone located between 0.52953 and 0.54031, as marked by the grey rectangle. A short-covering rally took the NZD/CHF into the 50.0 Fibonacci Retracement Fan Resistance Level before retreating below the 38.2 Fibonacci Retracement Fan Resistance Level. The reversal ensured the recovery remains healthy, from where more upside is favored. You can learn more about a short-covering rally here.

Switzerland announced an additional CHF32 billion in economic aid, following the initial CHF10 billion. Total stimulus now accounts for about 6% of GDP with CHF20 billion as bridge loans to healthy companies faced with a drop in revenues due to Covid-19. New Zealand is better positioned to overcome economic difficulties, allowing the NZD/CHF to push farther to the upside. The next short-term resistance zone located between 0.58712 and 0.59743, as marked by the red rectangle, including a minor price gap to the downside.

NZD/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.56750

Take Profit @ 0.59250

Stop Loss @ 0.56100

Upside Potential: 250 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 3.85

Should the Force Index sustain a breakdown below its ascending support level, a reversal in the NZD/CHF, is likely. The downside in this currency pair is limited to its support zone, and Forex traders are recommended to take advantage of temporary contractions in price action with new long positions. An increasingly bullish fundamental scenario is developing, and technical indicators suggest more upside.

NZD/CHF Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.55100

Take Profit @ 0.53550

Stop Loss @ 0.55800

Downside Potential: 155 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.21