Although the US dollar was affected negatively against most other major currencies after the surprising decision of the US Federal Reserve to cut US interest rates by half a point, the GBP/USD pair did not move up much, as it tested the 1.2843 level and returned to stability around the 1.2800 level in the beginning of today’s trading, with the continuation of pessimism about the future of the negotiations currently taking place between the European Union and Britain on the path of trade relations between them in the post-Brexit era.

The cable was also supported by a stronger reading for the UK construction PMI, and by what was mentioned in the testimony of the Governor of the Bank of England, Mark Carney, before the selected treasury committee, when he excluded the idea of trying negative interest rates and pledging to support the economy. Mark Carney said that the Bank of England will try to support the economy in the face of the coronavirus damage, which will be "significant but temporary", excluding any negative interest rates and confirming the bank's view that the UK has room to mitigate policy equivalent to 250 base points.

He also said that markets should expect a fiscal and monetary policy response to disrupt economic risks from the Coronavirus. Expectations are that the rate cut on March 26 to 0.50% by the Bank of England is becoming certain and the pound is currently priced based on that.

On the economic side. The UK Construction PMI rose from 48.4 to 52.6, when expectations were for an increase to only 49.0. The result indicates that the construction industry is no longer shrinking. The current level of the PMI is in line with building production rising 0.5% on a quarterly basis. However, growth could be stronger than this in the second quarter, given that the new orders index jumped to 55.3 - its highest level since December 2015 - from 49.5 in January. At the same time, we are still concerned that a tough exit for Britain from the European Union will lead to the collapse of exports of goods and services.

Although the economic calendar yesterday lacked important and influential US data, the Federal Reserve wanted to compensate for that by announcing a surprising reduction in US interest rates by stronger than what markets expected, with the bank’s official meeting is only two weeks from now, but the bank saw that speeding up stimulating the economy is important and can’t wait, especially since the Corona epidemic has spread recently in the American territories, and 9 deaths have been recorded due to this epidemic. The markets were astonished by the historical decision. The reaction in the US stock markets was unusually counterproductive, and it appears that investors believe that the risk is greater than expected and that the bank will have to be more stimulated if the epidemic is prolonged and global human and economic losses increase.

The US interest rate is now at 1.25% from 1.75%, and the Federal Reserve’s statement announcing the rate cut declared that it “will act as necessary to support the economy,” which economists considered a sign that it is leaning toward additional rate cuts, perhaps at the next policy meeting within two weeks. Usually emergency rate cuts, like what happened on Tuesday, is followed by further cuts soon after.

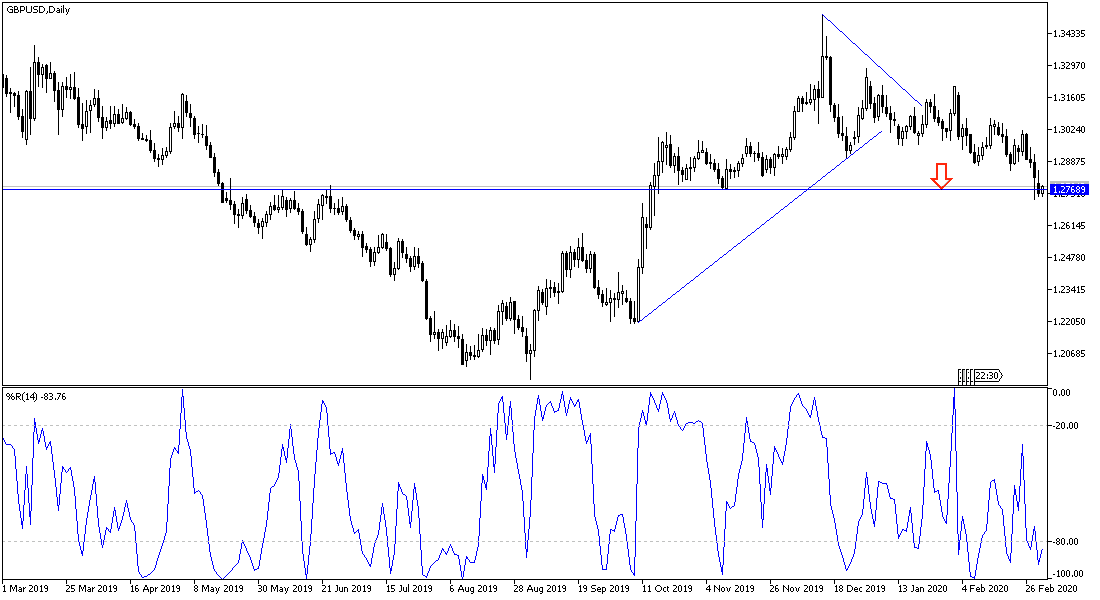

According to the technical analysis of the pair: As we expected before, we now confirm that if the GBP/USD price stabilizes around and below the 1.2800 psychological support, the pair's bearish momentum will increase and the support levels will remain at 1.2745, 1.2690 and 1.2580, as the next targets for the bears, especially with the announcement of a failure of the talks between Britain and the bloc. The opportunity for a trend reversal still depends on moving towards the 1.3000 psychological resistance. I still prefer to sell the pair at every upper level.

As for the economic calendar data: From Britain, the PMI for services will be announced. From the United States, the ADP survey of the change in the numbers of non-agricultural jobs then the ISM PMI for US services and oil stocks data will be announced.