GBP/USD: Significant recovery in price

Yesterday’s signals were not triggered as there was no bearish price action at 1.1710.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken prior to 5pm London time today.

Short Trade Ideas

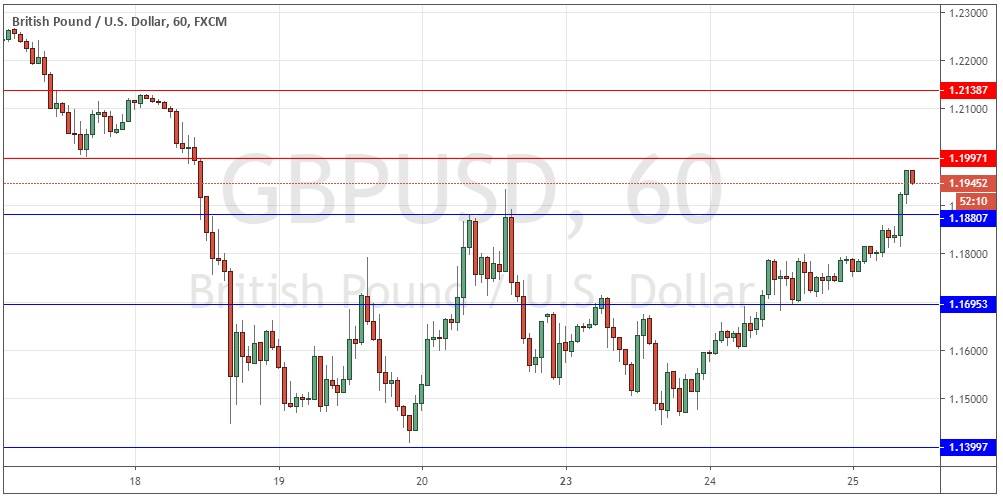

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1997 or 1.2139.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1881 or 1.1695.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that although I thought that the medium to long-term outlook remained bearish, I wanted to see the price break to new lows below 1.1400 before being strongly bearish, although speculative short trades from reversals at 1.1710 or (especially) 1.1881 also looked attractive.

I was wrong as the price has continued to rise relatively strongly, although waiting for these levels was enough to keep out of trouble as they did not produce bearish reversals.

We are seeing a general strong recovery in the riskier currencies, such as the GBP, against the USD which is falling. This is all due to the strong comeback by the U.S. stock market and other stock markets after the $2 trillion U.S. rescue package was agreed some hours ago.

Technically, the area at about 1.2000 looks very pivotal, as it is both logical resistance and a huge psychological round number.

I am prepared to take a short-term long trade from a bullish bounce at 1.1881 or a medium-term short trade from a bearish reversal at 1.2000 today. Concerning the GBP, there will be a release of CPI (inflation) data at 9:30am London time. There is nothing of high importance scheduled today regarding the USD.

Concerning the GBP, there will be a release of CPI (inflation) data at 9:30am London time. There is nothing of high importance scheduled today regarding the USD.