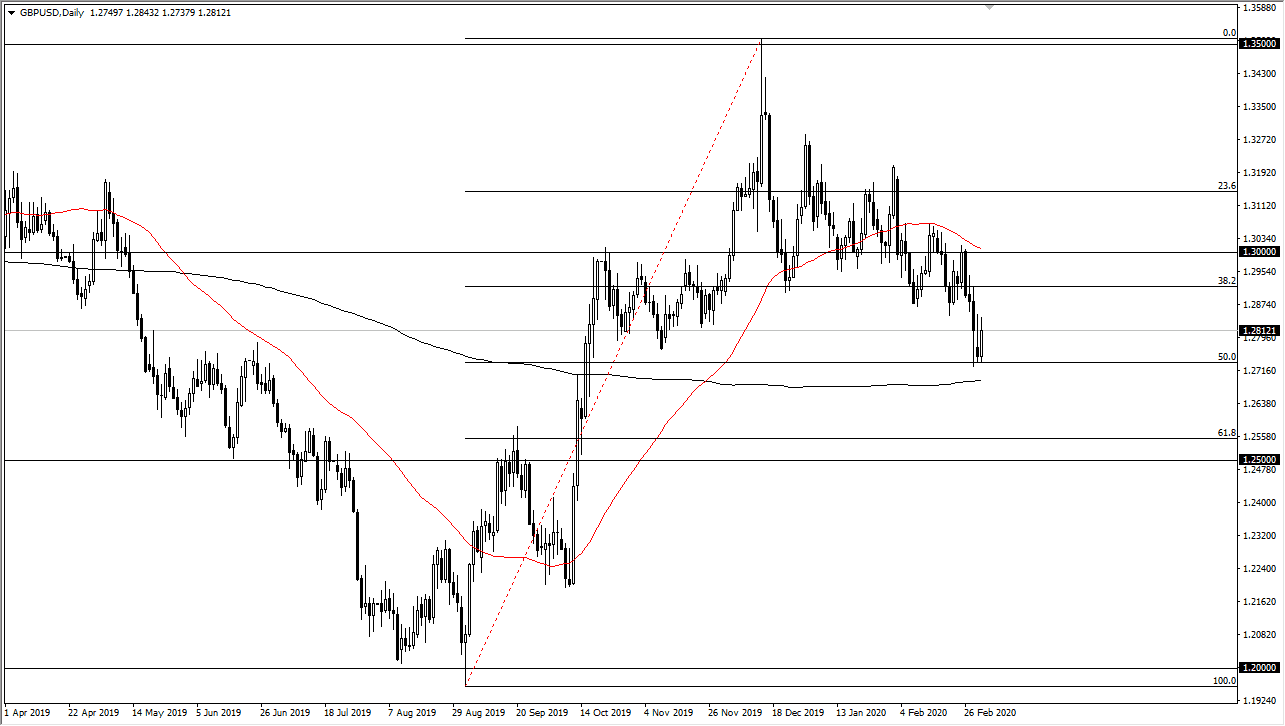

The British pound has rallied a bit during the trading session on Tuesday after the Federal Reserve cut rates by 50 basis points. That being said though, the market is very likely to continue being all over the place, and at this point it’s likely that the market is showing signs of support near the 200 day EMA. Furthermore, there is the 50% Fibonacci retracement level in this area as well, so I do think that it is only a matter of time before at least some attempt at recovery happens. That being said though, one thing that you should be paying attention to is the fact that the British pound has rallied, but not stringently so regardless of the rate cut.

If we turn around a break down below the 200 day EMA, then it’s very likely that we fall apart and drop down to the 61.8% Fibonacci retracement level and then perhaps even the 1.25 handle. Part of the reason I think this market is struggling a bit is that the Bank of England is still likely to cut interest rates as well, so the question then becomes whether or not it is all “a wash” when it comes to the US versus the United Kingdom.

Beyond that, we also have all of the noise coming out of the discussions between London and the EU, so that of course has a major influence on what happens with the British pound as well. Rallies at this point I would still look at with suspicion, and perhaps I would be looking to sell near the 1.2950 level. The 1.30 level above there is resistance as well, so if we can break above that and the 50 day EMA, then it could send this market much higher. Ultimately, this is a market that has been rolling over, but it is sitting right on top of a major support level. I think you will see an impulsive candle sooner or later, and that’s what you will be trading. Until then, it’s very difficult to get aggressive in this pair because you get your head ripped off in this type of environment. As I stated with the Euro analysis, I have not seen volatility in the stock markets and by extension other markets like this since 2008. Because of this, there has been a bit of a “rolling selloff”, meaning that markets get hit at different times.