The GBP/USD pair has been drifting a bit lower over the last couple of months, but recently things have changed. The most notable change has been that the Federal Reserve has cut interest rates by 50 basis points and is now projected by the Fed Funds futures to cut another 50 basis points in the short term. In other words, you should see the US dollar get crushed and quite frankly it is something that central banks around the world would like to see.

What makes the US dollar unique is that it is the world’s reserve currency, and most of the debt in various countries around the world is in fact denominated in greenback. So, think of it this way: if the US dollar starts to strengthen, emerging markets that take out bonds typically will have to pay back those bonds in US dollars. If their currency is dropping in value against the greenback, that means that debt becomes much more expensive. One prime example of this is China and much of the debt that it’s corporations have incurred. In fact, that is without a doubt one of the biggest landmines out there waiting for the financial system.

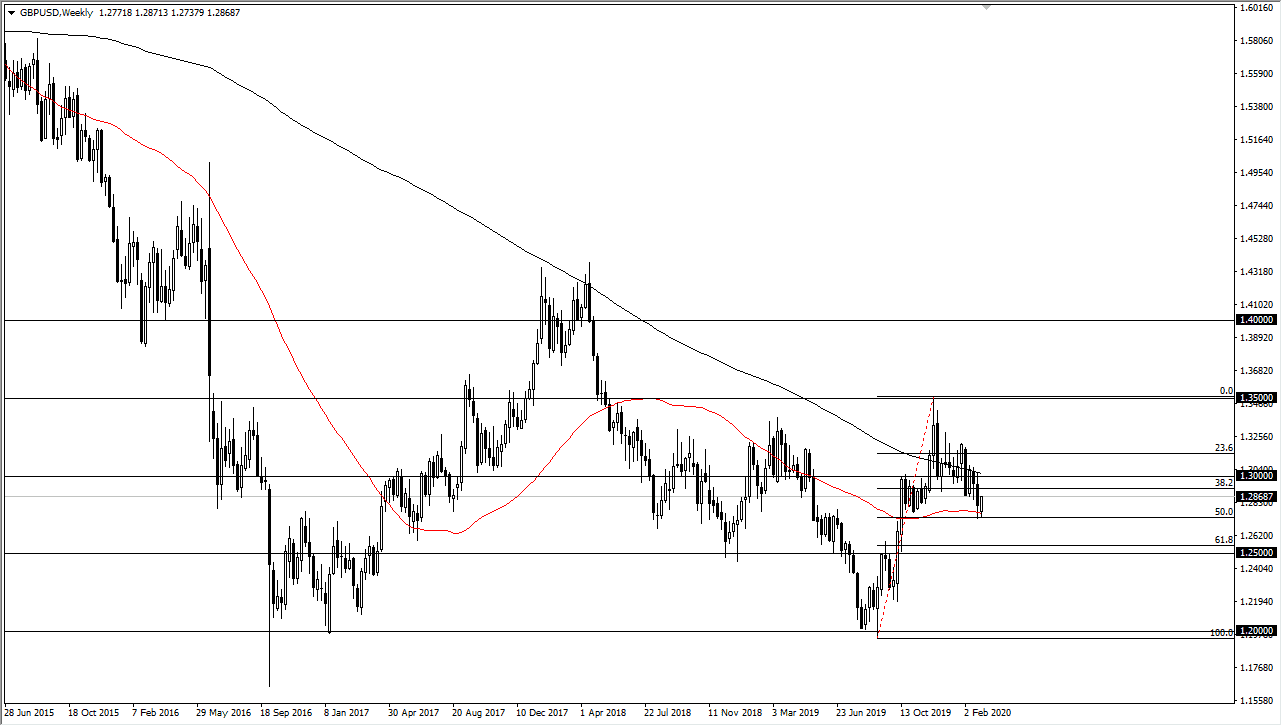

That being the case, the Federal Reserve is probably cutting interest rates for a multitude of issues. Keep in mind that the Federal Reserve is essentially the “central bank to the world”, and although the US economy is going fairly well, the reality is that it won’t be if some type of debt bomb explodes around the world. With this, I do believe that the US dollar is going to continue to struggle in the short term, but I don’t look for it to take a huge hit over the longer term. In this scenario, I believe that the British pound is probably going to be positive for the month, although the Bank of England may very well cut interest rates itself. That cut will not be as deep as the Federal Reserve cut though, so it should drive this market towards the 1.32 level given enough time.

If things do change and suddenly get ugly, then I believe that the market breaks down below the lows of the month of February, opening up the possibility of a breakdown below the 50% Fibonacci retracement level and a move down to the 61.8% Fibonacci retracement level closer to the 1.25 handle. Unless something ugly happens though, I look at short-term pullbacks as very likely being a buying opportunity in this pair.