The EUR/USD pair jumped to the 1.1213 resistance, highest level in two months, before settling again around the 1.1160 support in response to the sudden move by the US Federal Reserve, led by Jerome Powell, to reduce the US interest rate by half a point before the official meeting that is due two weeks from now. The historic measure from the bank came in light of the increasing global concerns about the continuation of the COVID-19 outbreak, and its real threat to the future of global economic growth, especially after the epidemic reached the American soil. Washington announced the death of 9 people due to the virus.

Jerome Powell told a news conference after the decision that the virus "will definitely burden economic activity here and abroad for some time."

This was the Fed's first step since last year, when it cut its key short-term interest rate three times. It is also the first time that the interest rate has fallen between policy meetings since the 2008 financial crisis, and this the largest rate cut since then.

The Dow Jones industrial average, which had fallen 356 points shortly before the Fed announcement, rose initially in response to the news. But by mid-afternoon, the Dow Jones fell more than 700 points, a sign of alarming concerns about the economic damage caused by the virus. However, the Dow Jones rose about 1,300 points on Monday - its biggest gain since 2009.

The yield on 10-year US Treasury bonds fell less than 1% for the first time ever.

The US central bank's announcement of a sharp interest rate cut indicates its concern that the Coronavirus, which slows economic activity worldwide, is a mounting threat and may lead to an economic recession. Increased uncertainty about how and when to resolve the threat is a constant pressure on markets. Powell said that since last week, when many Fed officials said they saw no urgent need to cut interest rates, "we have seen a wider spread of the virus and we had to act immediately."

And before the bank’s decision. Official data showed that Eurozone inflation slowed due to lower energy prices in February and the unemployment rate stabilized at its lowest level in more than a decade at the beginning of the year. According to Eurostat estimates, inflation in the cluster slowed to 1.2 percent in February from 1.4 percent in January. The rate was in line with expectations. Core inflation remained well below the ECB target "below, but close to 2 percent". However, core inflation, which excludes energy, food, alcohol and tobacco, rose 1.2 percent from 1.1 percent a month ago.

Economists believe that the impact of Covid-19 on the economy will distort inflation figures in the coming months, but it is too early to tell. For the European Central Bank, yesterday's figures will be nothing more than a confirmation of the current modest inflation environment, and for the March 12 meeting, immediate Covid-19 actions will be more important than the February inflation environment.

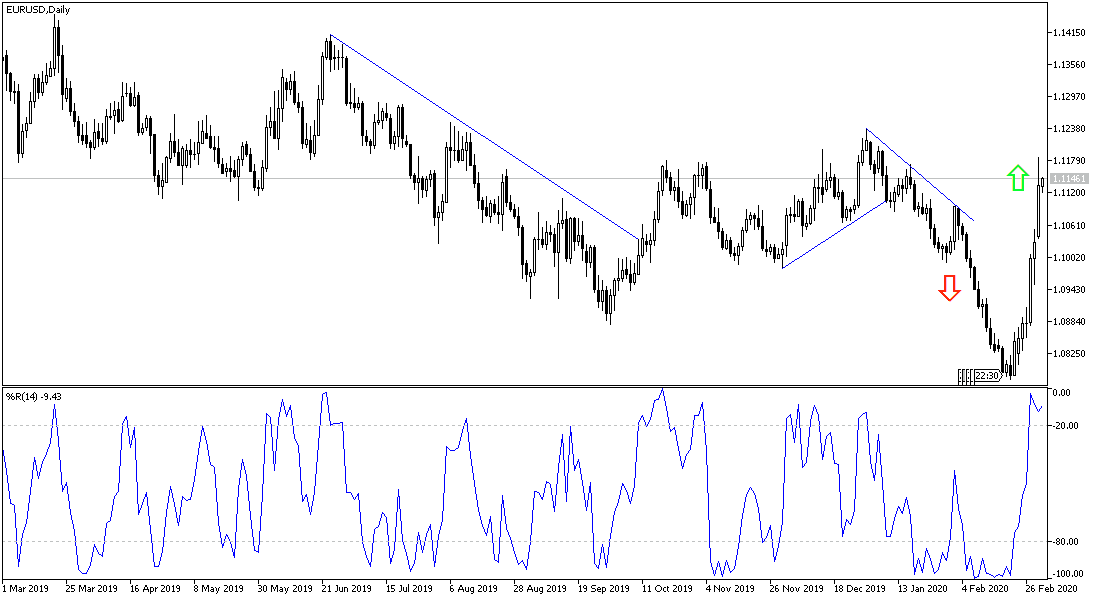

According to the technical analysis of the pair: The EUR/USD price path is still within the range of an upward correction channel, and the reflection will be strengthened by capturing the highest psychological resistance at 1.1200, but it is necessary to take into account the arrival of technical indicators to overbought areas and can a profit-taking correction can take place the at any time, especially if markets better absorbed the latest measure by the US Federal Reserve. On the downside, the correction might take the pair towards 1.1145, 1.1090 and 1.1000 support levels as a first stage.

As for the economic calendar data today: First, the PMI for services will be announced for France, Germany and the Eurozone, then the retail sales numbers for the block. From the United States, the ADP survey for the change of non-agricultural jobs, the PMI for US services sector and oil stocks data will be released.