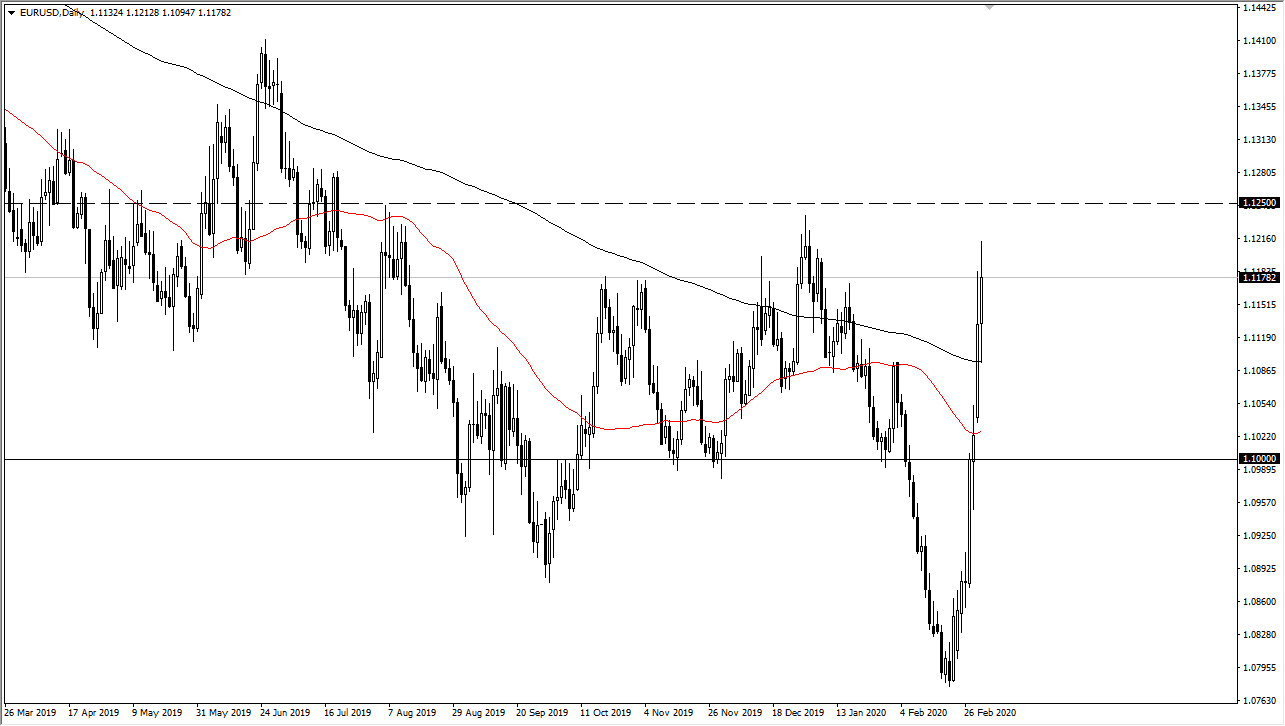

The Euro rallied again during the trading session on Tuesday as the Federal Reserve cut interest rates by 50 basis points in a surprise move. That being said though, it could not break above a major resistance barrier so don’t be surprised at all to see a rollover given enough time. I see the $1.12 level as an area that begins significant resistance for about an entire penny, so at this point I’m looking for an opportunity to continue shorting this pair from the longer-term standpoint. That being said though, the market does break above the 1.1250 level on a weekly chart then it’s likely that we could go to the upside. If that happens, the market will change the entire trend and we will more than likely continue to see noise be a major issue.

The US dollar is getting hammered due to the fact that the Federal Reserve has more room to move when it comes to cutting rates, and therefore the dollar may continue to suffer. Having said that though, the European Central Bank will almost certainly do something to ease tensions, so therefore it’s likely that the market will be waiting on whether or not they do some type of quantitative easing. I anticipate that this is going to be a very volatile market going forward, and therefore if we should keep very small positions going. Quite frankly, anything can happen at any moment by the one thing that I would pay the most attention to is the previously mentioned 1.1250 level. A break above there certainly changes a lot of things.

If we do break to the downside the 1.10 level could be targeted, but the biggest problem that traders will continue to move upon the latest noise more than anything else so it is difficult to imagine a scenario where anything close to certainty will be part of the game. Quite frankly, I know several prop traders who are simply out of the markets right now waiting for some type of stability. The most important thing you can do is keep your position size small so that you don’t blow up your account on a sudden announcement. If you are trading stocks today, you saw just how dangerous this type of event can be. I have not seen volatility like this since 2008, although we are quite that bad yet.