Needless to say, the financial markets are going to be difficult to predict the moves of over the next 30 days, as we have seen mass chaos introduced into the marketplace. Because of this, although technical analysis is my forte, I also have to keep in mind the fundamentals as they will more than likely become even more important this month than any other in recent memory.

When looking at the EUR/USD pair, we have seen a massive spike higher leading towards the “surprise rate cut” by the Federal Reserve which had already been priced into the Fed Funds rate futures. In other words, it was simply the Federal Reserve acquiescing to the markets again. With that in mind, it is important to watch that market and it is suggesting that we could get even lower rates. However, one would have to think that at the March 18 meeting another rate cut could be more of a question mark than anything else considering that they have already made this 50 basis point move. One thing that Forex traders tend to forget is that when you trade currency pair, you are trading relative strength or weakness. Fundamentals will drive where we go next.

The Euro is weak for a reason. Yes, there was a large interest rate differential between the two economies, but at this point part of the reason the Euro has rallied is simply because the Federal Reserve has more room to cut rates, thereby pushing its currency around. However, Europe has quite a few structural issues that continue to weigh upon it. Not the least of which would be the negative interest rates that are so prevalent over the continent, turning banks into financial bombs just waiting to explode. We obviously know about Deutsche Bank, but there are others out there as well.

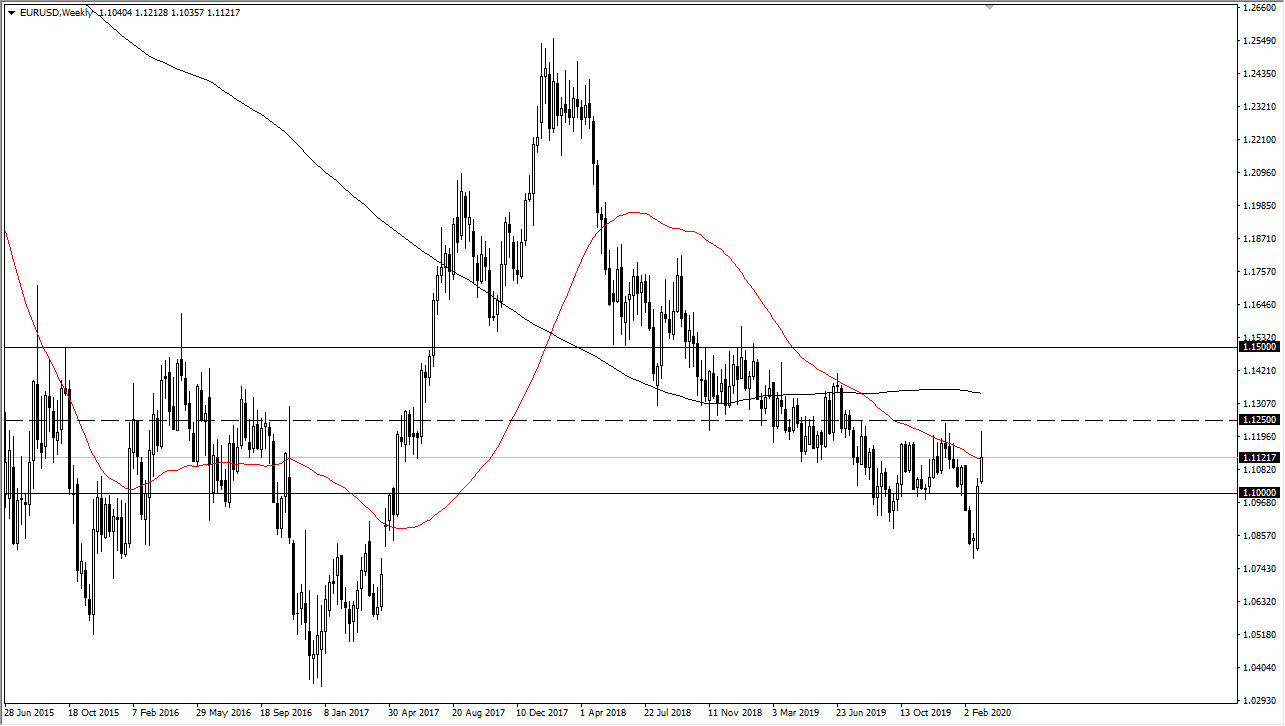

With all of that being said, and the fact that the European Central Bank will almost certainly have to do something, I am a bit skeptical about the Euro itself unless of course the Federal Reserve rescues it by cutting even further. This is always a possibility, but one has to think the bar is a little higher than once was. From a technical analysis standpoint, I believe that the 1.1250 level is the most important level on the chart right now, because if we break above there then it becomes more of a trend change to the upside. Otherwise, I think we are looking at a range between 1.10 and 1.1250 for a majority of the month.