The Australian dollar has broken down significantly after rallying due to a surprise 50 basis point interest rate cut by the Federal Reserve as it proves who it works for yet again. At this point, it looks to me as if there are a lot of sellers above, and of course there seems to be more of a “risk off” attitude in the markets. Don’t believe me? All you have to do is look at the fact that the Dow Jones Industrial Average is closing roughly 800 points lower than it started, and that’s after the massive spike higher due to that surprise announcement.

Due to this, it looks like we still have a lot of work to do as far as risk appetite is concerned and that of course will continue to weigh upon the Aussie dollar itself. The Australian dollar is far too levered to the Chinese economy in the entire coronavirus mess, and at this point the fact that it gave back 40% of the gains after the rate hike tells you that people are not willing to jump into Australia right away. They had shown the Aussies to cut rates earlier, so perhaps that was part of the noise as well.

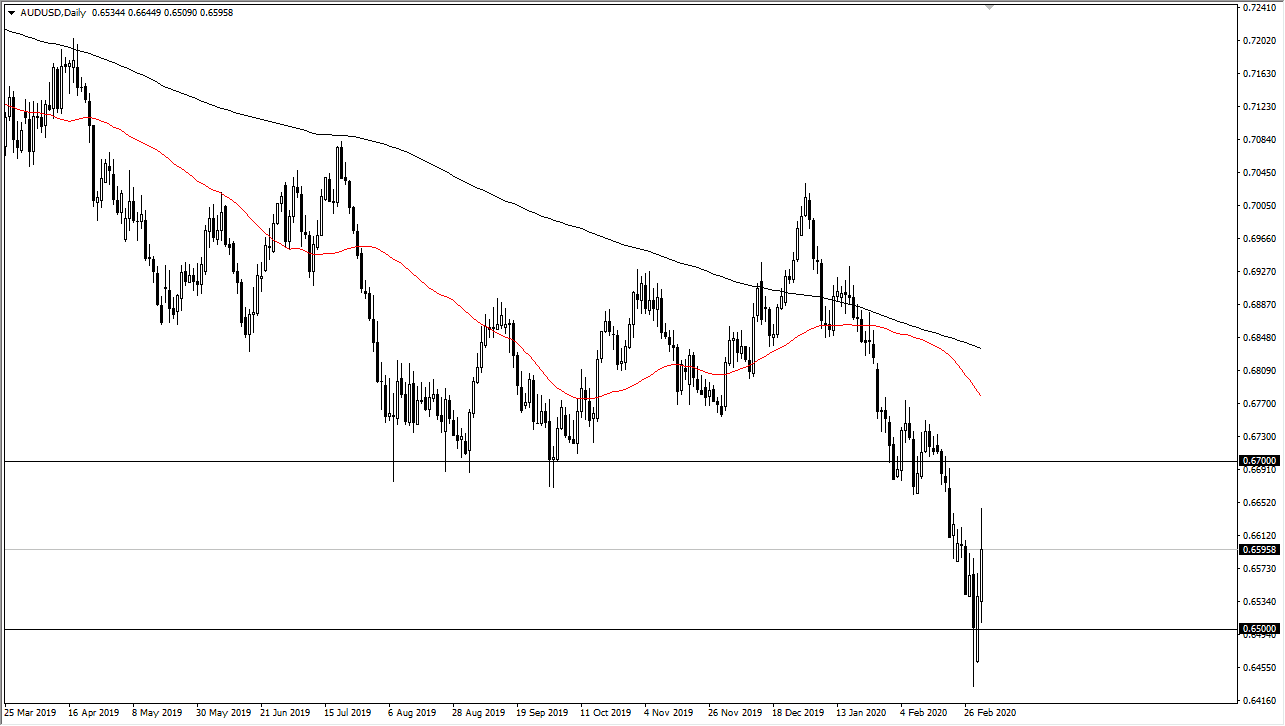

The 0.67 level above is the “ceiling” in the market and therefore I think it’s not until we break substantially over there on the weekly chart that I would consider buying. Overall, this is a market that continues to look very negative and ugly and I do think that we will be testing the lows again. We may get a short-term pop during the trading session on Wednesday, but I think that’s probably about as good as this gets. The 0.63 level has shown itself to be important in the past as it was the bottom of the financial crisis consolidation area and therefore, I think it’s likely that we will see plenty of buyers in that area. In fact, I think that the Australian dollar is begging to touch that level, and if it can hold that might be a buy-and-hold opportunity for longer-term traders. That being said, if we do break above the 0.6775 handle, then I think we will have cleared a major barrier. I think you can anticipate a lot of back and forth in this pair as we simply cannot make up our minds for any significant amount of time.