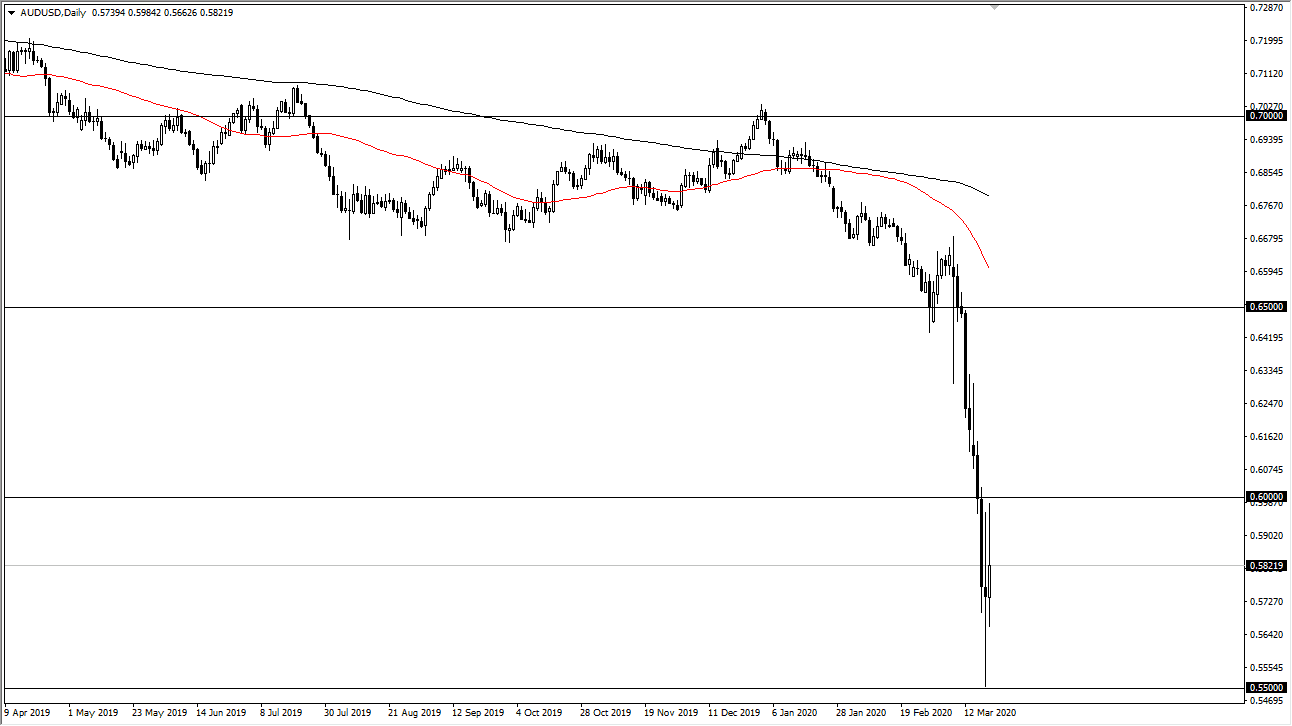

The Australian dollar initially tried to rally during the trading session on Friday but found a lot of resistance near the 0.60 level as one would expect. After all, the market does like these large, round, psychologically significant figures, and therefore it will be interesting to see what how long the 0.60 level can offer selling. Keep in mind that the Australian dollar is struggling due to Reserve Bank of Australia being so dovish, and of course the Australian dependence on the Chinese economy.

As global growth slows down, that will continue to work against the commodities out there, and that of course has a major influence on Australia as gold, aluminum, and iron are all important, not to mention the massive copper market that is found in the country. As demand picks up, people need to buy more Australian dollars in order to pay local miners and the like. At this point, as long as the global growth continues to cause issues, it’s very likely that we will continue to figure on a lower valued Aussie. That being said, we are at extremely oversold conditions so it’s likely that we will eventually find some type of bottom. However, the bottoming process is rather difficult, so keep in mind that trading the Aussie can be very dangerous right now.

The 0.55 level underneath should be thought of as support, as we have bounced so hard from that level. Beyond that, it was important in the past, but it should be noted that the 0.60 level is by far the most important level on this chart, because it was the bottom of the financial crisis. I think it’s probably only a matter of time before we break down below the 0.55 handle, looking to reach down to the psychologically important 0.50 level, which will more than likely mark the bottom. Obviously, it’s going to take a significant amount of effort to turn this trend around, but we are overextended. I think the best thing you can do at this point is simply fade signs of exhaustion after short-term rallies. If we do break above the 0.60 level, then we could have a little bit more of a move to the upside, perhaps to the 0.62 level. Above there, the market will more than likely go looking towards the 0.65 handle. However, that seems to be almost impossible at this point.