The Australian dollar has started off March and ended February with a bit of a bang. However, the question at this point isn’t so much as to whether or not it has been positive, but whether or not it can remain so. I think that this pair is in a downtrend for a good reason, not the least of which is that the Reserve Bank of Australia is likely to cut rates going further ahead. That being said, there are some technical levels that are worth paying attention to on the chart that could give us a little bit of guidance.

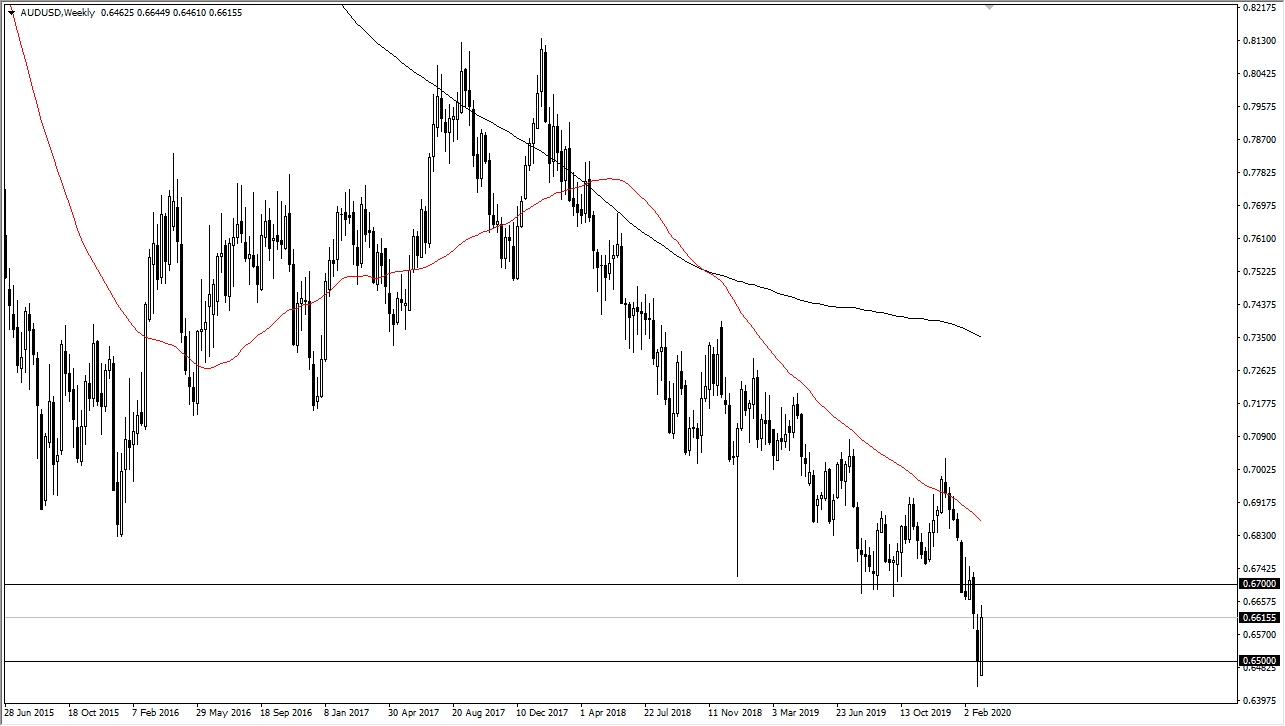

The 0.67 level is an area that I would anticipate seeing a lot of selling pressure. In fact, I think that extends all the way to the 0.6775 handle, possibly even as high as the 0.68 level. As long as we stay underneath that area, I anticipate that selling rallies will continue to work. This makes sense, because we have seen a significant break below the 0.67 level recently, which was previous support. For historical reference, it is the top of the consolidation area that turned the market back around during the financial crisis. The bottom of the support area extends all the way down to the 0.63 level, and it is very possible that we will visit that level over the next several weeks.

If we do break out to the upside, I expect a lot of noise all the way to at least the 0.70 level. However, that is a level that I have as a “line in the sand”, meaning that we should see a bit of a trend change at that area. Ultimately, if that happens, I suspect it will probably accompany some type of good news out of China, and more importantly out of the coronavirus situation in that same region. The biggest problem that people have trading the Aussie right now is that you cannot trust official Chinese figures as they have been caught lying more than once. Ultimately, Australia is a proxy for that region so therefore I think we do have some more pain ahead, especially considering how poor the economic numbers are. One thing to watch out for in March will be PMI figures coming out of China. As they had printed such horrific numbers during the last few weeks, the next set of numbers better be much stronger, otherwise this pair is going to fall apart. Fading short-term rallies probably works over the next couple of weeks though.