After the massive rally in the XRP/USD came to an abrupt halt this weekend, eliminating excessive bullishness, this digital asset found stability at its short-term support zone. The entire sector saw impressive gains over the past six-to-eight weeks, which led to a disconnect between fundamental reality and resurgent retail demand based on fear-of-missing out. More volatility is anticipated to follow, with periods of an orderly advance disrupted by violent sell-offs. You can learn more about a support zone here.

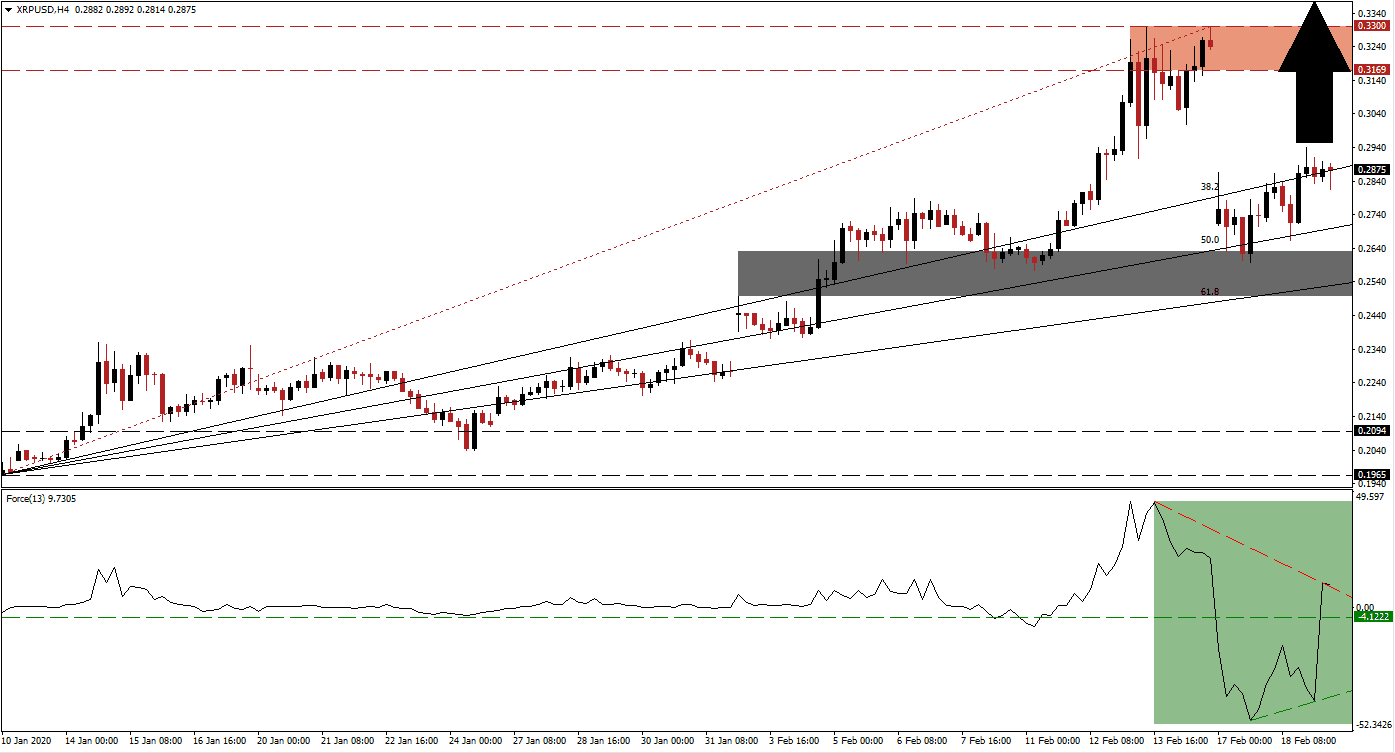

The Force Index, a next-generation technical indicator, plunged to a fresh 2020 low before a bullish momentum recovery emerged. Given the sharp contraction, the reversal is equally powerful and continues to evolve. The Force Index spiked back above its horizontal resistance level, converting it into support. An ascending support level emerged, providing a floor for future reversal. This technical indicator is now challenging its descending resistance level, as marked by the green rectangle. It already allowed bulls to take charge of the XRP/USD with a push above the 0 center-line.

Following the price gap to the downside, which led this digital asset into its short-term support zone, price action bounced higher. This zone is located between 0.2498 and 0.2630, as marked by the grey rectangle, the bottom range of its additionally shares the candlestick of a previous price gap to the upside. Adding to bullish developments is the support of the ascending 50.0 Fibonacci Retracement Fan Support Level. It elevated the XRP/USD above the entire Fibonacci Retracement Fan sequence, clearing the path for an extended advance.

A breakout in this digital asset above its intra-day high of 0.2939, the peak of its current bounce, will allow the XRP/USD to fill the massive price gap to the downside. It is anticipated to provide sufficient momentum to force a breakout above its resistance zone located between 0.3169 and 0.3300, as marked by the red rectangle. The next resistance zone awaits price action between 0.3828 and 0.3979, filling more price gaps. You can learn more about a breakout here.

XRP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.2875

Take Profit @ 0.3975

Stop Loss @ 0.2550

Upside Potential: 1,100 pips

Downside Risk: 325 pips

Risk/Reward Ratio: 3.39

In case of a reversal in the Force Index below its ascending support level, the XRP/USD is expected to follow with a breakdown. The threat of a more massive profit-taking sell-off lingers, especially if the Ripple Foundation executes another Ripple dump, which will supply downside pressure. An extended sell-off may take price action into its long-term support zone located between 0.1965 and 0.2094.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.2375

Take Profit @ 0.2000

Stop Loss @ 0.2550

Downside Potential: 375 pips

Upside Risk: 175 pips

Risk/Reward Ratio: 2.14