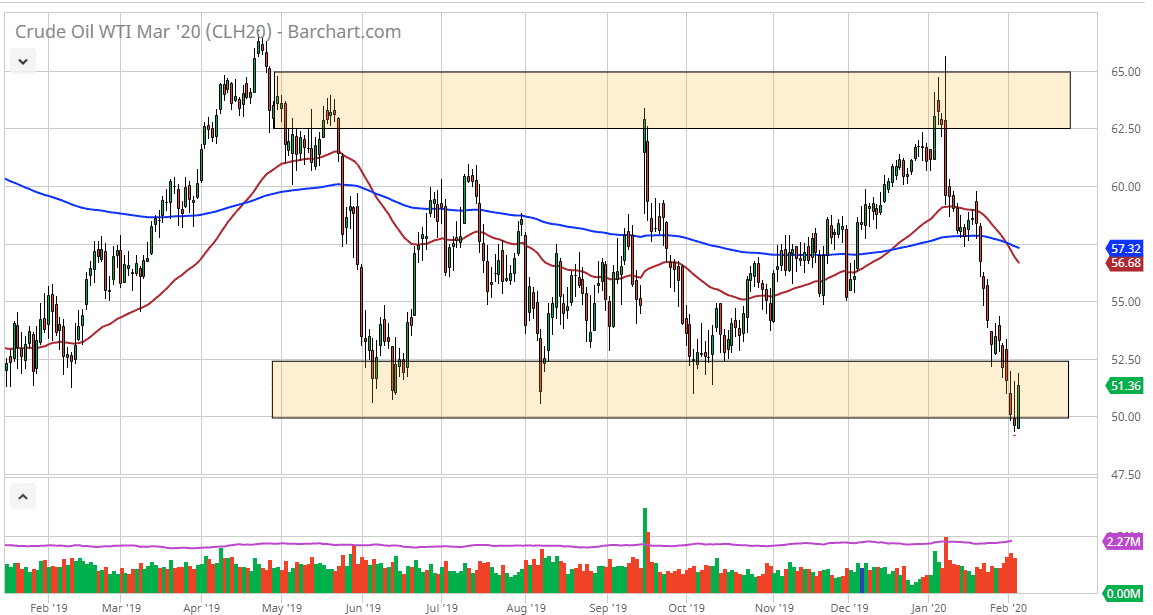

The West Texas Intermediate Crude Oil market has rallied significantly during the trading session on Wednesday, as the market breached the $50 level. We are at extreme lows of the most recent longer-term consolidation zone, so it does make sense that there would be a little bit of a reaction. At this point though, it is a bit difficult to get overly bullish as although the market has reached higher, it has given back roughly half of the gains. With that, it shows that we still have a lot of downward pressure in this market. Because of this, rallies are probably going to be sold although OPEC is trying to do something about a significant production cut in order to drive prices back to the upside.

All things being equal though, most of what’s causing the latest issue is the Chinese slowdown, which has demand in China falling by 20% or more. This of course has a major influence on what this supply/demand equation looks like, and as a result it’s likely that the selling pressure will still be around unless OPEC does something drastic.

On a daily close above the $52.50 level, then it’s likely that the market could turn around and go looking towards the $55 level. Alternately, if the market was to close below the $50.00 level on a daily close, the market could go looking towards the $47.50 level below, and then possibly the $45.00 level as well. Ultimately, the market is in an oversold condition so one would have to think that it’s only a matter of time before value hunters come back. However, it’s very difficult to be the first one to come into this market, so it’s probably best to wait for some type of daily candlestick to start either buying or selling at this extremely low level. Obviously, the idea of the $50.00 level will continue to attract a lot of attention, so this is going to be difficult to get involved in as headlines will continue to go back and forth based upon rumors and comments coming out of OPEC, not to mention the fact that a lot of technical trading will be done around this general vicinity. With that, I remain on the sidelines but will keep you up-to-date as to what I’m doing as I have not got a clear signal on the charts quite yet.