2019 resulted in the worst economic performance for Mexico since 2009, and Finance Minister Herrera is urging financial markets to be more optimistic for 2020. He pointed out that debt levels, as well as inflation, are well-contained. The Mexican Peso is reflecting this with stability and a bullish bias, while Pemex, the countries oil behemoth, reported a halt in production declines. Mexico is additionally set to benefit from supply chain shifts by the US out of China and closer to its borders, making Latin America’s second-largest economy an ideal location. The USD/MXN is likely to extend its correction with a new breakdown.

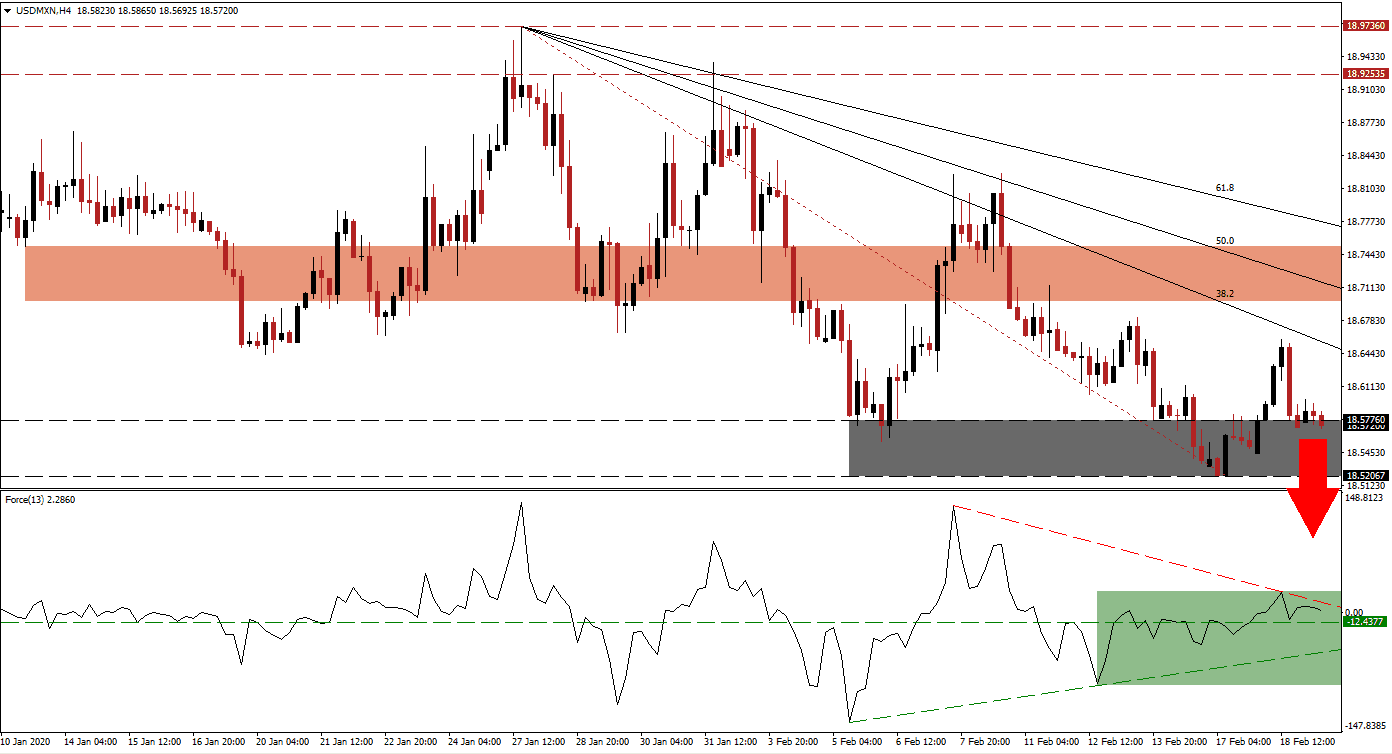

The Force Index, a next-generation technical indicator, was able to push through its horizontal resistance level, turning it into support, while price action temporarily spiked. A lower high allowed for the emergence of a descending resistance level, as marked by the green rectangle. The Force Index is expected to slip into negative territory, granting bears control of the USD/MXN, positioning this technical indicator for a breakdown below its ascending support level. An extension of the dominant bearish chart pattern is favored.

With a series of lower highs and lower lows, the bearish downtrend in this currency pair is well-established. It additionally results in the lowering of its short-term resistance zone, currently located between 18.69680 and 18.75200, as marked by the red rectangle. The descending 50.0 Fibonacci Retracement Fan Resistance Level is passing through this zone, enforcing the corrective phase in the USD/MXN. You can learn more about the Fibonacci Retracement Fan here.

Price action was reversed after closing in on its 38.2 Fibonacci Retracement Fan Resistance Level. It quickly entered its support zone located between 18.52067 and 18.57760, as marked by the grey rectangle. Given the ongoing Covid-19 threat and potential new limits in technology investment restrictions by the US regarding China, a breakdown is anticipated to materialize. The USD/MXN will then be cleared to descend into its next support zone, which awaits between 18.17062 and 18.26537, dating back to March 2018.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.57000

Take Profit @ 18.17250

Stop Loss @ 18.66000

Downside Potential: 3,975 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 4.42

Should the Force Index push above its descending resistance level, the USD/MXN may attempt a second breakout. Due to the developing long-term fundamental picture, in conjunction with technical developments, the upside potential appears limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to consider any price spikes from current levels as a second chance to enter fresh short positions.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 18.69500

Take Profit @ 18.77000

Stop Loss @ 18.66000

Upside Potential: 750 pips

Downside Risk: 350 pips

Risk/Reward Ratio: 2.14