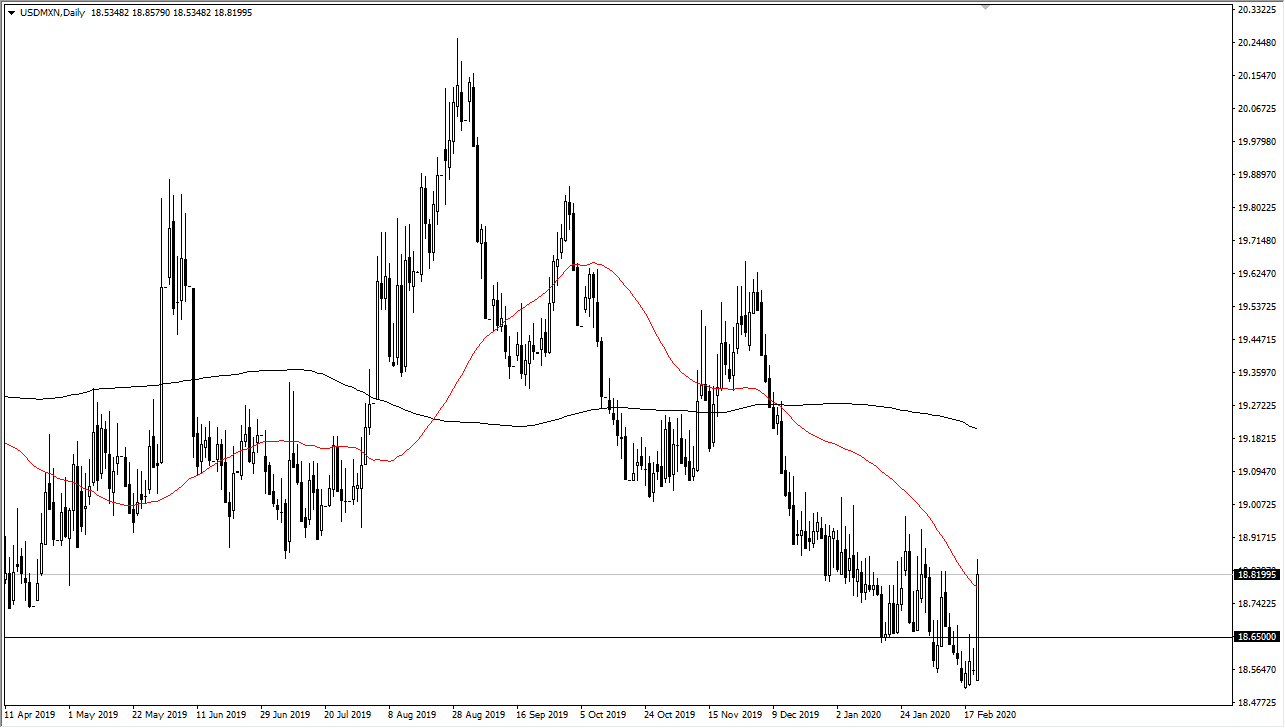

The US dollar shot straight up in the air against Mexican peso during the trading session on Thursday, clearing the 18.80 peso level. The candlestick for the trading session is extraordinarily bullish, and therefore it should continue to attract a lot of attention. The market looks as if it is trying to form some type of major bottom, as the 18.50 pesos level causes quite a bit of attention. This is a market that has been grinding lower for some time, but with the massive amount of trouble out there for global equities and the global markets in general, it makes sense that perhaps money runs away from emerging markets like Mexico.

Furthermore, the Mexican Central Bank has cut rates, so it shows just how concerned they are about growth. The Mexican economy is highly dependent on the idea of the global supply chain functioning, as Mexico is a major producer of goods for the US economy. From a technical analysis standpoint, the market has broken above the 50 day EMA, which of course is a bullish sign as well. If the market breaks above the top of the candlestick from the trading session on Thursday, it’s likely that the market is going to try to work towards the 19 pesos level but there is a lot of noise just above that will cause more of a grind.

More than likely, there is some type of pullback coming that will offer value as far as the greenback is concerned, and I would anticipate that people will jump in to take advantage of it. That being said, the market was to break down below the lows of the Thursday trading session, then it’s possible that we break down even further. That would be a bit surprising though, because there is so much in the way of fear out there that it’s difficult to imagine that suddenly people want to jump into the Mexican peso. That being said, the Mexican peso is a gateway currency for Latin America so that of course is something worth paying attention to. Several central banks in Latin America have cut rates recently, and that should drive down the value of all currencies in the region. Furthermore, the US dollar has been very strong against most other currencies, and as a result there shouldn’t be much of a difference when it comes to trading at against the peso.