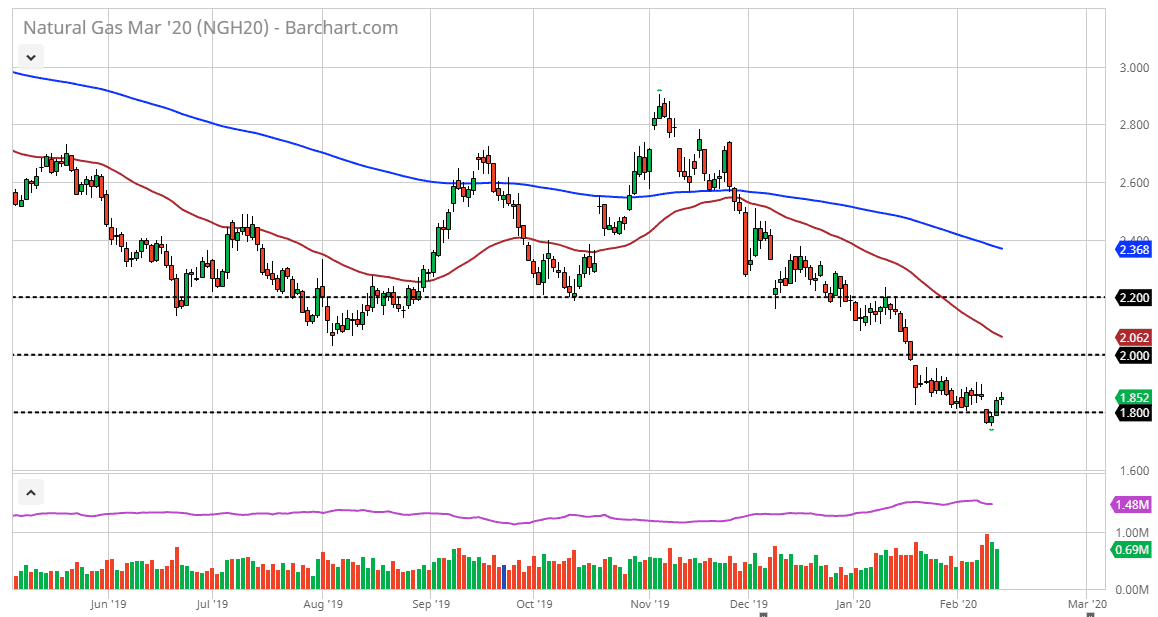

The natural gas markets have spent most of the day on Thursday, slicing back and forth as it shows a bit of instability. This is a market that is very sensitive to the weather situation in the United States which although getting colder, it is very late in the winter season to think that the market is certainly going to shoot to the upside due to the temperatures and hang on to those gains. The best strategy this point is to simply wait for some type of spike that you can take advantage of in order to start selling again.

The $1.90 level above could offer a significant amount of resistance, as it is a round figure, but more likely the sellers with start showing up at the $2.00 level as it is a large, round, psychologically significant figure. At this point, it looks as if the 50 day EMA is reaching a bit lower from here, and it could then go looking to reinforce the $2.00 level.

This is a market that continues to rollover every time it shows signs of strength, so you need to think of the market in those terms. In other words, when has it gotten “expensive”, and then take advantage of that. Only the so-called “dumb money” is buying natural gas at this point. However, we will see a slew of bankruptcies in the United States when it comes to natural gas producers, and that would be your signal to start buying. That is a story later this year though, as the bankruptcy process isn’t exactly quick.

At this point, the market needs to see some bit of “creative destruction” in order to start rallying. Overall, this is a market that has been in a downtrend for quite some time as the United States has the ability to power the entire world for the next 300 years based upon proven reserves in the ground. Canada has even more and of course there are plenty of countries around the world that have natural gas. In other words, any lack of supply will be short-term at best, so natural gas behaves quite a bit like gold did in the 1980s: it’s a “sell the rallies type of market from a structural standpoint. The bankruptcy of several corporations could drive up price, but then again given enough time that’ll bring new players into the marketplace yet again.