The persistence of fears of the fatal Corona epidemic still supports the gold price's strong stability at the $1587 an ounce in early trading today, near its highest level in seven years, as investors remain averse to the risk and resorting to safe havens, the most important of which is the yellow metal. China still announces the increasing numbers of deaths and injuries, and although it is less than before, according to official figures, the failure to reach a vaccine to eradicate the epidemic negatively affects the optimism of the Chinese numbers. The length of the period negatively affects the future of global economic growth. The Chinese government provides round-the-clock updates and follow-ups to the world on the situation in the world's second largest economy and the most linked with other global economies. Chinese central bank officials announce almost every day stimulus plans to cope with the catastrophic effects of the crisis.

The Chinese central bank lowered the interest rate on medium-term loans on Monday to reduce the impact of the new Corona virus, or Covid-19, on the economy. The People's Bank of China also cut its medium-term lending facility, or the Multilateral Fund, by 10 basis points to 3.15 percent. The bank offered 200 billion Yuan of one-year loans to commercial lenders through this measure. The central bank also pumped 100 billion Yuan through seven-day reverse repurchase agreements. The reverse repurchase value was about 1 trillion Yuan on Monday.

The interest rate was last cut in November, the first since the new lending rate began. The base loan rate is determined monthly based on the provision of 18 banks, although Beijing has an influence on setting the interest rate. This new lending rate replaced the traditional benchmark lending rate of the central bank in August 2019.

The recent economic slowdown in China was evident in some global economies, the most prominent of which were Japan, Australia and the Eurozone, the most closely linked to the Chinese economy. As for the American economy, despite the relatively weak association with China, but the US central bank monitors the situation to take the necessary action if things evolve and reach the level of non-solution for a longer period, thus slowing the global economy as a whole.

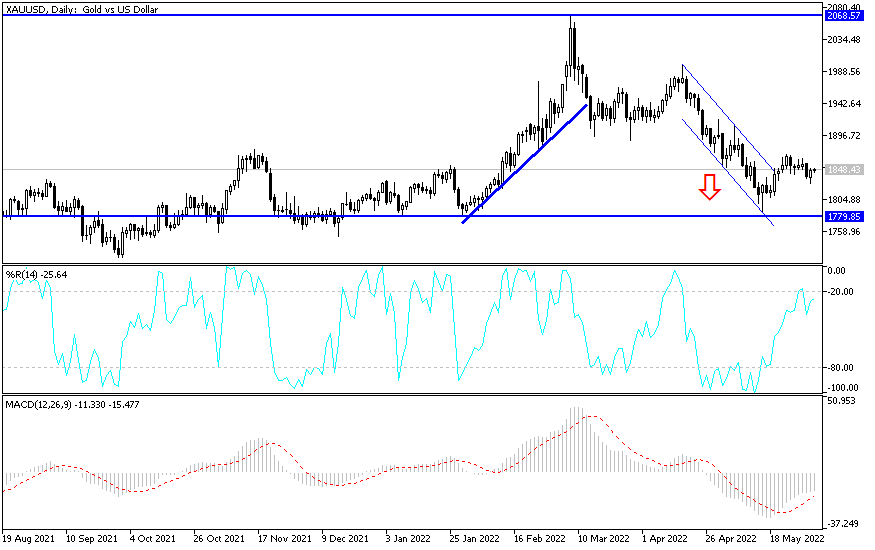

According to the technical analysis of the gold price: The general trend of the gold prices is still strongly bullish and continues to ignore the strength of the US dollar. Aggravation of things in China may inevitably push the price of gold to the $1611 psychological resistance again, which is the closest to it now. As we mentioned before, we now confirm that there will be no opportunity for a downward correction of gold prices without moving below the 1550 support, and I still prefer to buy gold from every downside level.

The gold price will react today with the announcement of the British job numbers and the German ZEW index along with the developments of the Corona virus.