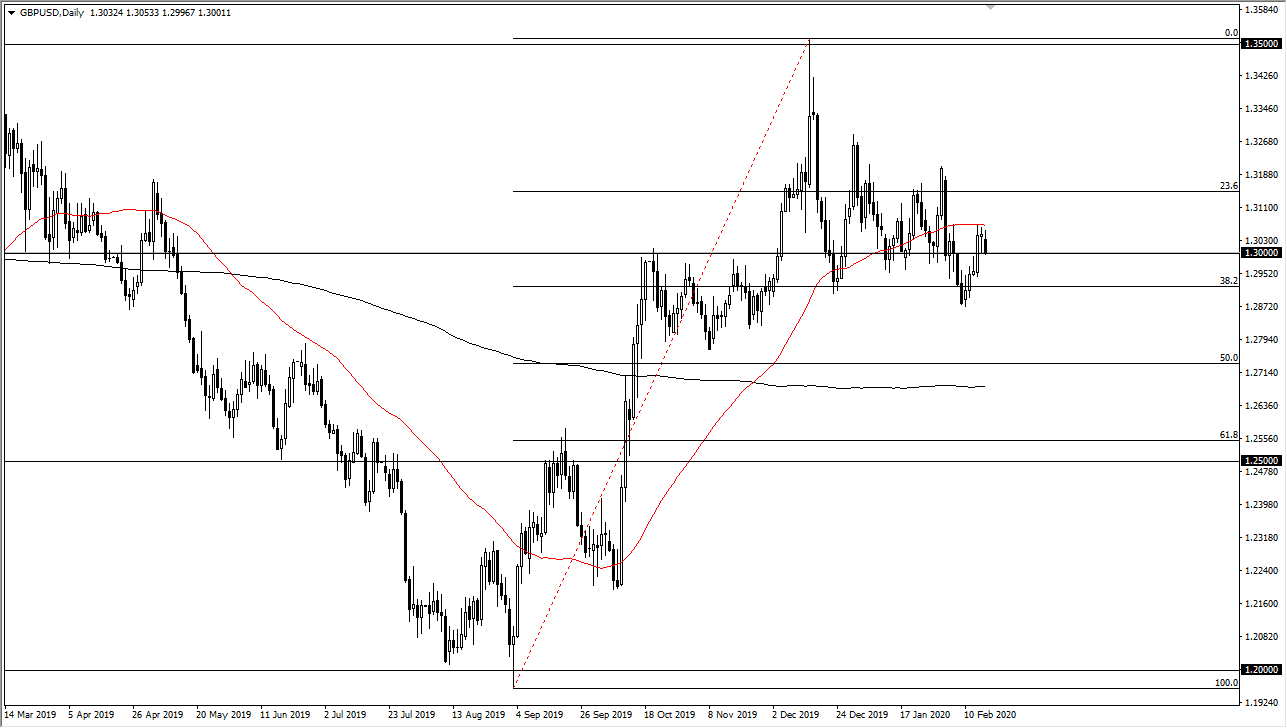

The British pound pulled back a bit during the trading session on Monday, reaching down towards the 1.30 level underneath. This is an area that will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, but ultimately this is a market that continues to favor the US dollar in general, because the US economy is doing much better than the British economy.

That being said, I also think there is a certain amount of buying pressure when it comes to the pound, because it is undervalued from a longer-term standpoint. I also recognize that there is a lot of noise between here and the 1.28 handle, possibly even as low as the 1.2750 level. Because of this, I would anticipate that there will probably be a bit of a bounce given enough time. I’m not interested in buying this pair until we get a daily close above the 50 day EMA which is painted in red on the chart. You can see that area has been very resistive, so if we can break above there and close above there it would of course be a very positive sign, opening up the door to a move towards the 1.32 handle.

This market has been grinding lower recently, but it should be noted that there has been a lot of fighting back and forth. Remember that the British pound is still going through the negotiations between the UK and the EU, but ultimately it looks as if the British are starting to get a bit of an upper hand in that scenario. The market pulling back here probably has a lot more to do with the US dollar strengthening and less to do with British pound weakness. For example, you can see that the British pound has fared better against the Japanese yen and more specifically the Euro.

With that being the case, I don’t necessarily want to short this pair, but I would like to see a breakout above that 50 day EMA to start buying or perhaps some type of supportive or impulsive candle on the weekly timeframe to start getting long. I recognize the 1.35 level above will cause some issues, but I do think that’s the target over the next several months. Keep in mind that this pair will continue to be very volatile and therefore position sizing is crucial.