The EUR/USD performance did not change much in the beginning of trading this week, as it remained stable around the 1.0825 support, the lowest for two and a half years. Performance was limited in light of an American holiday and the complete absence of important economic releases. This week, investors will face the first notable readings of the economic situation in the Eurozone in the opening month of the year 2020, which may have an impact with large bearish technical signs from the charts. Today, the Euro will focus on the release of the influential January economic ZEW survey, which includes more than 300 analyst views on the current economic situation and growth prospects for Europe's largest economy. The German economy is still leading the slowdown of the bloc economy.

As for the latest updates of the Coronavirus, the most powerful influence on the morale of global financial markets; the number of deaths in China has reached 1868 and the total confirmed cases reached 72,436. Yesterday, the Chinese Center for Disease Control and Prevention published a study of past cases of the disease, and found that more than 80% of cases have mild illness and the number of new infections appears to be declining since early this month. Accordingly, the Director-General of the World Health Organization, Tidros Adhanum Gebresos, told a news conference that Monday's report gives the World Health Organization a clearer picture of the direction in which the outbreak occurred. But he added that it was too early to know whether the aforementioned decline would continue. He said: "Every scenario is still on the table."

The COVID-19 Corona epidemic has added pressure to the Eurozone economy already suffering from the consequences of the global trade war. The trade link with China is strong, which explains why the Euro remains under downward pressure against other major currencies for a longer period, especially since the outbreak of the epidemic in China and its spread in many countries around the world.

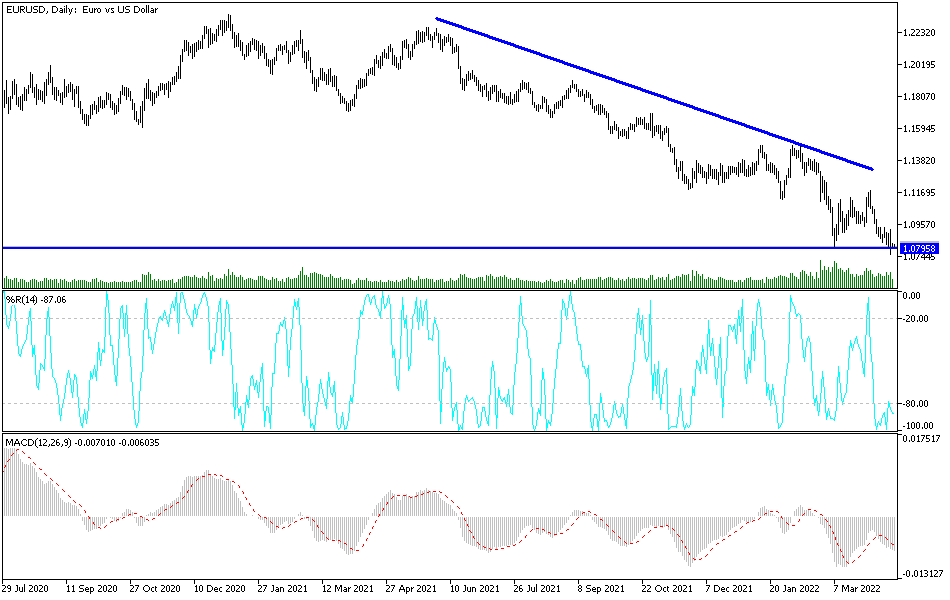

According to the technical analysis of the pair: The general trend of the EUR/USD is still bearish and there are yet no signs of improvement and a beginning to reverse the trend. The single European currency will not have the opportunity to be corrected without the positive outlook of the German economy in particular and the surprising announcement by the European Central Bank of quick plans for reviving the Eurozone economy. The current performance may support the pair's move to the next support levels at 1.0790 and 1.0700, respectively. The first opportunity for the bulls to take control may be with stability above the 1.100 resistance.

As for the economic calendar data: From the Eurozone, the focus will be on announcing the ZEW German economic sentiment index. There are no significant US economic data for the second consecutive day.