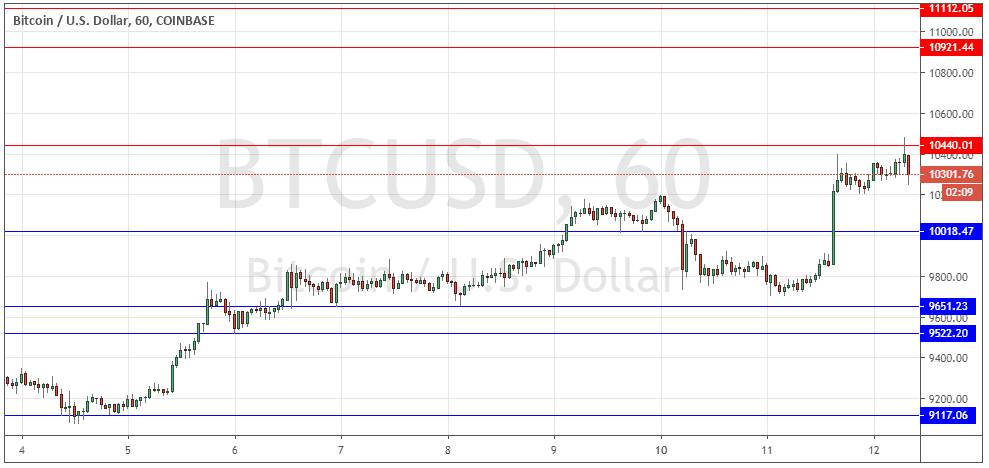

BTC/USD: More bullish above $10,400

Yesterday’s signals may have produced a short trade from the bearish reversal right at the end of the Asian session at the resistance level identified at $10,440. At the time of writing, this is in a small floating profit: it may be wise to take the risk off the trade and hope for the best, or to monitor it carefully on short time frames, so that it does not turn into a loss due to the dominant bullish trend.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades should be entered before 5pm Tokyo time Thursday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $10,018, $9,651 or $9,522.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is $50 in profit by price.

Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

Go short after a bullish price action reversal on the H1 time frame following the next touch of $10,440, $10,921, or $11,112.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is $50 in profit by price.

Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that I took no directional bias today and could see either long or short trades from reversals at any key levels as potentially good trades.

Maybe I should have had more faith in the medium-term bullish trend which we have seen this year in 2020, as recently forecasted on our site.

The picture is now more bullish with the price getting established above the former resistance level which was confluent with the very major round number and psychological level at $10,000.

However, the next resistance level at $10,440 has held so far.

I prefer a bullish bias, but the next step is to see how the price behaves now between $10,440 and $10,018. I think a long trade from a solid bounce rejecting $10,018 and ideally $10,000 also is the best opportunity that we can hope for here. Concerning the USD, the Chair of the Federal Reserve will be testifying before Congress at 3pm London time.

Concerning the USD, the Chair of the Federal Reserve will be testifying before Congress at 3pm London time.