With Covid-19 cases spreading outside of China, South Korea and Italy have entered crisis mode, safe-haven demand for risk-averse assets like the Japanese Yen and gold are on the rise. Forex traders started to worry about the state of the Japanese economy, pushing aside concerns over the impact on the global supply chain, but the accelerated spread of the virus has recaptured the attention. The AUD/JPY was rejected by its short-term resistance zone, from where more downside is expected to follow, as bearish momentum is expanding.

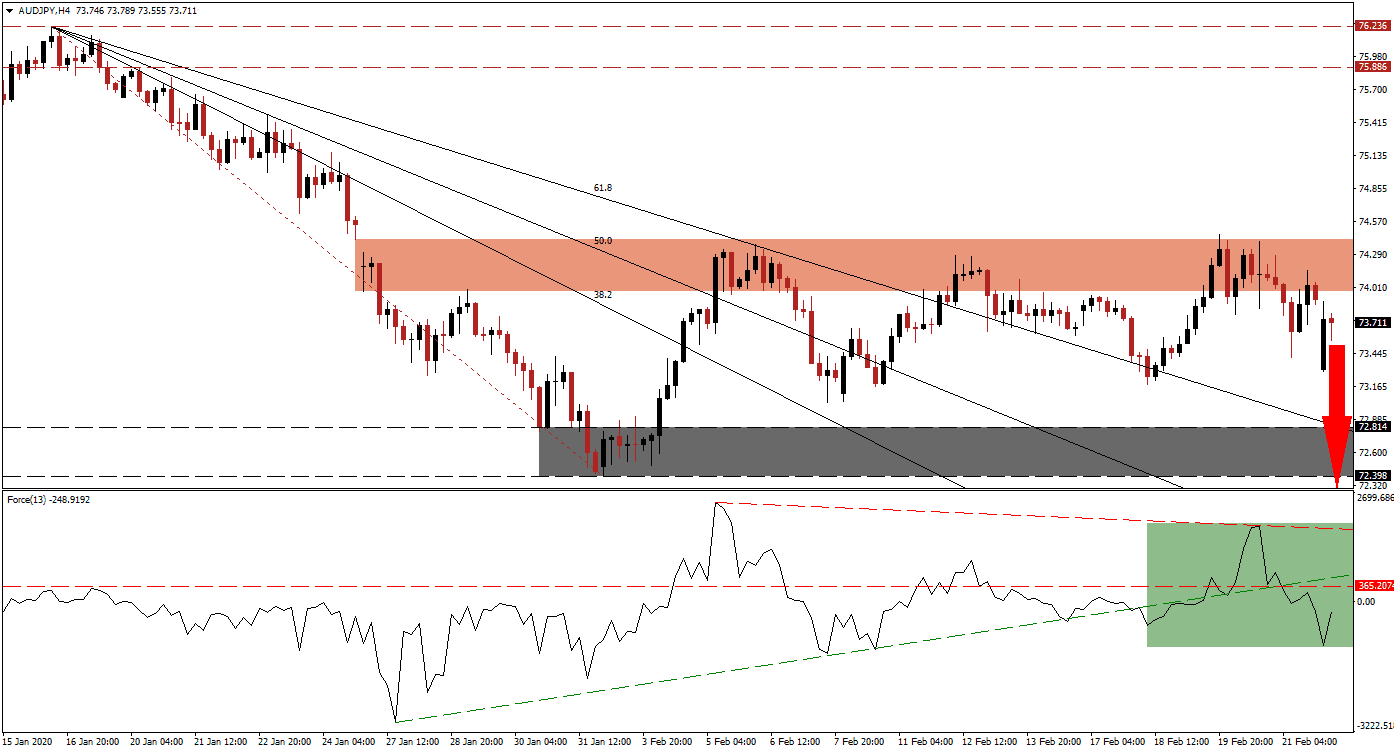

The Force Index, a next-generation technical indicator, advanced to a lower high before reversing its steady advance. A descending resistance level formed, pushing the Force Index below its horizontal support level, which has now turned into resistance. It additionally contracted below its ascending support level, as marked by the green rectangle. Bears are in control of the AUD/JPY after this technical indicator crossed below the 0 center-line. You can read more about the Force Index here.

This currency pair failed to extend above its short-term resistance zone located between 73.980 and 74.419, as marked by the red rectangle. The breakdown further increased bearish pressures, with the AUD/JPY closing the gap to its descending 61.8 Fibonacci Retracement Fan Support Level. Forex traders are recommended to monitor the intra-day low of 73.181, the last instance price action bounced higher off of its 61.8 Fibonacci Retracement Fan Support Level. A breakdown is anticipated to result in the net addition of short positions.

An extension of the breakout below its support zone is favored, guided by the Fibonacci Retracement Fan. The 50.0 and 38.2 Fibonacci Retracement Fan Support Levels have already crossed below this zone, located between 72.398 and 72.814, as marked by the grey rectangle. A breakdown will clear the path for the AUD/JPY to descend into its next support zone, which awaits between 70.891 and 71.358. You can learn more about a breakdown here.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.700

Take Profit @ 70.900

Stop Loss @ 74.500

Downside Potential: 280 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.50

In case of a breakout in the Force Index above its ascending support level, the AUD/JPY may attempt to push higher. Given the dominant fundamental outlook, the upside remains limited to its long-term resistance zone located between 75.886 and 76.236. Forex traders are advised to consider this a great short-selling opportunity, as safe-haven demand until Covid-19 is under control is likely to persist.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 74.700

Take Profit @ 76.000

Stop Loss @ 74.100

Upside Potential: 130 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.17