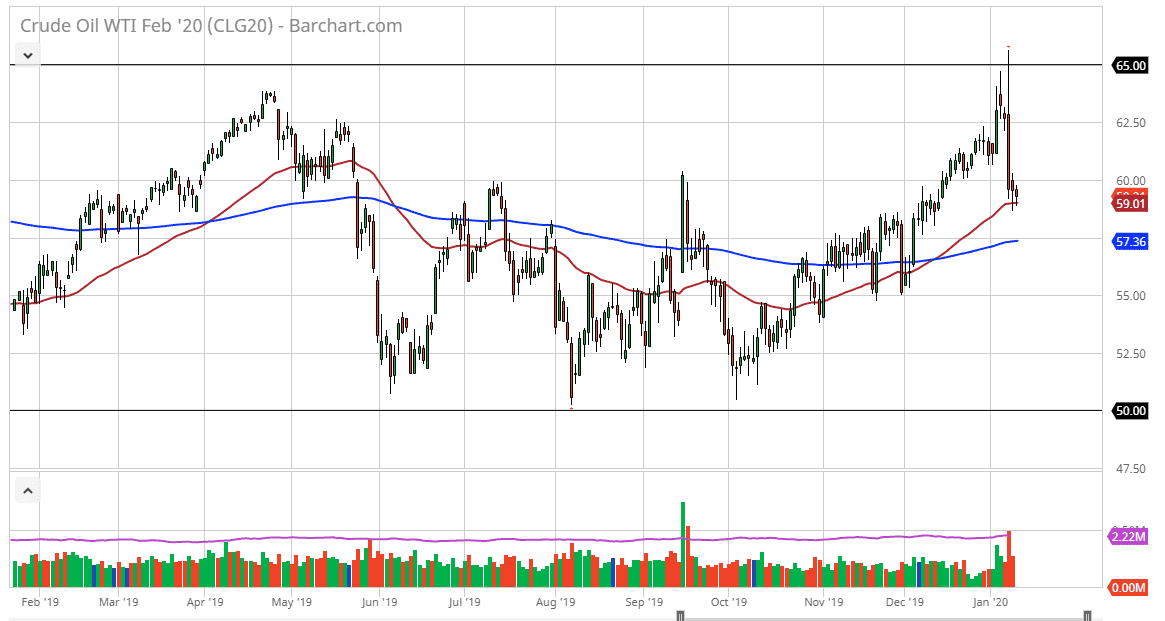

The West Texas Intermediate Crude oil market broke lower initially during the trading session on Friday, as we awaited the jobs number. The jobs number was a little bit lighter than anticipated so that of course shows that there could be problems. That being said, the market is oversold at this point as we had collapsed after the Americans and the Iranians have cooled tensions. We are currently trading around the 50 day EMA and then should take quite a bit of attention back towards this market. Longer-term traders do tend to look at these indicators, and the fact that we did up forming a bit of a hammer at the Thursday close suggests that there are plenty of buyers.

If we break down below the bottom of the hammer from the Thursday session that opens up the door down to the 200 day EMA which is closer to the $57.50 level. Otherwise, if we turn around and break above the top of the hammer, the market is likely to go looking towards the $62.50 level. This is a market that has been consolidating for some time but got way ahead of itself over the last several weeks.

The impulsive reaction to the killing of the Iranian general sent the oil market into overdrive, but then broke down rather significantly as tensions fell off. At this point now, we can start to look at the fundamental picture, which was grinding higher before all of that noise. We are currently trading right around the $59 level, an area that should continue to attract a bit of attention based upon the moving average as well. All things being equal, I do think that the market goes higher, but it’s going to take work to get back up to those higher levels. However, if we break down below the 200 day EMA, it opens up the door down to the $52.50 level. At this point, wait for a break above the top of that hammer from the Thursday session in order to go long. Otherwise, look for price action at the 200 day EMA to take advantage of. As far shorting is concerned, if we do give up the 200 day EMA, I would become aggressively short and sell every time it rallies and show signs of exhaustion. Obviously, if tensions flare up again in the Middle East, it could put a turbocharged in the move higher.