Natural gas markets went back and forth during the trading session on Thursday, showing signs of support underneath. After all, we ended up forming a bit of a hammer but at the end of the day I think it’s very difficult to get overly bullish about this market. Every time it looks as if the natural gas market is ready to turn around for the typical winter push higher, it gets crushed yet again. There are multitudes of reasons for this but there are a couple of different ones that are much more important than anything else.

Those issues of course include oversupply and warmer than usual temperatures in the wintertime. The Americans drilled 17% more than the previous year, and that of course has only exacerbated the oversupply of natural gas. Furthermore, this has been an extraordinarily warm winter in the United States, so the supply of natural gas is nowhere near being threatened, and at this point probably won’t be by the end of the winter. After that, warmer temperatures will drive down the demand for natural gas, adding to the perpetually negative cycle.

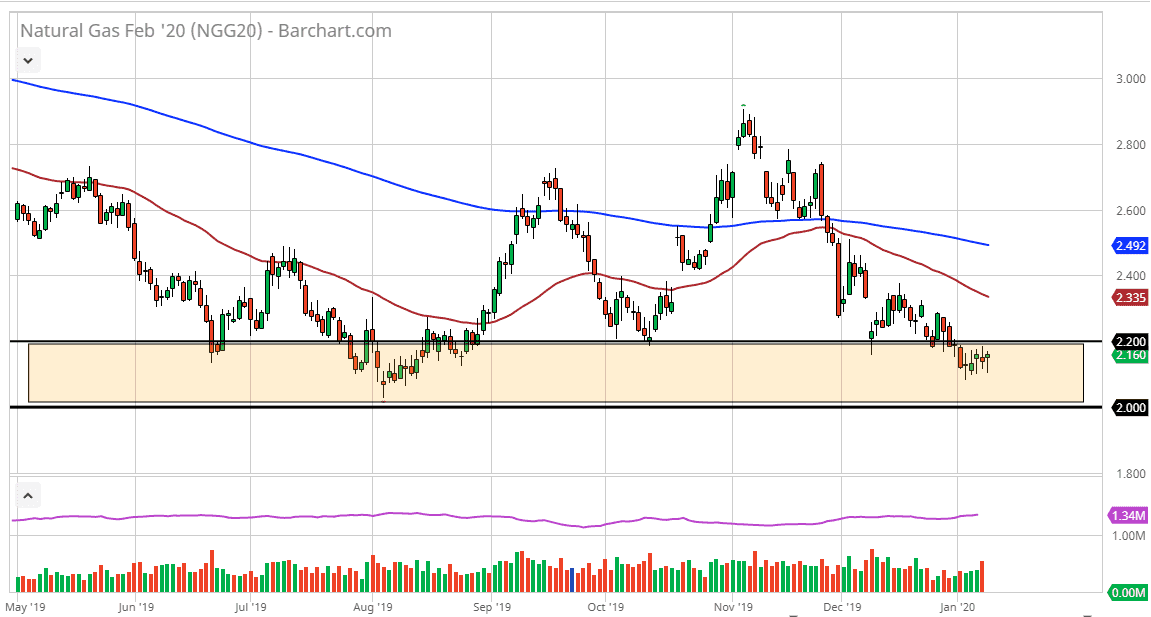

With this, natural gas markets are very likely to continue to go to the upside, only to see sellers closer to the 50 day EMA. That is currently near the $2.33 level, and at this point any rally should not be trusted. Signs of exhaustion after a short-term pop will probably be the best way to enter the market, shorting natural gas in the meantime. I don’t necessarily think that we are going to break down below the $2.00 level, but if we did it would be extraordinarily negative, and you can see the market collapse at that point. This is a market that is probably somewhat range bound in the meantime, but we might get one or two extremely cold storms this winter that we can take advantage of, with the market shooting straight up in the air and then fading off just as quickly on signs of exhaustion. Ultimately, that’s probably the easiest trade that you can take, shorting this market once it gets a little ahead of itself. The candlestick is bullish, but the overall trend certainly has been bearish. At this point, the market looks very likely to offer plenty of opportunities on signs of extension, as the market has been essentially tight more than anything else.