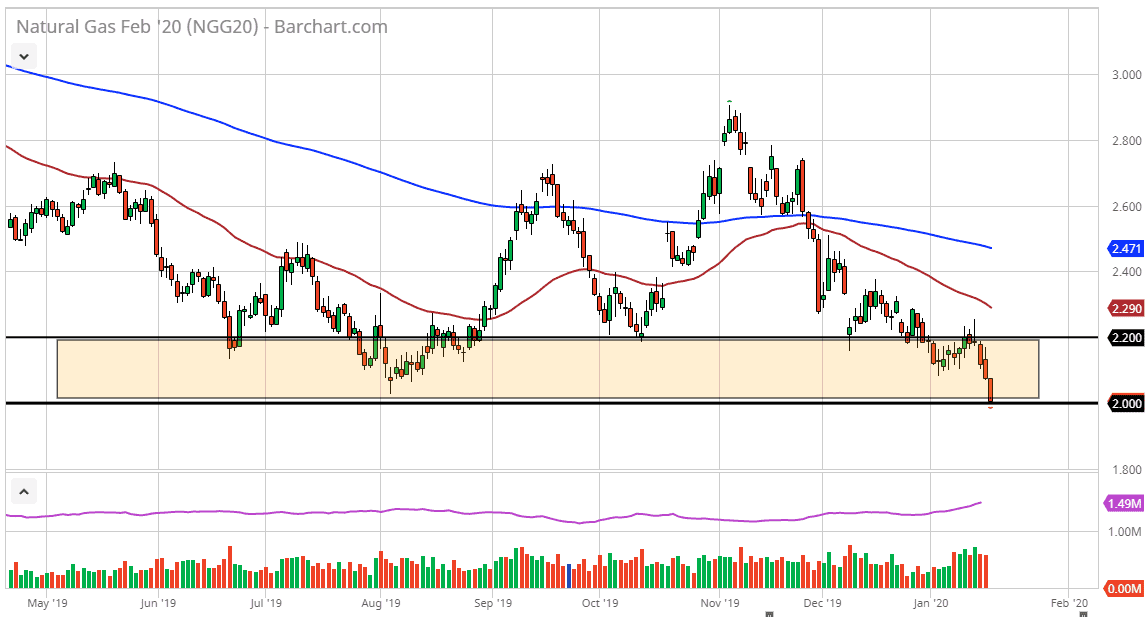

Natural gas markets have broken down significantly during the trading session on Friday, peeking through the $2.00 level. At this point, the market continues to look extraordinarily soft, considering that the simply can’t seem to get off of its own back. The weather reports are suggesting that the winter storm that was supposed to be coming to the northeastern part of the United States isn’t going to make it due to a high-pressure system hovering over the North Atlantic. If that’s going to be the case, the market is likely to continue to see plenty of selling pressure, and I think at this point it’s a simple matter of “fading the rallies.”

At this point, it looks as if the market is going to continue to suffer due to the massive oversupply of natural gas, as the Americans drilled 17% more this past year than they did the previous year. Ultimately, with the warmer temperatures and the massive amount of natural gas out there continues to drive this market lower. If we do rally from here, the $2.20 level should be a massive barrier, and that the first signs of exhaustion will be sold into rather rapidly. If we do break above the shooting star from the Tuesday session though, that could open up a little bit more of a rally, but at that point it’s only going to be more of an opportunity to start selling again.

Looking at this chart, it has been an absolute disaster this winter, and as a result the real trade might be shorting natural gas related companies in the stock markets as there will probably be a string of bankruptcies to be seen as most of these companies are finding it very difficult to make a profit with the natural gas markets being so cheap. The three candlesticks over the last three days all closed towards the bottom of the range, so having said that it’s obvious that we are going to plunge to new depths rather soon. I don’t see a scenario in which you should be buying this commodity, even though I would anticipate that we could get a little bit of “dead cat bounce” rather quickly. Nonetheless, look at that as an opportunity to take advantage of the market that is so obviously negative and therefore you should be thinking in one direction. However, selling at this extreme lows might be a bit tough.