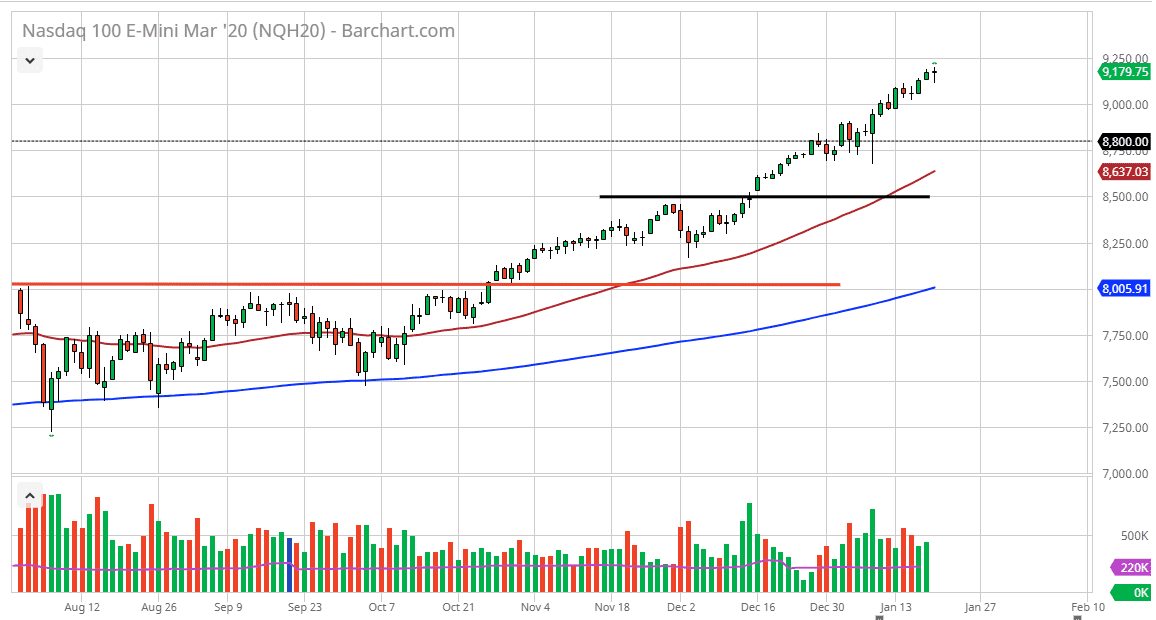

The NASDAQ 100 has gone back and forth during trading on Tuesday, as traders came back from the Martin Luther King Jr. holiday. At this point, the market looks like it desperately needs to pullback in order to find value, especially near the 9000 handle. Looking at this chart, the market has formed a neutral candlestick, hanging around the 9150 handle. Ultimately, the 9250 level above is resistance, and I think that it’s only a matter of time before we break above it. However, don’t be surprised at all to see this market pullback and quite frankly I think that would be healthy.

The market has been a bit overextended, so at this point it would make quite a bit of sense that we would try to find some type of value down the road. I like the idea of taking advantage of cheaper prices, because quite frankly at this point it seems to be a bit dangerous to simply throwing money at what could be the highs. Furthermore, the candlestick looks a lot like a hammer, so if we were to break down below the bottom of it it’s likely that it would then turn into a “hanging man.” That would be a negative sign, but it is not a sign to start selling. The 9000 level obviously has a lot of psychological importance attached to it, so a bounce there could make some sense. However, I think that the 50 day EMA underneath could be a massive supportive technical indicator and an area that a lot of people will be looking for a bounce in that general vicinity.

If we do break above the top of the candlestick, it’s likely that the market could go to the 9250 handle, and perhaps even the 9300 level but I don’t like that trade as it is far too expensive at this point. Markets need the advent flow of a pullback occasionally, and of course the earnings season may or may not offer that. There was a bit of negativity seen in the Dow Jones Industrial Average during the day as Boeing continues with its problems, but at the end of the day it’s only a blip on the radar. We need to see market participants find plenty of value down the road. I don’t like the idea of shorting even though some day trading types may do so, I think it’s easier to simply wait for the market to reset itself.