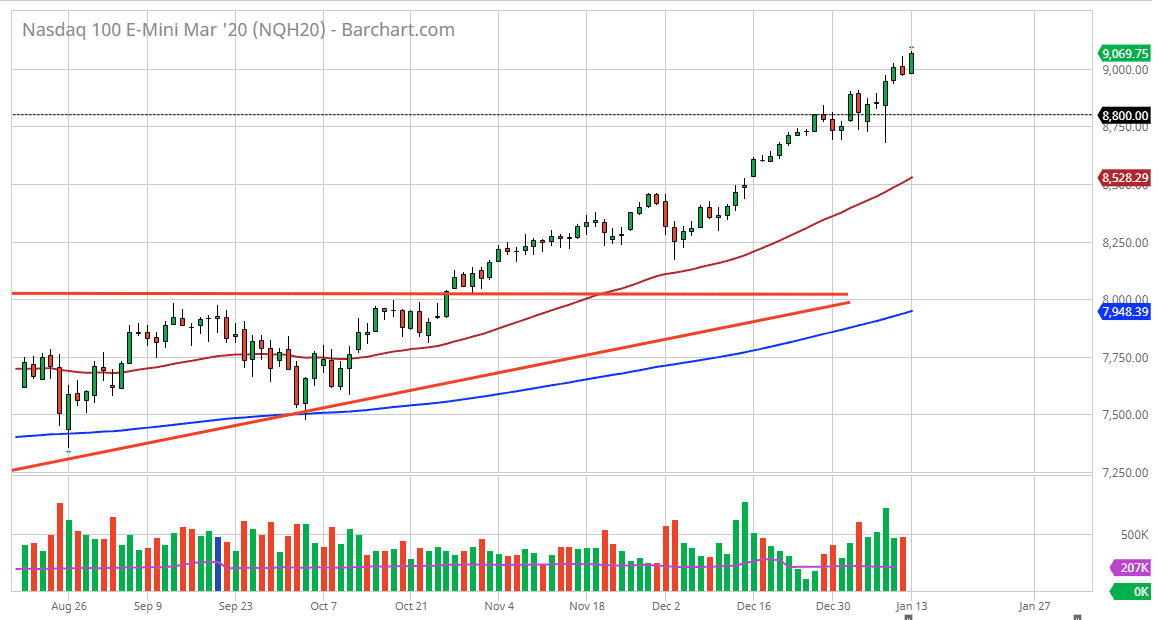

The natural inclination of the NASDAQ 100 has been to go higher for quite some time, and now we are clearly above the 9000 handle. At this point, it you should see the market pull back a bit, but I think that should only be thought of as a buying opportunity. Ultimately, the market had previously been aiming for the 8800 level, but we have now clearly broken higher than that. The ascending triangle that was so prominent late last year measured for a move to the 800 level, and now I believe it’s only a matter of time before that proves itself to be “the floor.”

Now that we are above the 9000 handle, it’s very likely that the market will continue to go higher and I do think that we could see the NASDAQ 100 go looking towards the 10,000 level sometime this year. That would represent about and 11% gain, but in the meantime, I think it’s only a matter of time before we go looking towards 9100, followed by 9200. I believe pullbacks offer plenty of buying opportunities, as there is so much in the way of optimism when it comes down to the US/China trade relations. Remember, most of the major corporations in the NASDAQ 100 do a lot of business in both countries, and therefore it makes sense that if they get long, the NASDAQ 100 should rally.

The candlestick is closing towards the top of the range and the fact that the momentum has picked up during the end of the trading session suggests that a lot of institutions are getting involved, and that of course is a very bullish sign. Remember, Monday would have been the first “normal day” after the holiday season now that we have gotten the jobs numbers out of the way as well. That being the case, the market is likely to find plenty of institutional traders jumping in over the next week or so in order to give the market a bit of directionality, as the market will try to continue the overall trend. At this point, I have no interest in trying to short this market, at least not until we break down below the 50 day EMA which is much lower than current pricing. The NASDAQ 100 should continue to lead all of the other indices that major traders follow.