The GBP/USD pair collapsed quickly to the vicinity of the 1.3000 psychological support in light of strong sales of the pair after a series of negative results for U.K economic releases, supporting expectations of the imminent date of the interest rate cut by the Bank of England, unlike the markets had hoped that the bank had might raise them after the anxiety about the future of the Brexit has disappeared, especially after the general and early elections that took place in the country in December 2019, which showed a complete acquisition by the Conservative Party, to determine the Brexit course scheduled for the end of next week.

The weak numbers of retail sales in Britain sharply completed the weak picture of the country’s economic performance, with the beginning being with the weak growth of the U.K GDP and the inflation figures falling to the lowest level in three years. Expectations are now stronger that the Bank of England will cut interest rates on January 30. The drop in retail sales for the month of December came as a big shock and confirms that consumer spending fell sharply at the end of last year, amid a state of increasing political uncertainty. It has been five months now without a monthly increase in sales, the longest period without growth since registration began in 1970.

Some polls conducted since the elections indicate a strong sentiment recovery, and markets will be watching this week's releases, particularly the IHS Markit PMI for the manufacturing and services sectors. A strong outcome will be required to convince the Bank of England that interest rates should remain unchanged. The strong PMI result is likely to lead to a rebound in the value of the British Pound.

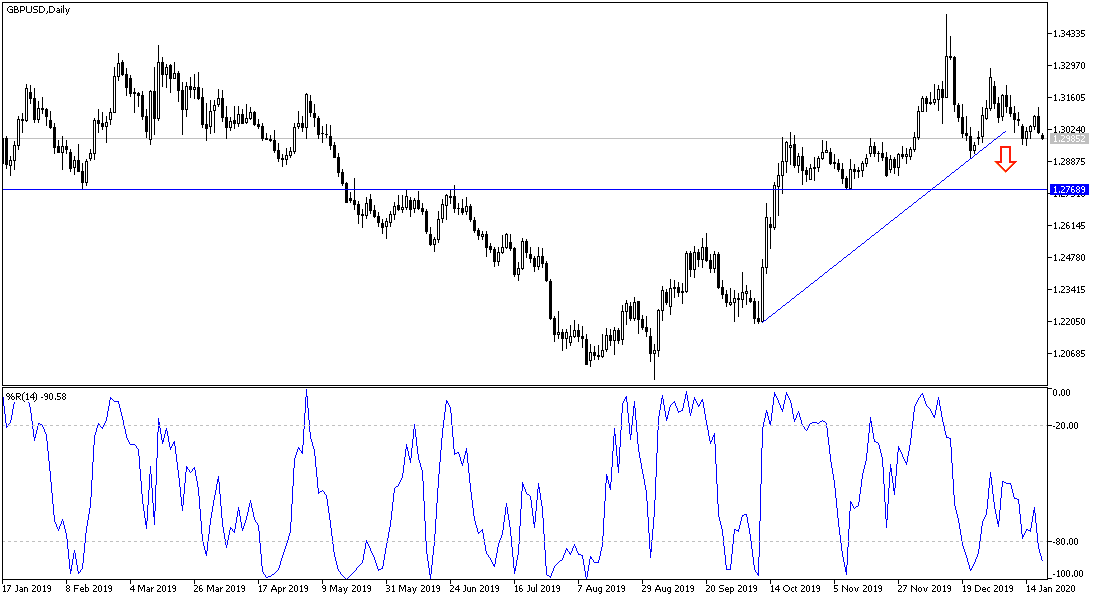

According to the technical analysis of the pair: The general downtrend of the GBP/USD pair will strengthen if the pair moves around and below the 1.3000 psychological support, which is the closest currently to the performance, therefore sales may increase to push the pair towards stronger support levels, and the closest of which are currently 1.2975 and 1.2880, which confirms the bear control On performance. Bulls' control will not return without the pair's success in moving towards the 1.3300 resistance, which seems far-fetched during this week's trading. We expect a limited range movement during today's trading, with an American holiday celebrating Martin Luther King Day. There are no significant economic releases from Britain today.