The British pound initially fell during the trading session on Thursday but found enough support at the uptrend line yet again to turn around and rally. This was of course exacerbated by the fact that the Bank of England has kept its rates on hold, something that some of the traders out there figured that they wouldn’t be able to do. The fact that the Bank of England has remained steady was a bit of an upward surprise, but if you’ve been paying attention to the most recent economic figures out of the United Kingdom, you would recognize that the situation in the UK has gotten better as of late. That being said, Mark Carney suggested that perhaps there would be no real inflation between now and the end of the year 2021.

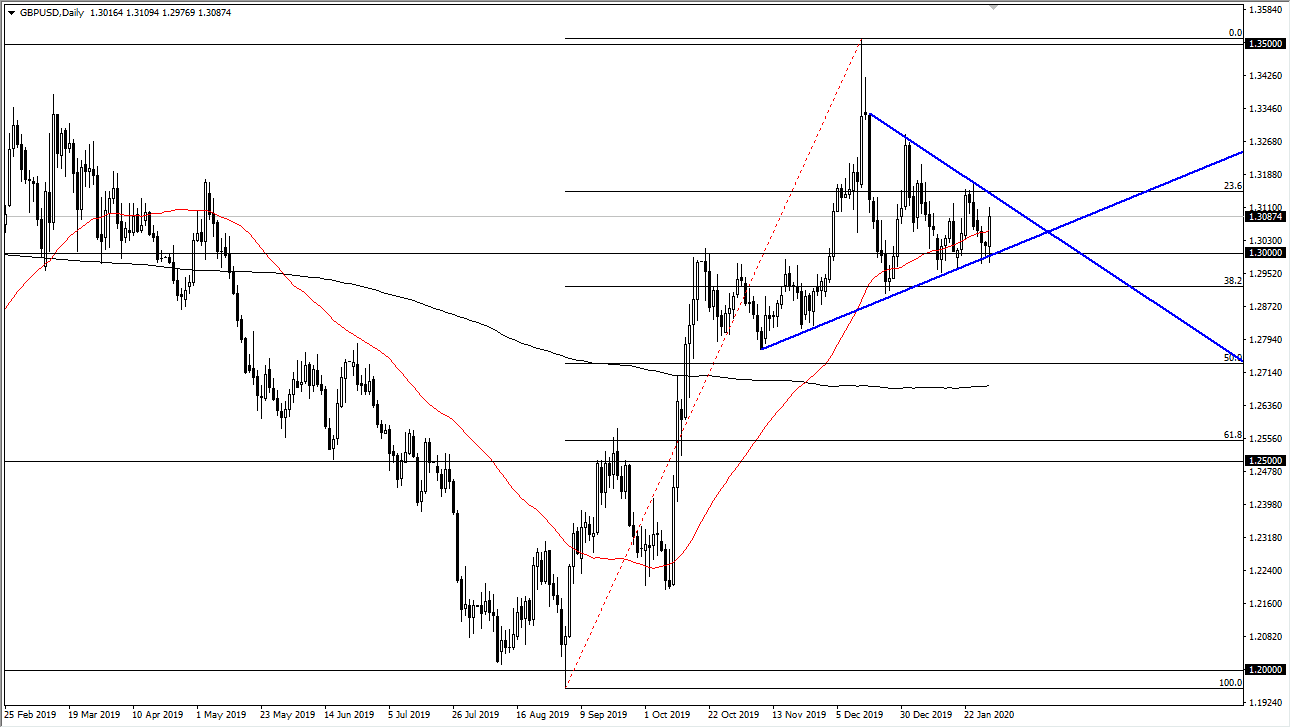

We are in a symmetrical triangle still, so that of course will keep the market somewhat tense but if we can break above the 1.3150 level, then the market should be able to go much higher. The candlestick for the day is relatively bullish, but the downtrend line of course will cause a bit of downward pressure. That being said, the market was to turn around a break down below the bottom of the candlestick for the trading session on Thursday, then it would show complete turnaround.

That being said, the Federal Reserve looks likely to remain somewhat loose with monetary policy, so having said that it’s likely that the US dollar could lose a little bit of steam anyways. At this point, the market is building up inertia for the next move, so it will be interesting to see how this all plays out. It should be noted that the UK is leaving the European Union today, so that of course is something that will cause some psychological influence, but the reality is that this whole thing is going to be about what type of trade deal that the UK and the EU forge going forward. For the longest time most people assume that the European Union had the upper hand, but clearly the terms have changed as the UK is a united front after the election, and the UK has been showing better economic figures recently than the European Union. Obviously, the United Kingdom will more than likely be able to set some type of an agreement on much more equal footing than once thought.