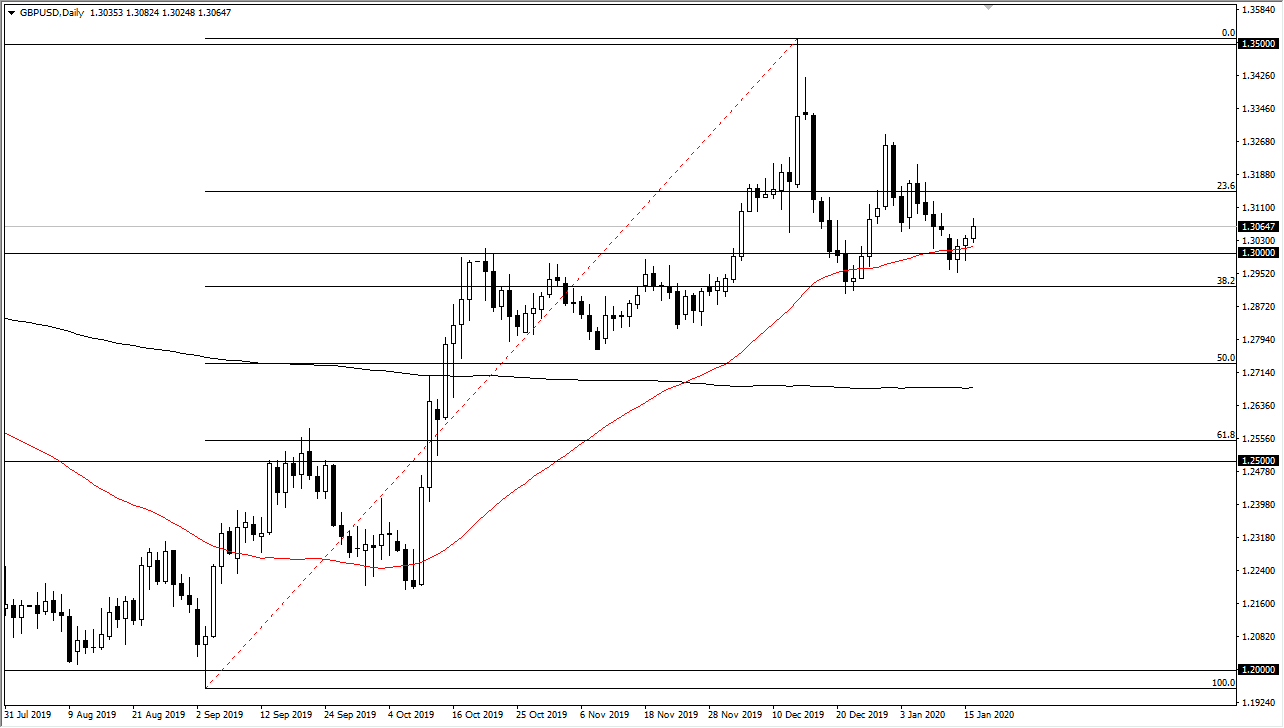

The British pound rallied against the US dollar during trading on Thursday, filling the gap from the Monday opening, and breaking through it. Beyond that, the 50 day EMA is sitting just below and then should continue to cause a significant amount of interest as well. Ultimately, looking at the chart we are still in an uptrend although we are most certainly consolidating and tightening up after that spike higher.

With a little bit of imagination, you can see that the market may be trying to form a bit of a symmetrical triangle, and that wouldn’t be a huge surprise after the massive move higher that we have seen. Furthermore, you can also see that there was a bullish flag previously that we kicked off from, with 1.30 level being the top of it. That has since offered support more than once, and therefore you should pay attention to the 1.30 level as a significant support level. I believe that the support extends down to the 1.28 level based upon the bullish flag that had formed there.

The British pound is starting to rally due to a little bit more certainty, although the British are still trying to negotiate with the Europeans when it comes to leaving the EU. Overall though, this is a market that is still undervalued from a historical standpoint so I think that a lot of people will be looking to pick up Deb’s as value. In fact, I know I have done that several times lately, and it looks as if we are starting to see the next move higher. The market continues to see a lot of interest on these dips and you could even make an argument for a “higher low” just be informed, and that of course has a certain amount of effect on the market as well.

I anticipate quite a bit of choppiness and volatility, so it’s not a huge surprise to think that we may pull back in order to offer more value going forward. Nonetheless, we have seen a massive move to the upside, and therefore one would have to think that there is still a lot of interest in the British pound. I think that we are more than likely going to grind it towards the 1.3175 level again over the next couple of days. I am more than willing to step in and pick up dips as value as well.