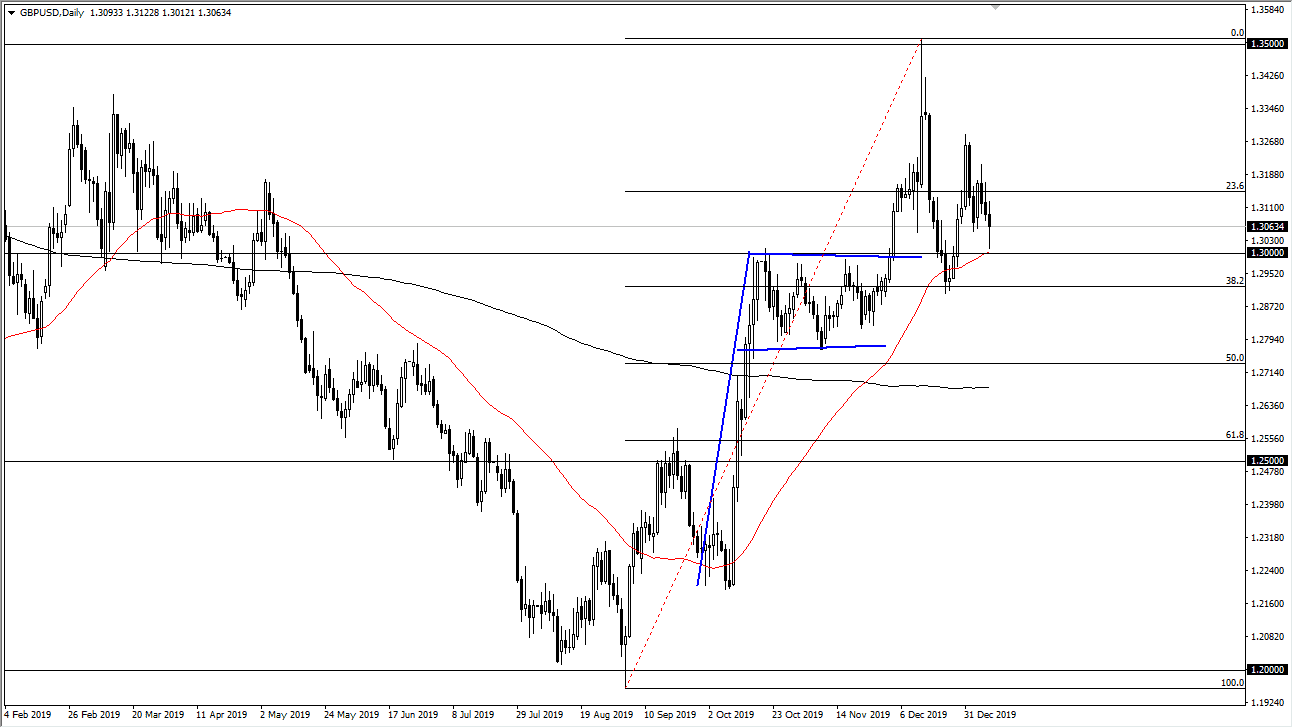

The British pound initially tried to rally during the trading session on Thursday but then turned around to reach towards the 1.30 level before bouncing yet again. The 50 day EMA sits right at that level as well, and the fact that we are trying to form a bit of a hammer suggests that we still have plenty of buying pressure. At this point, the British pound has been very noisy as you would anticipate, due to the fact that Brexit is going on and of course we have a lot of concern around the world.

At this point, I think the market is essentially trading between the 1.30 level on the bottom and the 1.35 level on the top. All things being equal, I believe that the market is trying to go back and forth between this to levels, and at this point I think it’s very likely that we will see some type of rally from here, and quite frankly all we need is some type of “risk on” type of event or some type of good news coming out of the Brexit negotiations or situation. Overall though, we had formed a bullish flag that continues to have its effects felt in the market, as it has recently been supportive. That bullish flag suggests is that we were going to go to the 1.38 handle, but obviously we can get there overnight.

The 1.35 level above is where we had run into a bit of a brick wall, so I do expect that to continue to be a bit difficult to overcome. However, I do think that it makes a nice juicy target the buyers will be looking for, so that is still the theory in which I attacked this market. That doesn’t mean that it will be easy, and I also recognize that the 1.3250 level will cause a certain amount of reaction as well. The market looks very likely to continue to attract buyers on dips, and it’s also possible that we have just made a “higher low”, which of course is a very strong sign. At this point I think that it’s only a matter of time before we continue to see value hunters coming back into this market and take advantage of the opportunity. Ultimately, if we were to break down below the most recent low, then we will probably go looking towards 1.28 handle.