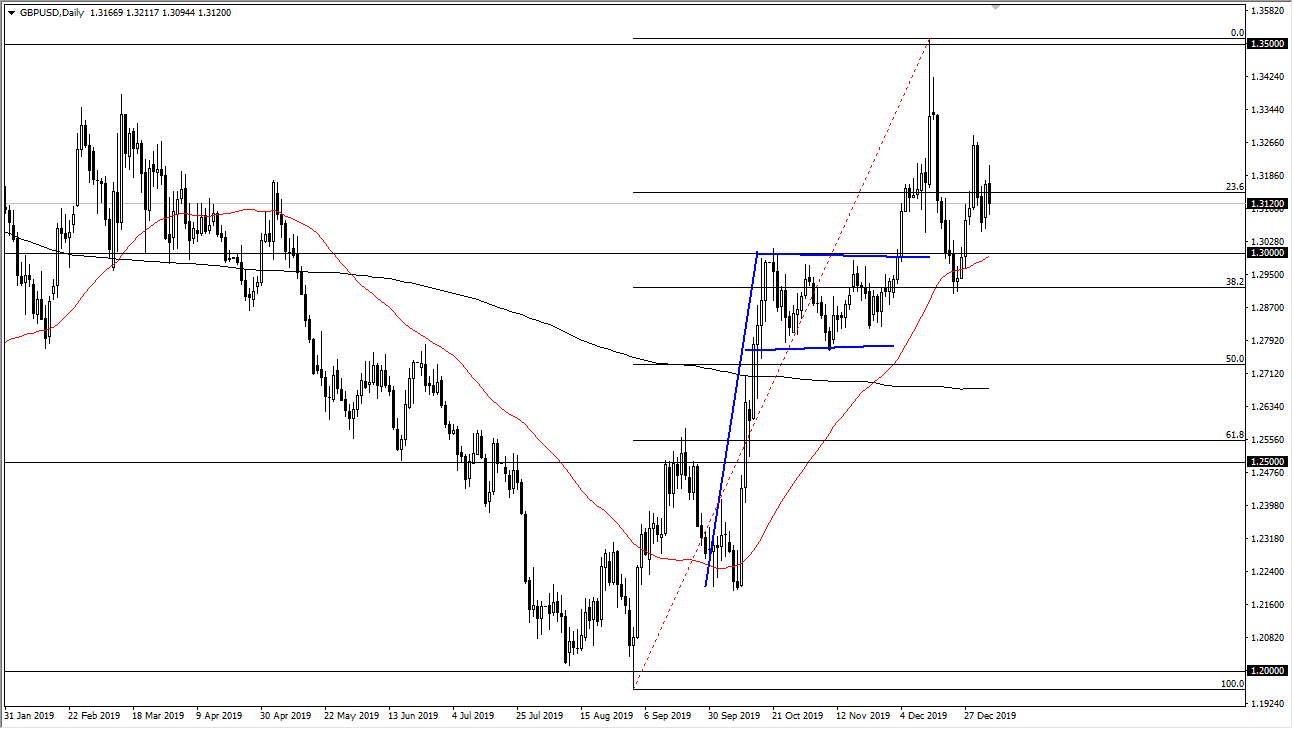

The British pound has been a bit noisy during the trading session on Tuesday, as we continue to dance around the 1.31 level. At this point, the market is very likely to find a lot of noise due to the fact that Brexit is still going on and of course the negotiations between the United Kingdom and both the European Union and the United States. Ultimately, this is a market that has been very bullish, but the last couple of weeks have been a little bit more difficult than the ones before. The 50 day EMA underneath is reaching towards the 1.30 level, which of course is a large, round, psychologically significant figure. It’s also the top of a bullish flag that has been such a predominant feature of this chart. That bullish flag measures for a move to the 1.38 handle, but that doesn’t mean that we get there overnight.

To the downside, I think we are plenty of support that extends all the way down to at least the 1.28 handle so as long as we can stay above there, I am interested in buying dips. I think it offers value that we can take advantage of and therefore will look at it has buying British pounds “on the cheap.” If we were to break down below the 1.28 level, then the market is probably going to try to break down through the 200 day EMA. That being said, it seems to be very unlikely this point, unless of course we get some type of major “risk off” event, perhaps something to do with the United Kingdom dealing with the European Union.

Now that we have a unified government in the United Kingdom, it’s likely that the British will continue to negotiate a bit more stringently with the European Union and things should continue to be leaning in the favor of London over the longer term. That doesn’t mean that we can go straight up in the air, but I do believe that we will find buyers on dips it will eventually send this market towards 1.3250 level, and then the 1.35 level after that. Ultimately, I do believe that we find the 1.38 level being targeted over the longer term, but we honestly have a lot of work to do before we can get there. At this point, the market looks like it is simply trying to build up the momentum to make the move higher.