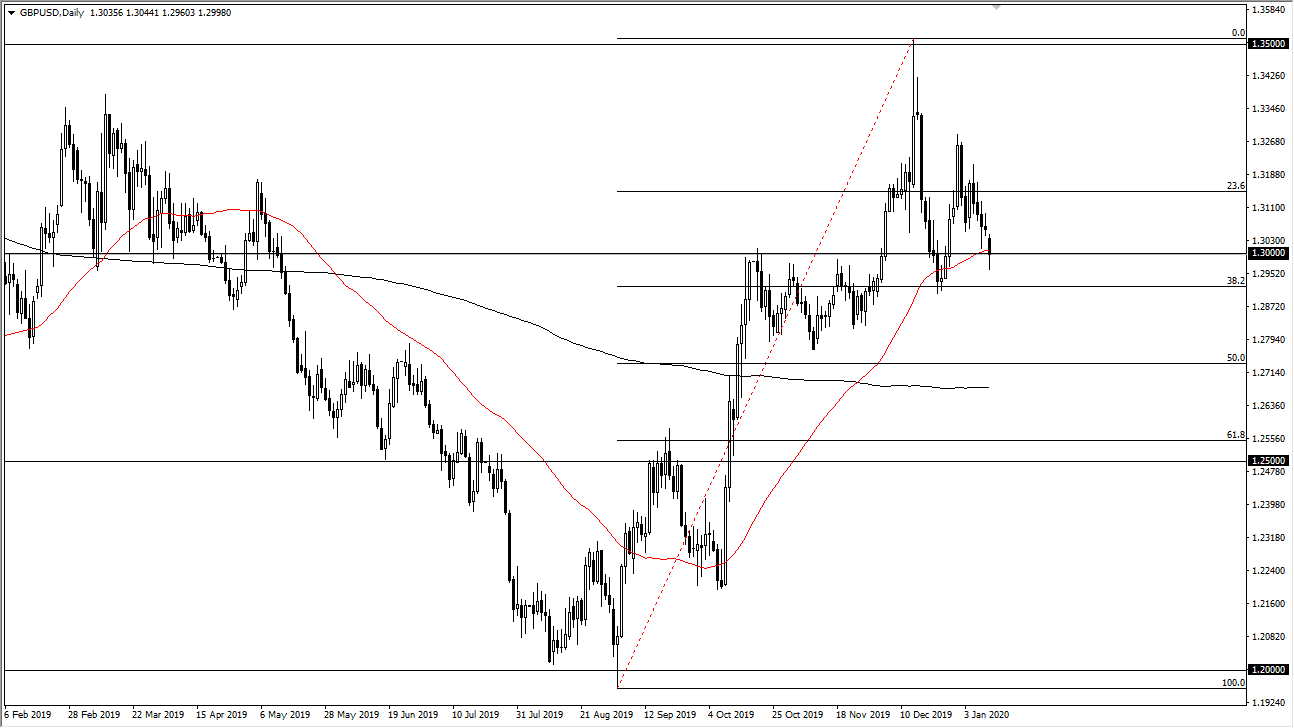

Despite the fact that the GDP figures came out very disappointing during the trading session on Monday, the British pound has recovered quite nicely to hang on to the 1.30 level against the US dollar. That tells me everything I need to know about this pair and it’s very likely that we are going to go higher. While a lot of traders out there are concerned about the Bank of England cutting interest rates, price is king, and price doesn’t lie. There was an initial move lower and well below the 1.30 level, but quite frankly we have seen nothing but buying since that initial move. We are hanging about the 50 day EMA which is in and of itself a technical indicator and was an area where we had seen a lot of resistance previously. In other words, if I had no idea about the fundamental noise, I would look at this is a market that is ready to try and rally.

In general, we are seen the US dollar take a bit of a hit during the trading session, in more of a “risk on” move. This isn’t to say that the US dollar is in any serious trouble, just that other currencies are outperforming at the moment. The US dollar had been overbought for some time, so this makes quite a bit of sense. Because of this, I like the idea of buying this pair and I do think that we will eventually go to the upside. Even if we break down below the bottom of the candlestick for the trading session on Monday, I think that there is plenty of support all the way down to the 1.28 handle, so in this sense I don’t see an opportunity to short this market anytime soon. Granted, the Bank of England may find itself cutting rates, but it’s not about interest rates at this point when it comes to Pound Sterling, it’s about expectations for exiting the European Union. This isn’t to say that this will be an easy market to trade this year, in fact I expect it to be just as much of a pain as it was last year. That being said though, I think the bias is more to the upside this year than it was last year. The candlestick does look very informative, and it does in fact suggest that we are at the very least going to get a bit of a bounce.