Downside pressure on the Singapore Dollar increased after the 2019 GDP came in at the lowest growth rate in ten years, at 0.7% annualized. The manufacturing recession led the dismal GDP report, while the services and construction sectors showed signs of resilience. Economists anticipate the export-oriented economy to experience a weak recovery in 2020, with no monetary easing expected by the Monetary Authority of Singapore. The GBP/SGD was able to add to its gains following the breakout above its support zone. You can learn more about a support zone here.

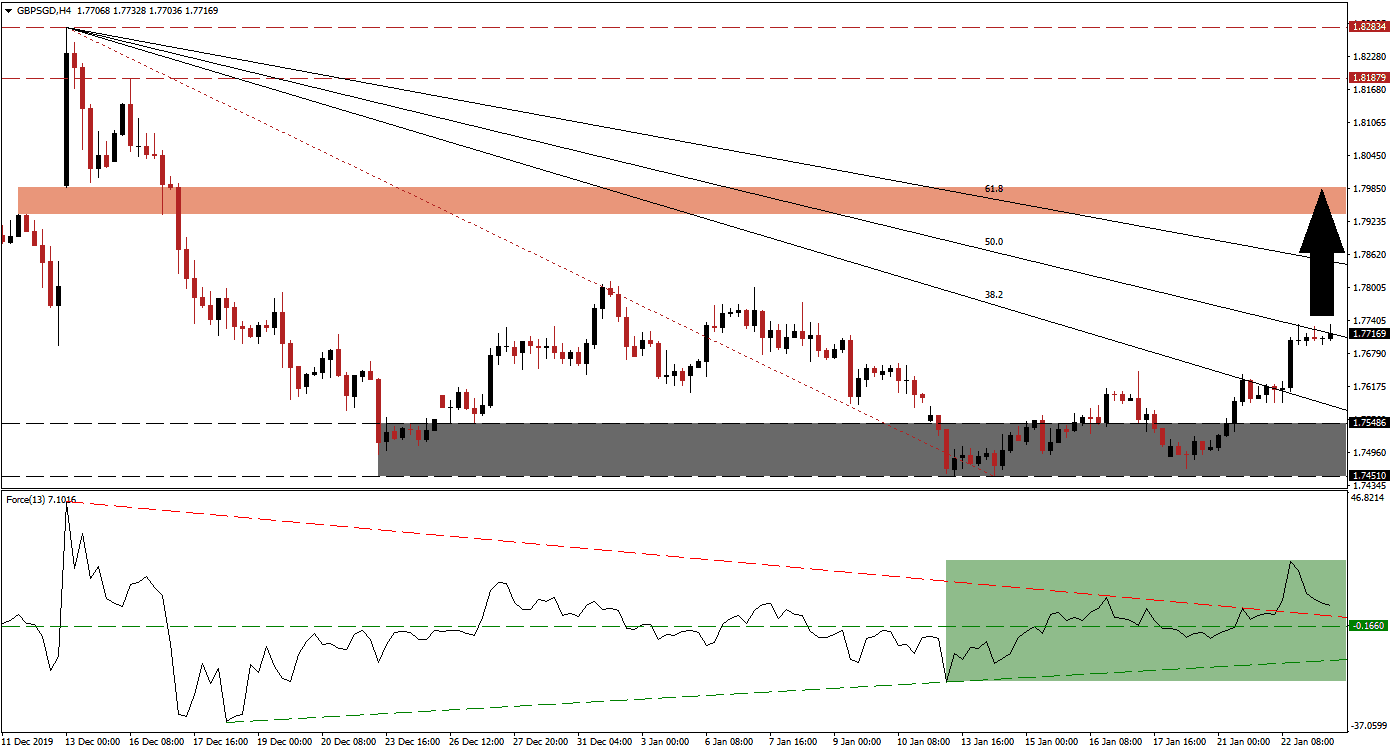

The Force Index, a next-generation technical indicator, supports more upside as bullish momentum is expanding. Before this currency pair reached its support zone, the Force Index started to gradually advance. The ascending support level provided upside pressure, which led to the conversion of its horizontal resistance level into support. This currency pair spiked above its descending resistance level, as marked by the green rectangle. After a pullback from a multi-week high, it remains in positive conditions with bulls in charge of the GBP/SGD.

Adding to positive developments in this currency pair is the higher low, which emerged inside its support zone located between 1.74510 and 1.75486, as marked by the grey rectangle. With the conversion of the descending 38.2 Fibonacci Retracement Fan Resistance Level into support, which led to a higher high, the formation of a bullish chart pattern is dominant. The strongest employment report out of the UK for 2019 is providing a fundamental boost to price action, and the GBP/SGD is favored to extend its breakout sequence.

Forex traders are advised to monitor the intra-day high of 1.78118, the peak of a previously reversed breakout. A move in the GBP/SGD above this level is anticipated to result in the net addition of buy orders, and firmly elevate price action above its 50.0 Fibonacci Retracement Fan Resistance Level. It will additionally strengthen the bullish chart formation and clear the path into its short-term resistance zone. This zone is located between 1.79372 and 1.79860, as marked by the red rectangle, and will close a price gap to the upside.

GBP/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.77150

Take Profit @ 1.79850

Stop Loss @ 1.76400

Upside Potential: 270 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 3.60

Should the Force Index complete a breakdown below its ascending support level, the GBP/SGD is likely to reverse. Given the fundamental outlook for this currency pair, the downside potential is limited to its support zone located between 1.74510 and 1.75486. This will represent an excellent buying opportunity, and forex traders are advised to take advantage of any breakdown attempt in price action.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.75800

Take Profit @ 1.74600

Stop Loss @ 1.76400

Downside Potential: 120 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.00