Brexit will be officially complete at midnight Brussels time, granting the first step of the freedom the UK voted for. During the eleven-month transition period, the UK will abide by EU rules, and intense negotiations are expected. EU officials already noted that a lot more time is required to reach a trade deal, but UK Prime Minister Boris Johnson passed an amendment making an extension of the transition period illegal. Bullish sentiment in the British Pound is expanding, allowing the GBP/JPY to enter a short-covering rally.

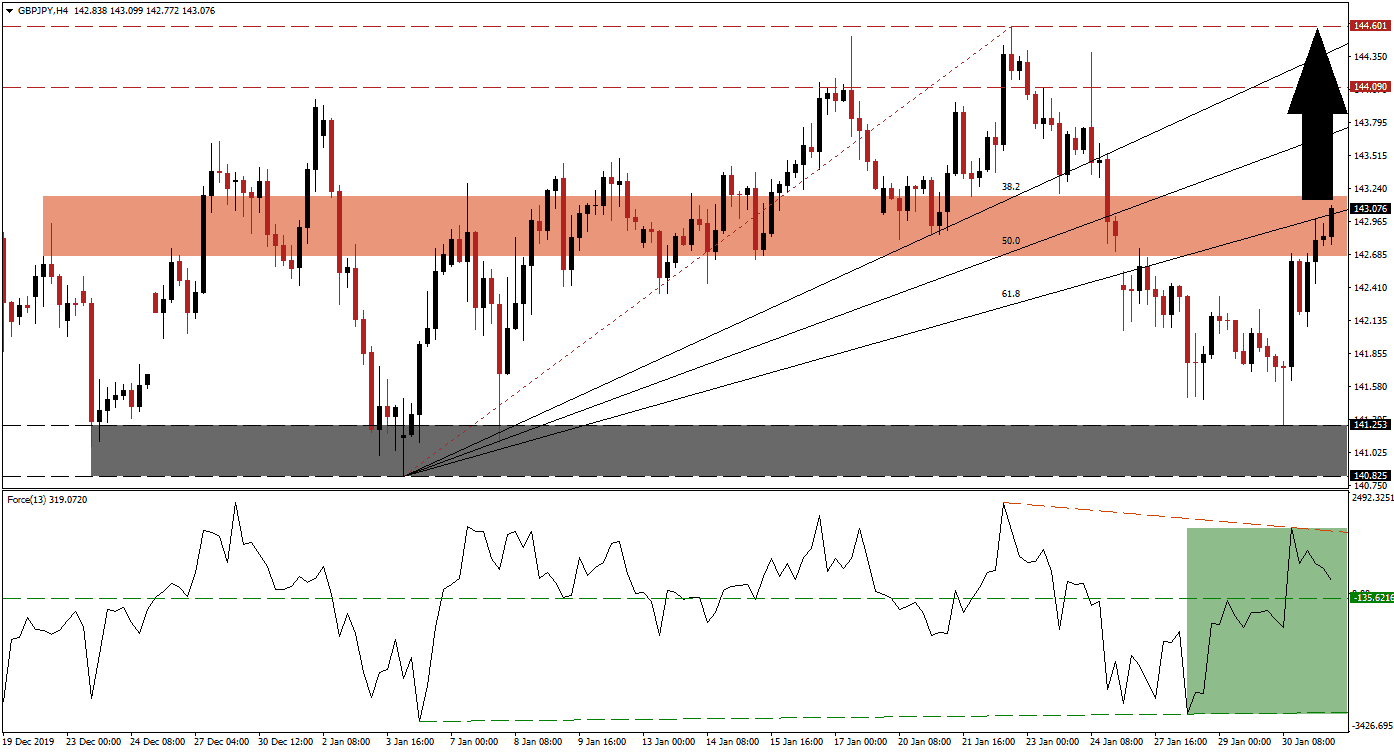

The Force Index, a next-generation technical indicator, indicates the bullish momentum recovery. As price action pushed to a multi-month high, the Force Index confirmed it, before retreating as the GBP/JPY entered a corrective phase. After recording a lower, it accelerated to the upside and converted its horizontal resistance level into support, as marked by the green rectangle. A lower high led to the formation of a descending resistance level, but this technical indicator remains in positive conditions with bulls in charge of price action. You can learn more about the Force Index here.

After this currency pair grazed the top range of its support zone located between 140.825 and 141.253, as marked by the grey rectangle, price action quickly reversed. This materialized despite safe-haven demand in the Japanese Yen due to the spreading coronavirus. The Bank of England’s decision to make interest rate announcements dependent on economic data added to stability in the British Pound. More upside in the GBP/JPY is anticipated as bullish momentum is set to drive the price action recovery.

Price action is now in the process of completing a breakout above its ascending 61.8 Fibonacci Retracement Fan Resistance Level, converting it back into support. This is materializing inside of its short-term resistance zone located between 142.675 and 143.174, as marked by the red rectangle. A breakout extension is favored to elevate the GBP/JPY into its long-term resistance zone, which awaits this currency pair between 144.090 and 1.44601, guided higher by its Fibonacci Retracement Fan sequence.

GBP/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 143.100

Take Profit @ 144.600

Stop Loss @ 142.600

Upside Potential: 150 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.00

A move in the Force Index below its horizontal support level, followed by a descend into its shallow ascending support level, is likely to inspire a breakdown attempt in the GBP/JPY. The downside potential remains limited to its support zone, offering forex traders a second buying opportunity, as the long-term outlook for the British Pound is increasingly bullish. An increase in volatility should be expected, but wild price swings are unlikely following yesterday’s Bank of England announcement.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 142.250

Take Profit @ 141.250

Stop Loss @ 142.600

Downside Potential: 100 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.86