Investors' appetite for the US dollar as a safe haven, after the recent tensions between the United States and Iran, which threaten the outbreak of war there, has weaken the chance of the EUR/USD pair to return to the correction above the 1.1200 resistance, which gives the pair the momentum to reverse the general downward trend that still dominates the performance in the long term. The pair fell back to 1.1133 support, and he ignored the improvement in inflation figures in the Eurozone to its highest in six months. Eurostat data showed that inflation hit a nine-month high in December and consumers increased their spending in November, adding to signs that the European economy was stabilizing in the wake of an 18-months slowdown.

Eurozone inflation rose from 1% to 1.3% in December, the highest level since April 2019, due to gains in commodity prices, while core inflation remained unchanged at its highest level after the crisis, from 1.3% last month. Core inflation removes volatile items such as food and energy, so central bankers and markets alike see them as a more reliable measure of locally generated inflation trends.

Separately, Eurozone retail sales increased by 1% in November, while the -0.6% contraction initially announced for October was revised to -0.3%, which was another win for the Euro, and the continental economy appears to have stabilized. There were fears last year that the recession in the manufacturing sector would spread to services and other sectors of the economy.

It is the United States of America. The ISM PMI for the services sector rose to a reading of 55, from 53.9 in November. A reading above 50 indicates growth. The ISM survey covers retail, healthcare, hotels, restaurants, professional services and other sectors. Service companies added jobs last month but at a slightly slower pace than in November, and consumer spending was steady, supported by a strong labor market and good wage gains. A separate ISM manufacturers survey this month showed that factories are still struggling due to trade wars and weak global economic growth. The sectors covered by the ISM Services Survey account for about 90% of the US economy.

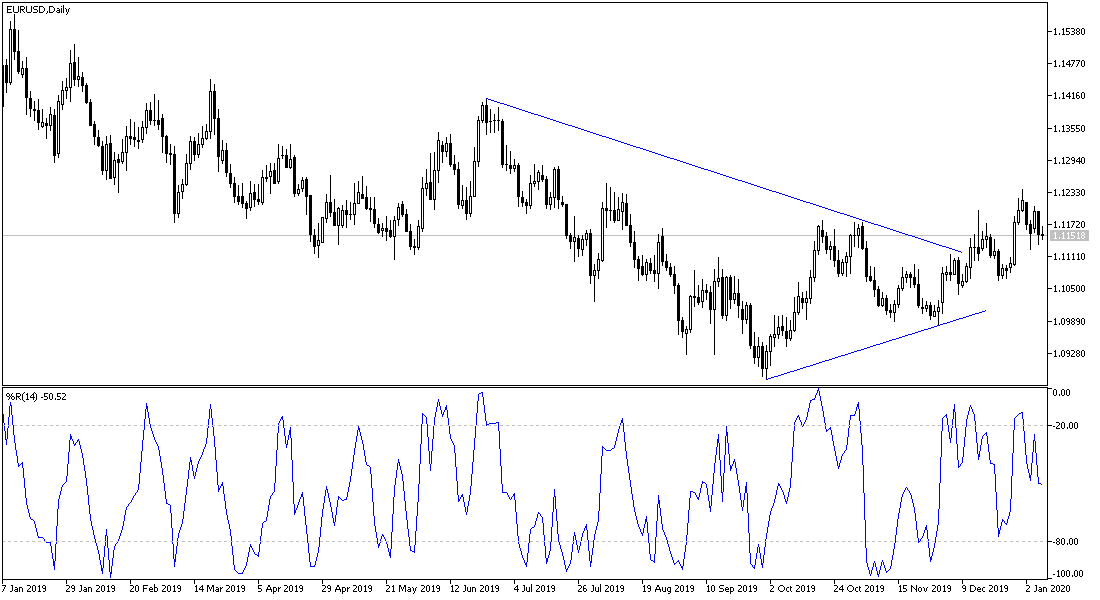

According to the technical analysis of the pair: There is still no change in my technical view towards the EUR/USD performance; as we mentioned before, breaking the 1.1200 resistance will give the pair an opportunity to correct up, but gains will remain under the threat of continuing weak Eurozone economic performance. The downtrend might return if the pair moves towards the support levels of 1.1080 and 1.1000, respectively.

As for the economic calendar data: From the Eurozone, German factory orders and the French trade balance will be announced. From the United States, ADP survey of the change in the non-farm jobs numbers.