Better than expected economic data out of China this morning provided a boost to the Australian Dollar, the leading Chinese Yuan proxy currency. While GDP data for 2019 confirmed government estimates, industrial production surprised to the upside. Consumers remained resilient, and the Chinese economy continues to show signs of stability. The EUR/AUD maintains its positions just below its short-term resistance zone, as bearish momentum is expanding.

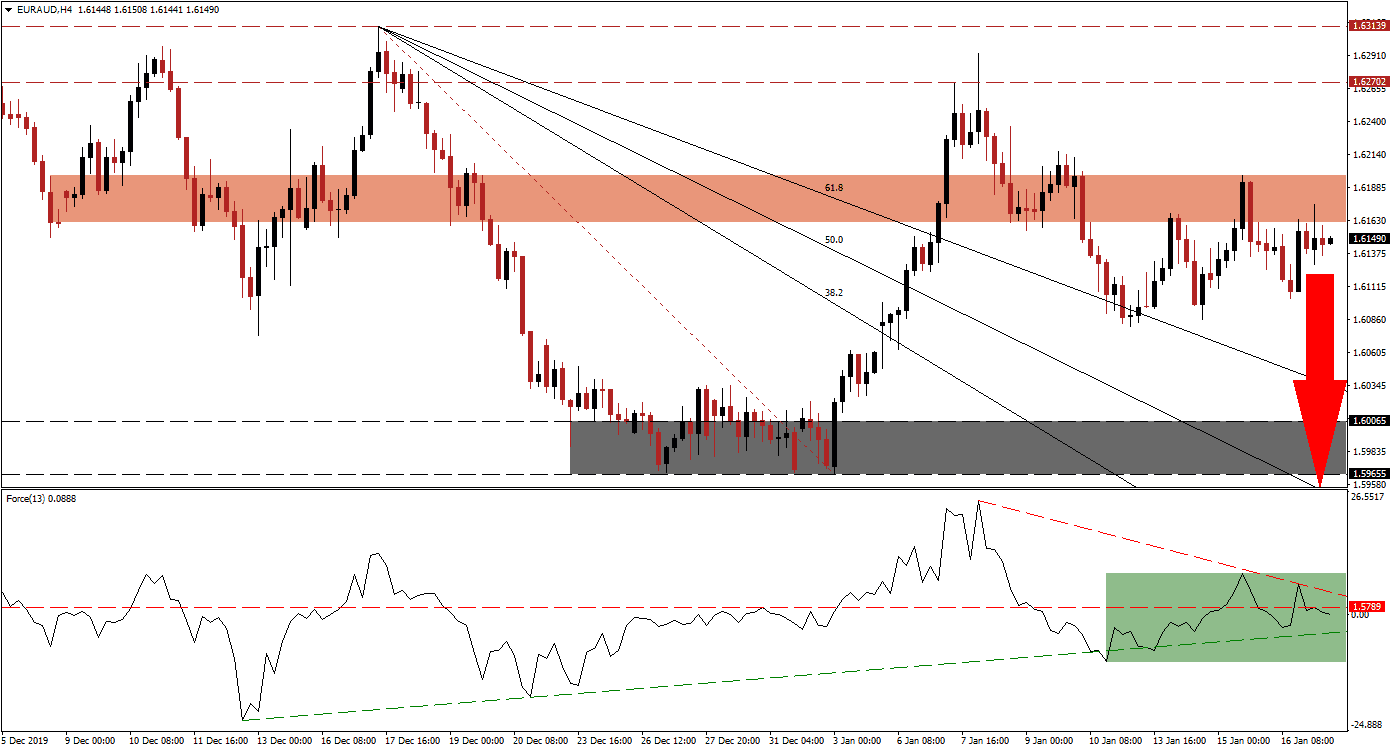

The Force Index, a next-generation technical indicator, points towards the rise in bearish pressures, after converting its horizontal support level into resistance. Its descending resistance level is adding to downside momentum, as marked by the green rectangle. A breakdown in the Force Index below its ascending support level is anticipated to follow. This will also place it in negative conditions and bears in control of the EUR/AUD, preceding a corrective phase in this currency pair. You can learn more about the Force Index here.

Following the breakdown in the EUR/AUD below its short-term resistance located between 1.61612 and 1.61983, as marked by the red rectangle, more downside is favored. With the rise in bearish pressures, a profit-taking sell-off is likely to close the gap between this currency pair and its descending 61.8 Fibonacci Retracement Fan Support Level. Economic data out of the Eurozone has been mixed with a bearish bias, which is providing more bearish pressures on the Euro, than a dovish Reserve Bank of Australia is on the Australian Dollar. You can learn more about the Fibonacci Retracement Fan here.

This currency pair is expected to correct into its support zone located between 1.59655 and 1.60065, as marked by the grey rectangle. Since the 38.2 and 50.0 Fibonacci Retracement Fan Support Levels already moved below this zone, a further breakdown cannot be ruled out. Forex traders are recommended to monitor the intra-day low of 1.60807, the low of the previous breakdown. A move below this level is likely to result in the addition of new net short orders. The next support zone awaits the EUR/AUD between 1.58055 and 1.58519.

EUR/AUD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.61450

Take Profit @ 1.59650

Stop Loss @ 1.62050

Downside Potential: 180 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its descending resistance level is likely to lead the EUR/AUD into a breakout attempt of its own. With existing fundamental developments, the upside potential is limited to the long-term resistance zone located between 1.62702 and 1.63139. This should be viewed as an outstanding short-selling opportunity, as the outlook is increasingly bearish.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.62250

Take Profit @ 1.63000

Stop Loss @ 1.61900

Upside Potential: 75 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.14