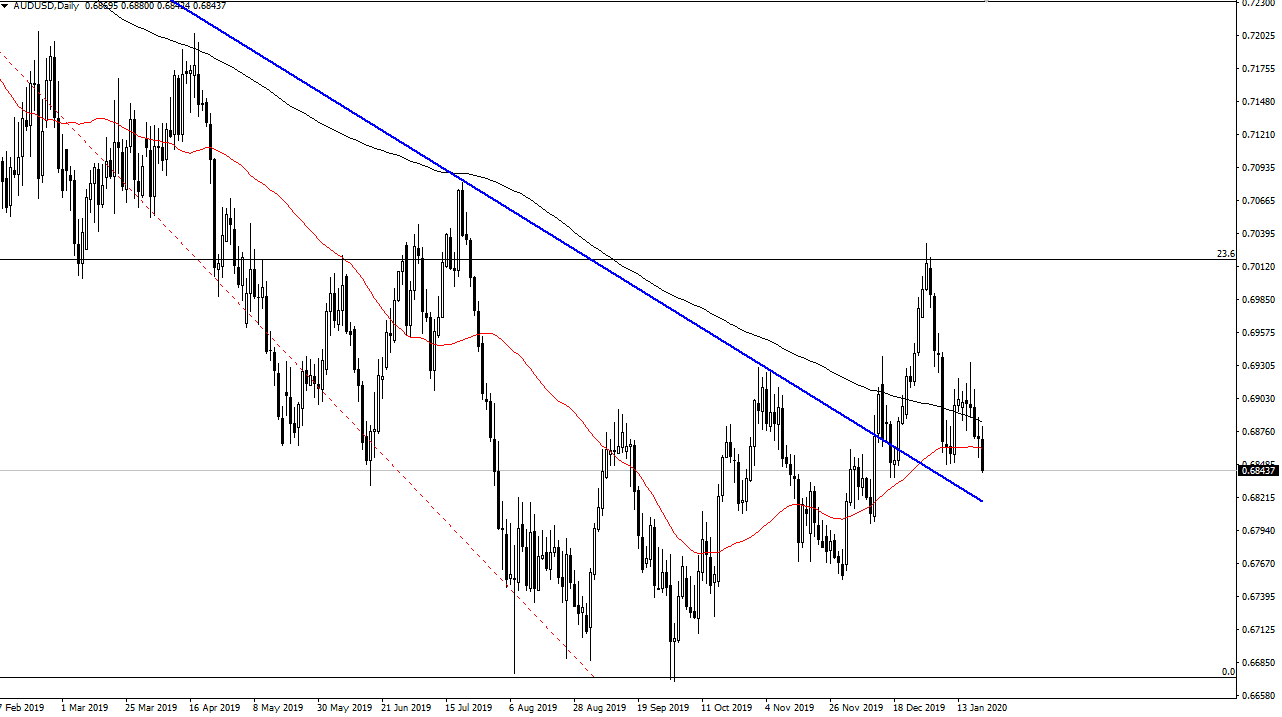

The Australian dollar initially tried to rally during the trading session on Tuesday but gave back the gains to break down significantly through the 50 day EMA. As we reached towards the 0.6850 level, that is a significant area that could cause a bit of noise. We bounced from there initially, but then by the end of the day found our way right back to that level. At this point, it looks as if the market may drift a bit lower and the attempt at changing the overall trend is certainly threatened at this point.

The US/China trade situation continues to favor the Australian dollar rising, but you should also keep in mind that the Australian dollar is in a bit of a different type of pickle right now due to the fact that wildfires have caused quite a bit of damage to the economy. The RBA could very well end up cutting rates, and that would of course be negative for the Aussie dollar itself. Furthermore, there seems to be more of a “risk off” move over the last couple of days and that favors the greenback.

There is the remnants of the downtrend line that should now offer support, so if we were to break down below the 0.68 level it’s likely that we would go quite a bit lower. At this point we need to recapture the 200 day EMA above in order to have a good look to the Aussie dollar. This has been an extraordinarily volatile and choppy situation but if this is in fact going to end up being a trend change, that should not be a huge surprise as trend changes tend to be absolute nightmares of volatility. We will eventually get some type of larger impulsive candlestick that tells us which way we are ready to go but at this moment it’s a bit difficult to put any serious money into work. In general, I believe that the market is probably one that you should wait for a weekly set up to put money to work, as the noise continues to be so difficult. At this point, the market is likely to be very difficult to deal with, and therefore it’s likely that we will see a lot of ups and downs, and therefore it’s only a matter of time before we go in one direction or the other and therefore it’s very likely that we will continue to struggle here.