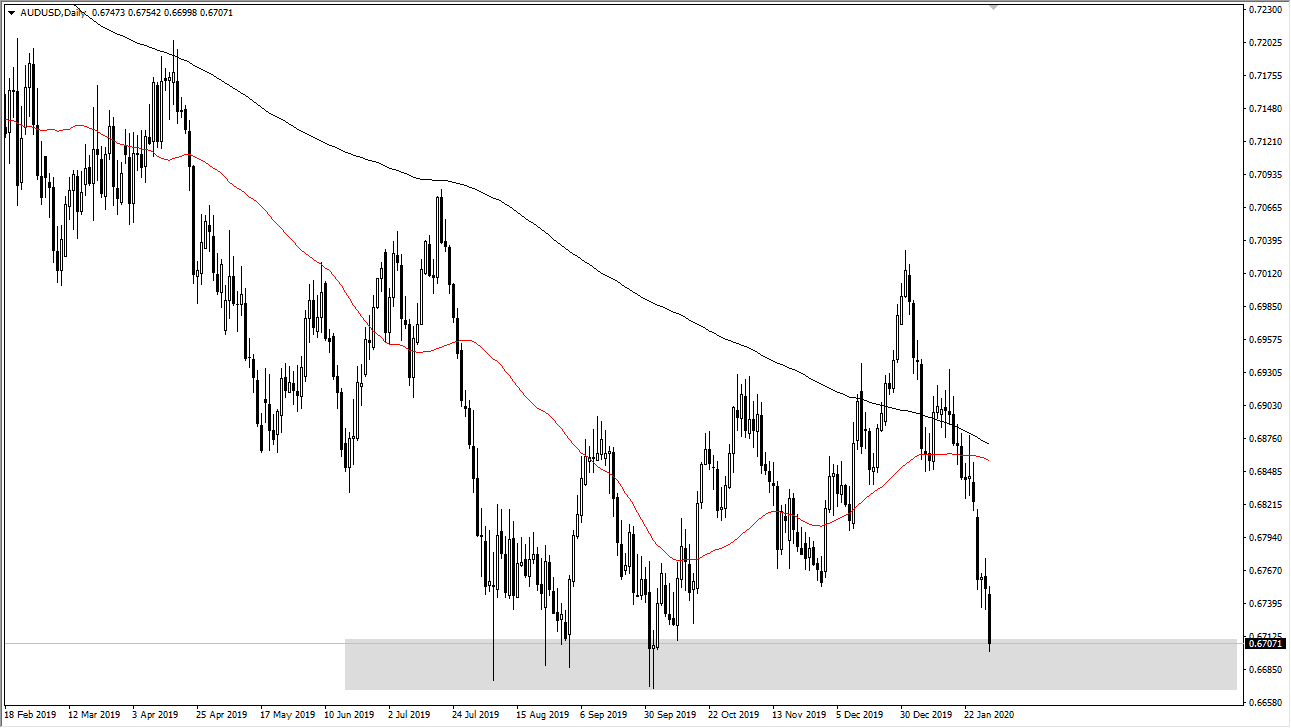

The Australian dollar has gotten hammered during trading on Thursday, reaching down towards the 0.67 level which of course is an area that has been important more than once. At this point, the Australian dollar is being used as a proxy for the entire situation involving China and the coronavirus care, so obviously it has gotten hammered. The question at this point is how much further can it go? Obviously, the market can break down, but the 0.67 level has been massive support more than once, so I think at this point we are probably a bit overdone. That being said, the market is certainly negative, and it is going to be very gut wrenching to simply step in and buy this market. Ultimately, there will come a chance to start buying but the question is whether or not it’s now. I think that waiting for a daily close to give us that signal is probably the best way going forward.

Looking at the longer-term charts, the area below the 0.67 level is massive support based upon the fact that the area below and extending down to the 0.64 level was the consolidation from the financial crisis from 12 years ago. That tells me that the market is clearly overdone at this point. However, that doesn’t mean you simply jump in with all abandon.

I am waiting for some type of daily candlestick to tell me to start buying and we don’t have that quite yet. My suspicion is that we will probably try to push a little bit lower during trading on Friday, but the support will more than likely hold. If it does, I would anticipate seeing some type of candlestick along the lines of a hammer that I can take advantage of to the upside. However, if we do break down below the 0.67 level solidly on a daily close, it’s likely that the market will probably go down to the 0.66 level next, and then possibly even as low as the 0.64 level. Breaking down below that level seems to be inconceivable, but I’m the first to admit that if you told me we were going to be bouncing around the 0.67 level just two years ago, I would have scoffed at that as well. All things being equal though, we are most certainly oversold at this point so keep that in the back of your head.