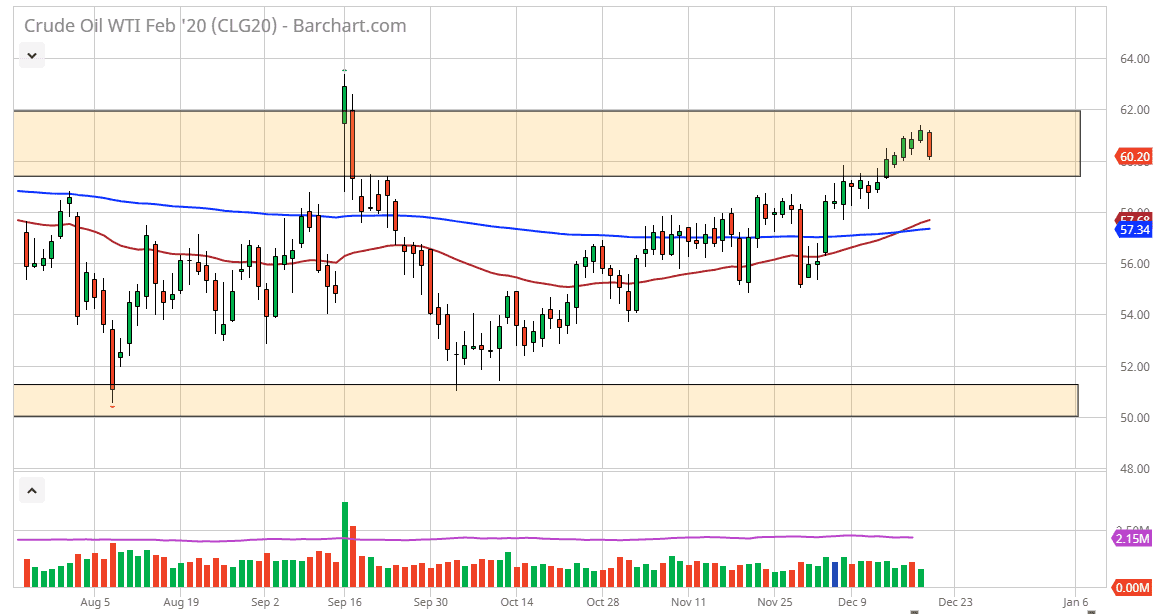

The West Texas Intermediate Crude Oil market fell during the trading session on Friday, showing signs of exhaustion and probably more likely, profit-taking. The $62.50 level above is the top of a larger range, and therefore I think we will probably continue to pull back to look for some type of support. Yes, I recognize that the OPEC countries have voted to increase production cuts, but at the end of the day I don’t know if it’s going to be enough to overcome the lack of demand. So far it has been bullish, but the Friday candlestick was rather negative.

That being said, the reality is that the pullback is probably just a simple function of profit-taking more than anything else, as a lot of traders will be working this coming week. After all, it is Christmas week and they will be more worried about other things around the world as opposed to spending a bunch of time with the markets. Remember that the US/China trade situation continues to be tentative at best, and with that being the case it will have an idea of increasing or decreasing demand for petroleum.

I think that the $60 level will be slightly supportive, but I think there’s even more support at the $58 level. That is an area that should show a lot of support based upon not only structural support but the 50 day EMA is starting to go in that general vicinity. If that support does get broken to the downside it’s very likely that the market will continue towards the $52.50 level which is the bottom of the overall channel. Ultimately, I do think that we can get there given enough time, but we would need some type of capitulation as far as demand is concerned. Recently, the numbers have been a bit of a mixed proposition so I suspect we aren’t going to get any type of major breakdown and will more likely go to the idea of supporting this market underneath. Ultimately, this is a market that is simply going to try to find support underneath before bouncing yet again. Given enough time, we will have to make a move out of the range, but we are looking more short-term bullish after we get a little bit of support here. All things being equal though, you are probably better off sitting out this entire week.