The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Monday, breaking above the 50 day EMA, and therefore it’s a very bullish sign initially. However, we gave back a bit of those gains and now it looks as if we are going to be more likely to test this uptrend line again. Keep in mind that a lot of the selling pressure on Friday was probably done in a very low volume environment. At this point, the market is now starting to pick up more volume, and it has a lot to think about as OPEC meets this week.

While it is anticipated that OPEC will probably continue to find the production cuts that are currently going on as being useful, it’s likely that the market will see a continuation of those production cuts. Beyond that though, the Iraqi oil minister has suggested that perhaps OPEC may even extend production cuts by another 400,000 barrels. This caused a little bit of a boost to price, but that’s not a done deal at this point. Beyond that, one would have to pay attention to the fact that OPEC suggesting that even further cuts signals that that there is not anywhere near enough demand. While this should in theory be massively bullish, the reality is that crude oil is in a range.

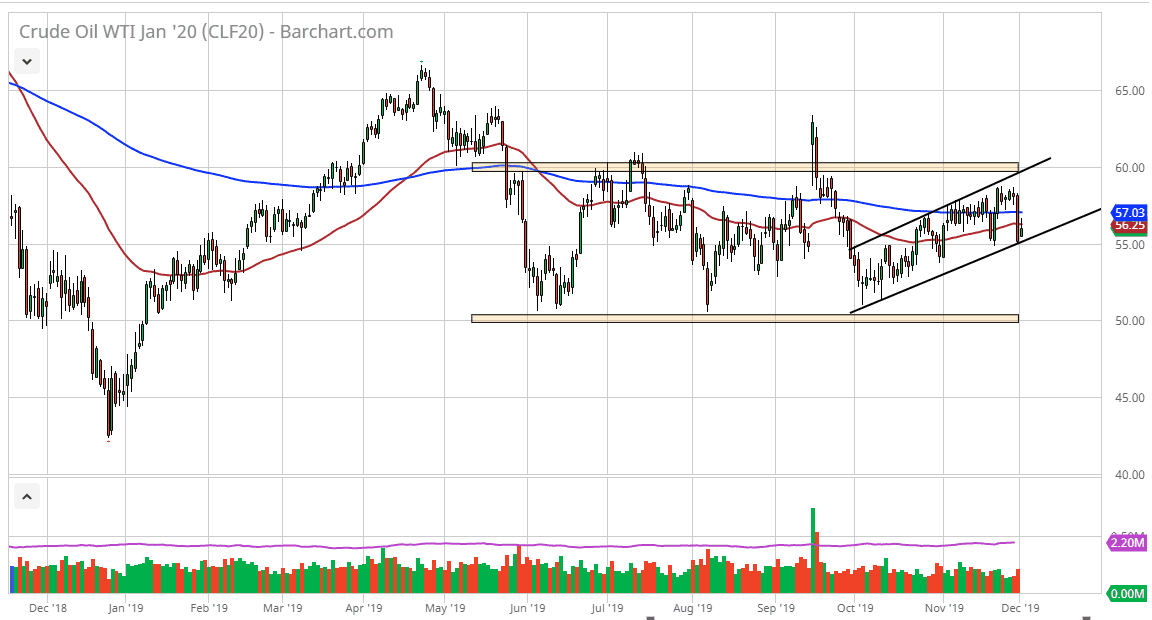

All things being equal, I believe that we continue to stay between the $60 level on the top and the $50 level on the bottom. The market has been in a bit of an uptrend and channel, so now we are testing the bottom of it. I believe it’s that simple, and I think between now and the end of the OPEC meeting in the middle of the week is probably a good time to avoid this market. If we were to break down below the $55 level, then it opens up the door to the $52.50 level. Alternately, if we can break above the top of the range for the Monday session, then we will probably have a lot of resistance at the $58 level above. In the meantime, expect a lot of noisy trading and will be standing on the sidelines until we get some type of clarity. Right now, we simply do not have it in this market, as the moving averages are simply flat and going sideways.